Apple (NASDAQ:AAPL) – Apple is laying off 614

employees in Silicon Valley after ending its secret autonomous

electric vehicle project. These are the first significant job cuts

since the beginning of the pandemic, mainly impacting satellite

offices in Santa Clara, California. Moreover, Hon Hai, known as

Foxconn (USOTC:FXCOF), saw an 11.8% increase in

sales in March, but first-quarter revenue of NT$1.32 trillion fell

9.6% year-over-year, below the expected NT$1.39 trillion. The

decline in iPhone sales, especially in China, directly affected the

company as it is the main contracted manufacturer of these devices

for Apple. Despite this, the company is diversifying its business,

with a growing focus on building server racks for data centers and

other equipment for artificial intelligence clusters.

Walt Disney (NYSE:DIS) – CEO Bob Iger announced

that Walt Disney’s streaming service will begin cracking down on

password sharing in June, aiming to boost subscriber growth. He

also indicated a pursuit of double-digit profit margins.

Meta Platforms (NASDAQ:META) – Meta rejected

the U.S. FTC’s attempt to alter the 2020 privacy agreement, citing

voluntary disclosure of technical flaws in Messenger Kids in 2019.

Meta invested $5.5 billion in privacy. The FTC seeks to tighten the

agreement, accusing Meta of misleading parents about child

protection.

Alphabet (NASDAQ:GOOGL),

HubSpot (NYSE:HUBS) – Alphabet, the parent company

of Google, is considering making an offer for HubSpot, an online

marketing software company valued at $35 billion. The potential

acquisition would be one of Alphabet’s largest and would expand its

operations in the CRM market.

Microsoft (NASDAQ:MSFT) – Microsoft’s Azure

cloud segment is expected to face a formal complaint from South

African antitrust watchdogs amid growing concerns from regulators

worldwide about the U.S. tech giant’s market power abuse.

Nvidia (NASDAQ:NVDA) – Nvidia shares advanced

on Friday, boosted by Samsung Electronics‘

(USOTC:SSNHZ) robust profit forecast, indicating strong demand for

artificial intelligence chips. Samsung Electronics forecasts a

tenfold increase in first-quarter profits compared to the previous

year. The positive expectations lifted NVDA shares by 0.81% to $866

in pre-market trading.

Trump Media & Technology Group (NASDAQ:DJT)

– Republican presidential candidate Donald Trump is scheduled to be

deposed by lawyers for the co-founders of his social media company,

Trump Media & Technology Group, amid a dispute over ownership.

The deposition is set for April 15, coinciding with the start of

Trump’s first criminal trial.

Reddit (NYSE:RDDT) – Two U.S. brokerages,

Bernstein and Baird, began evaluating and recommending Reddit

shares, expressing concerns about its profit-making ability and

highlighting challenges such as lack of profitability since its

founding in 2005 and its stock market debut below the IPO price.

While Bernstein adopted an “underperform” rating with a target

price of $40, questioning the platform’s potential against

competitors like Pinterest (NYSE:PINS) and

Snapchat (NYSE:SNAP), Baird adopted a “neutral”

rating with a target price of $50, emphasizing the user base’s

growth potential.

Spotify (NYSE:SPOT) – Spotify named Christian

Luiga, a former Saab executive, as its new CFO, replacing Paul

Vogel. Luiga, who served as CFO and vice CEO at Saab for about four

years, will assume the role in the third quarter. Ben Kung will act

as interim CFO until then.

Cinemark Holdings (NYSE:CNK) – Cinemark

Holdings shares rose 3.4% in pre-market trading to $19.40 after

Wells Fargo analysts upgraded the cinema company from Underweight

to Overweight. Additionally, they raised the price target from $13

to $23.

International Paper (NYSE:IP) – International

Paper plans a secondary listing in London as part of its proposal

to buy British company DS Smith (LSE:SMDS) for $7

billion, challenging competitor Mondi (LSE:MNDI)

in a potential bidding war.

US Steel (NYSE:X) – Following comments from

both President Biden and his rival Trump on Nippon Steel’s purchase

of US Steel, US Steel began defending the deal through billboards

near its factories. This deal, valued at $15 billion, is subject to

regulatory and union approval. The stance of unions, especially the

United Steelworkers, and regulatory considerations are crucial in

determining whether the deal will be completed.

Sigma Lithium (NASDAQ:SGML) – Sigma Lithium’s

CEO, Ana Cabral-Gardner, stated she would not sell the miner at

current lithium price levels, focusing on expanding operations. The

company plans to double in size by next year, increasing production

to 520,000 metric tons per year by 2025.

