Exxon Mobil (NYSE:XOM) – Exxon Mobil predicted

a drop in first-quarter operating results due to lower oil and gas

prices and significant losses on fuel derivatives. After two years

of strong profitability, the quarter registered an operating profit

of about $6.65 billion.

Twilio (NYSE:TWLO) – Twilio, a leader in cloud

communications, proposes to shorten the board’s tenure to one year.

Byron Deeter will retire before the 2024 meeting, reducing the

board to nine members. Andy Stafman, from Sachem Head, joins the

board. Pressured by investors such as Legion Partners and Anson

Funds, the company faces demands for strategic changes.

Apple (NASDAQ:AAPL) – Apple is delving into

personal robotics, eyeing potential innovations for its next

product phase. Research includes a mobile robot that accompanies

users at home and a desktop device with robotic movement. Despite

the early stages, Apple is seeking new revenue streams.

Additionally, issues with Apple’s services such as the App Store,

Apple TV+, and Apple Music were resolved after disruptions in

various regions, including reports of crashes in Apple Fitness+,

Arcade, Audiobooks, Books, and Podcasts.

Alphabet (NASDAQ:GOOGL) – Alphabet is

considering introducing paid premium features in its AI-based

search engine, exploring options like incorporating them into

premium subscription services. The move, a first for Google, aims

to boost its presence in the AI field. The free search model would

continue with ads.

Meta Platforms (NASDAQ:META) – Meta’s WhatsApp

resumed operation on Wednesday after hours of global outage. The

service confirmed the resolution of the issues. Thousands of users

were affected in the US, UK, Brazil, and India. Instagram also

experienced outages.

Amazon (NASDAQ:AMZN) – Amazon Web Services

(AWS) eliminated hundreds of jobs in sales, marketing, and

technology, part of a restructuring at Amazon.com. The affected

team includes employees from the sales, marketing, and technology

divisions of physical stores. The reorganization reflects efforts

to streamline the organization, according to Reuters.

Taiwan Semiconductor Manufacturing Company

(NYSE:TSM) – TSMC resumed operations after the worst earthquake in

25 years, with no significant damage to essential equipment. The

earthquake left 10 dead and over 1,000 injured.

BlackBerry (NYSE:BB) – BlackBerry surprised

with a profit in the fourth quarter, driven by high demand for its

cybersecurity services amid rising online crimes. The company

reported an adjusted net profit of 3 cents per share in the fourth

quarter. Quarterly revenue was $173 million, with cybersecurity

unit revenue at $92 million and IoT at $66 million. The revenue

forecast for 2025 is $586-616 million, and for the first quarter in

the range of $130 million to $138 million, below the analyst

estimate of $151.12 million.

Vodafone (NASDAQ:VOD) – The proposed merger

between Vodafone Group Plc and CK Hutchison Holdings’ UK unit Three

now faces an in-depth antitrust investigation in the UK, with the

companies at risk of having the deal blocked unless they offer

concessions.

Levi Strauss (NYSE:LEVI) – Levi Strauss

reported an adjusted net profit of 26 cents per share in the first

quarter, exceeding expectations. Net revenue was about $1.56

billion, slightly above estimates. Direct-to-consumer sales grew

8%, while wholesale sales fell 19% in constant currency. Levi

Strauss revised its annual profit forecast upwards, driven by cost

savings, job cuts, and less aggressive discounts.

Simulations Plus (NASDAQ:SLP) – The company

specializing in pharmaceutical safety software reported a 16%

increase in second-quarter revenue, reaching $18.3 million,

surpassing analyst projections. As a result, its shares saw a

pre-market increase of 8.7%.

Walt Disney (NYSE:DIS) – Billionaire investor

Nelson Peltz faced a defeat on Walt Disney’s board, but his

investment portfolio remains solid, with Disney shares up 50% since

his involvement. Despite the loss, he influenced changes at Disney,

showing that even in defeat, his impact is significant. With

Peltz’s months-long battle in the rearview, Disney focuses on CEO

Bob Iger’s succession. The board extended his retirement five

times, promising to take the matter seriously, considering both

internal and external candidates.

Paramount Global (NASDAQ:PARA) – Paramount

Global opted for exclusive merger talks with Skydance Media instead

of accepting Apollo Global Management’s (NYSE:APO) $26 billion

offer. This decision could end Shari Redstone’s control over

Paramount.

Costco Wholesale (NASDAQ:COST) – Costco

Wholesale will expand its partnership with online healthcare

provider Sesame, offering members access to weight loss programs,

including prescription medications like Ozempic and Wegovy. Members

will pay $179 for three months, compared to $195 for

non-members.