Shell (NYSE:SHEL) – Shell forecasts

significantly lower liquefied natural gas trading results in the

first quarter of 2024 compared to the previous quarter. However, it

expects superior oil trading results. The company also anticipates

a smaller loss in its chemicals segment, which has faced challenges

due to weak global demand. Additionally, it forecasts about $600

million in amortization, mainly related to exploration in

Albania.

Woodside Energy (NYSE:WDS) – Proxy advisor CGI

Glass Lewis is advising shareholders of Australian company Woodside

Energy to vote against the reelection of Chairman Richard Goyder

and against the company’s climate strategy. This follows opposition

expressed by activist investor Australasian Centre for Corporate

Responsibility (ACCR), criticizing Woodside’s board stance on

climate risks. Goyder, who also chairs Qantas Airways, will leave

the airline at the end of 2024, and his leadership at Woodside is

under scrutiny due to concerns over his oversight on climate

issues.

Bank of America (NYSE:BAC) – Significant fund

inflows were observed in the technology sector in the first

quarter, totaling $18.6 billion, the third largest on record. Bank

of America Global Research also highlighted large cash and bond

flows in the previous week, attributing this to the quarter’s end.

In other news, Bank of America faces a lawsuit over allegations of

deceitfully withdrawing an overdraft fee refund program during the

pandemic. The judge ruled that customers had a plausible cause,

stating that the bank misled them by continuing the fee waiver

promise.

Goldman Sachs (NYSE:GS), Morgan

Stanley (NYSE:MS) – A New York appeals court ruled that

former ViacomCBS investors could sue Goldman Sachs, Morgan Stanley,

and other banks that underwrote two stock offerings for the media

company. The court’s decision upholds an earlier ruling, which the

banks fear could disrupt capital markets.

JPMorgan Chase (NYSE:JPM) – JPMorgan Chase

reorganized its leadership in the global banking division,

appointing new leaders in capital markets and investment banking,

aiming to enhance team connectivity and serve growing clients.

Changes include new heads for capital markets and investment

banking coverage. JPMorgan is also promoting senior leadership

changes in China, with Park Pu stepping down as chairman of its

onshore securities business. He will be replaced by Lu Fang, a

former employee of China’s securities regulator. Greg Yu will take

over Lu Fang’s CEO role.

Morgan Stanley (NYSE:MS) – Morgan Stanley opted

to maintain its European headquarters in Canary Wharf, London,

extending its lease until 2038. The agreement includes investments

in sustainability. Other companies, such as

Barclays (NYSE:BCS) and Citigroup

(NYSE:C), are also renewing their presence in the area.

Jefferies Financial (NYSE:JEF) – Jefferies will

strengthen its presence in Canada through an expanded partnership

with Japanese Sumitomo Mitsui Banking Corp (NYSE:SMFG),

collaborating in mergers and acquisitions, healthcare, and

leveraged finance since 2021, focusing on the Canadian market’s

competitive advantage.

Carlyle Group (NASDAQ:CG) – Carlyle Group is

considering strategies for StandardAero, including a possible sale,

valuing it at about $10 billion, according to Reuters. This move

comes as the aviation sector recovers, and other private equity

firms take advantage of increasing mergers and acquisitions.

Block (NYSE:SQ) – Block has attracted more

investors recently, highlighting its growing focus on

profitability, but analyst James Faucette of Morgan Stanley

expressed skepticism about the stock’s prospects, citing

overoptimism about the expansion of Square and Cash App

businesses.

PayPal (NASDAQ:PYPL) – PayPal Holdings’ Xoom

now allows customers to send international funds using dollars

converted from PayPal’s USD stablecoin, reflecting the growing

influence of cryptocurrency on remittances. This initiative follows

the successful launch of PYUSD, PayPal’s first public

stablecoin.

Tesla (NASDAQ:TSLA) – According to Bloomberg,

Tesla has moved from rapid price cuts a year ago to offering

significant discounts on accumulated stock cars. While raising

prices for custom orders, the company is offering substantial

discounts for in-stock SUVs. Tesla is also producing right-hand

drive cars at its German factory for export to India later this

year, as it plans a visit to select sites for a local factory. The

move follows tax reductions for electric vehicles. Additionally,

Tesla investors are restless after disappointing first-quarter

results, with sales below expectations. Meanwhile, CEO Elon Musk

seems more interested in tweeting about other topics than

addressing the company’s issues.

Ford Motor (NYSE:F) – Ford has delayed the

planned launch of its three-row EVs in Canada and the next

generation of electric pickups in Tennessee due to a global

slowdown in electric vehicle demand. The company aims to expand its

lineup of hybrids and electrics by 2030.

Nikola Corporation (NASDAQ:NKLA) – Nikola

exceeded truck delivery expectations in the first quarter,

delivering 40 vehicles, surpassing the estimate of 30 units

projected by four analysts surveyed by Visible Alpha.

Spirit AeroSystems (NYSE:SPR) – Boeing and

Airbus (USOTC:EADSY) are considering a potential

deal to split the operations of troubled Spirit AeroSystems,

essential for their jet programs. Boeing (NYSE:BA)

seeks to regain control of its supply chain, facing antitrust and

regulatory challenges. The fate of the facilities is uncertain.

Additionally, proxy advisory Glass Lewis recommended that Spirit

AeroSystems shareholders vote against the election of two

directors, including the head of the risk committee, Ronald Kadish,

citing concerns over questionable oversight and management

following a cabin panel explosion on a Boeing 737 MAX.

Alaska Air Group (NYSE:ALK) – Alaska Air Group

announced that Boeing paid approximately $160 million in the first

quarter as compensation for the temporary grounding of the 737 MAX

9 jets, with more compensations expected.

Conagra Brands (NYSE:CAG) – Conagra beat

third-quarter revenue and profit expectations, driven by increasing

demand for staple and frozen foods as more consumers cook at home

to cope with persistent inflation. Conagra reported net sales of

$3.03 billion, above the expected $3.01 billion, and adjusted

earnings of 69 cents per share, beating the predicted 65 cents.

Carrefour (EU:CA), PepsiCo

(NASDAQ:PEP) – The recently resolved dispute between Carrefour and

PepsiCo highlighted a shift in the dynamics of negotiations between

retailers and suppliers. The growing pressure for advertising has

made both industries more interdependent, with significant

implications for both parties.

Walmart (NYSE:WMT) – Walmart is recalling

approximately 51,750 Mainstays Electric Mini Choppers due to

reports of blade cuts, some resulting in injuries. Owners are

advised to immediately stop using the product and request a refund.

Other recalled products include handrails and vaporizers.

McDonald’s (NYSE:MCD) – McDonald’s is acquiring

its 30-year Israeli franchise from Alonyal Ltd, taking back

ownership of 225 restaurants in the country. The move follows

controversies after the franchisee offered free meals to Israeli

military personnel, leading to boycotts and protests.

Lamb Weston (NYSE:LW) – Lamb Weston shares

plummeted nearly 20% on Thursday, marking its biggest daily loss,

due to a slower-than-expected transition to a new software system,

affecting third-quarter results. Lamb Weston’s profits dropped to

$146.1 million, or $1.01 per share, compared to $175.1 million, or

$1.21 per share, in the same period last year. Sales rose to $1.46

billion, representing a 16% growth.

Kura Sushi (NASDAQ:KRUS) – Kura Sushi USA’s

(KRUS) fiscal second-quarter sales rose 31% to $57.3 million,

exceeding expectations. The company reported a loss of $998,000, or

nine cents per share, compared to a loss of $1 million, or ten

cents per share, in the previous year.

GameStop (NYSE:GME) – GameStop’s Chief

Operating Officer, Nir Patel, is leaving the video game company,

effective immediately. His responsibilities will be absorbed by

other executives. Patel, who joined in 2022, previously served as

CEO of Belk Inc.

Hilton Worldwide Holdings (NYSE:HLT) – Hilton

Worldwide is taking majority control of the Sydell Group, boosting

the expansion of the NoMad Hotels brand and strengthening its

luxury offering. Chris Silcock, Hilton’s president for global

brands, anticipates significant global expansion, with independent

NoMad properties integrating into Hilton.

Johnson & Johnson (NYSE:JNJ) – J&J

advised shareholders against accepting an unsolicited offer from

TRC Capital Investment Corporation to acquire approximately 0.04%

of its ordinary shares, valued at $151.23 per share in cash.

Royal Philips NV (NYSE:PHG) – Royal Philips NV

warned that some of its ventilators might be affected by a sudden

power loss, according to a statement from the Dutch Health and

Youth Inspection. The company will install a software update to fix

the issue.

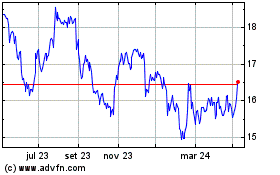

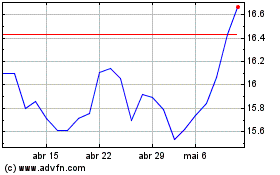

Carrefour (EU:CA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Carrefour (EU:CA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025