Tapestry (NYSE:TPR), Gap

(NYSE:GPS) – Luxury handbag maker Coach sued Gap, claiming that the

Old Navy brand sold T-shirts with the “Coach” name without

authorization, potentially confusing consumers. Coach and its

parent, Tapestry, seek compensation for damages and the destruction

of the inventory.

Etsy (NASDAQ:ETSY) – Jesse Cohn from Elliott

Investment Management expressed confidence in Etsy, foreseeing

“significant long-term upside.” Holding more than 10%, he envisions

growth opportunities, citing potential for user expansion and

monetization. Elliott appointed Marc Steinberg to Etsy’s board in

February.

Goldman Sachs (NYSE:GS) – Goldman Sachs faces

pressure to separate the CEO and chairman roles, currently held by

David Solomon, as recommended by the Institutional Shareholder

Services (ISS). ISS highlighted mistakes in the consumer sector and

executive departures. The bank disagrees with the recommendation,

citing its robust leadership structure.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase

launched Chase Media Solutions, allowing advertisers to target its

80 million customers based on spending data. The platform combines

a retail media network with Chase transaction data, helping brands

precisely reach customers. The launch follows the acquisition of

the Figg platform two years ago.

Bank of America (NYSE:BAC) – Bank of America’s

securities portfolios decreased in the fourth quarter as markets

recovered, but pressures return. By the end of 2023, unrealized

losses exceeded $100 billion. The $595 billion portfolio,

predominantly mortgage-backed, withstood these declines.

Nomura Holdings (NYSE:NMR) – Nomura Holdings

plans to expand its US credit portfolio to over $50 billion in 10

years, possibly seeking smaller acquisitions to strengthen its

private credit business. This reflects its strategy to diversify

revenue and expand in private markets to mitigate global risks.

BlackRock (NYSE:BLK) – BlackRock, the world’s

largest asset manager, is considering investing in Kenyan stocks,

which rebounded after poor performance in 2023 due to economic

policy changes, offering investment opportunities in a stable

market with high growth potential.

Block (NYSE:SQ) – Block’s shares are falling in

pre-market trading, down 3.75% to $76.66, after Morgan Stanley

analysts downgraded their rating from Equal Weight to Underweight.

They also lowered the stock’s target price from $62 to $60, as

reported by The Fly.

Wayfair (NYSE:W) – Wayfair’s rating was

upgraded from In-Line to Outperform by Evercore ISI, while analysts

raised the stock’s target price from $65 to $80. As a result,

shares saw a 5.3% increase in pre-market trading, reaching

$65.69.

JetBlue Airways (NASDAQ:JBLU) – Nearly 5,000

pilots from the Air Line Pilots Association (ALPA) requested

JetBlue to start negotiations for a new collective bargaining

agreement. The pilots negotiated an extension during the canceled

merger talks with Spirit Airlines (NYSE:SAVE).

Stellantis (NYSE:STLA) – Stellantis CEO Carlos

Tavares emphasized the need to halve the weight of electric vehicle

(EV) batteries over the next 10 years to make electrification

environmentally viable, during the automaker’s Mobility Freedom

Forum. He highlighted the importance of advancements in cell power

density to achieve this goal, aiming also to address the lithium

shortage, a key component in current batteries. Tavares dismissed

hydrogen as a viable alternative due to high costs, suggesting it

could be a solution for large corporate fleets but not for ordinary

consumers.

Tesla (NASDAQ:TSLA) – Elon Musk acknowledged

that Tesla is struggling to retain artificial intelligence experts,

some migrating to his new AI venture. Tesla is adjusting AI team

salaries based on performance, in response to intense competition

for talent.

Fisker (NYSE:FSR) – On Wednesday, Fisker

announced the withdrawal of its financial projections for 2024,

while exploring alternatives to address financial challenges. The

company is considering options such as restructuring, fundraising,

and asset sales, but warns of uncertainties and risks.

Intuitive Machines (NASDAQ:LUNR) – After NASA

awarded one of three contracts to develop a new lunar lander to

Intuitive Machines, its shares increased by 8.7% in pre-market

trading. The company became the first to successfully land a

privately funded probe on the Moon with its Odysseus spacecraft, in

February.

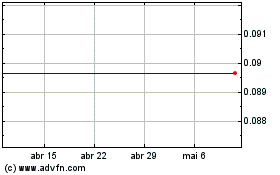

Fisker (NYSE:FSR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Fisker (NYSE:FSR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025