Hong Kong approves Bitcoin and Ether ETFs

On Monday, Hong Kong regulators gave the green light for the

launch of spot Bitcoin and Ether ETFs, asset managers announced,

following the trend set by the US earlier this year. Approvals came

from three fund managers, including ChinaAMC, which also plans to

offer virtual asset management services, with OSL Digital

Securities acting as custodian. Harvest Global and Bosera

International also received authorization for their Bitcoin and

Ether ETFs. This advancement positions Hong Kong as a potential

regulated center for crypto assets, competing with Dubai and

Singapore.

$126 million outflow in crypto funds marks first withdrawal in

three weeks

Crypto funds managed by major firms such as BlackRock

(NASDAQ:IBIT), Bitwise (AMEX:BITB), Fidelity (AMEX:FBTC), Grayscale

(AMEX:GBTC), ProShares (AMEX:BITO), and 21Shares (AMEX:ARKB) faced

global outflows of $126 million last week, as reported by

CoinShares. This value contrasts with the record withdrawal of

nearly one billion dollars in the week ending on March 22.

According to James Butterfill of CoinShares, stagnation in positive

price dynamics led to increased caution among investors, reflected

in a drop in ETP/ETF activity from 40% to 31% of total volume on

trusted exchanges. US crypto funds had a particularly challenging

week, with $145 million in outflows, while Germany saw inflows of

$29 million.

Bitcoin partially recovers after sharp weekend drop driven by

geopolitical tensions

Over the weekend, Bitcoin (COIN:BTCUSD) experienced a sharp drop

to $61,300, motivated by geopolitical tensions. The decline was

attributed to tensions in the Middle East, with market sentiment

improving after the announcement of a temporary cessation of

hostilities. After recovering to $66,600, Bitcoin was down -3% to

$63,828 at the time of writing. The next Bitcoin halving event is

expected on April 20 and will halve the rewards offered to network

miners. The Bitcoin halving event is also cited by analysts as a

factor triggering a temporary selling reaction.

Movement of 50 old Bitcoins sparks speculation about miner activity

Earlier today, 50 bitcoins, valued at $3.3 million and untouched

for nearly 14 years, were transferred, indicating possible activity

from an early Bitcoin miner. The bitcoins, mined in April 2010,

were split into two transactions: 17 BTC went to a wallet that may

be linked to an exchange, and 33 BTC went to a new address,

possibly to maintain the original miner’s balance privacy.

Solana rolls out critical update to address congestion and

stabilize prices

Solana (COIN:SOLUSD) developers deployed an emergency update,

version 1.18.11, to combat network congestion issues and recent

market value declines. The infrastructure team led by Anza invited

validators to test the new solution on Solana’s testnet. Recently,

the network has faced high transaction failure rates and bot

interference, causing delays in various launches. However,

improvements have been noted, with the Phantom wallet reporting a

significant increase in transaction success rate. Despite the

updates, Solana’s price recorded a steep decline of -8.52% in the

last 24 hours, influenced by a bearish market, with potential

larger repercussions if congestion issues persist.

Vitalik Buterin emphasizes the importance of privacy in crypto

transactions

Vitalik Buterin, co-founder of Ethereum (COIN:ETHUSD),

reiterated the importance of privacy in crypto transactions, using

the RailGun tool to protect his movements. According to Wu

Blockchain, Buterin transferred 100 ETH to RailGun, highlighting

his recurrent use of the tool over the past six months. After his

statements, privacy-focused assets like Monero (COIN:XMRUSD) and

Zcash (COIN:ZECUSD) saw price increases before falling again.

Buterin praised RailGun’s ability to balance privacy and security,

citing the potential of privacy technologies in promoting a more

trustworthy and transparent environment in DeFi.

Ripple unveils loan protocol proposal on XRP Ledger to bolster DeFi

Ripple is advancing the expansion of DeFi functionalities on the

XRP Ledger (XRPL) with a new loan protocol proposal named 0066

XLS—66d. Currently under public review on GitHub, this protocol

aims to create a censorship-resistant DeFi ecosystem on XRPL. It

introduces a flexible lending mechanism, allowing users to

contribute tokens like XRP (COIN:XRPUSD), Wrapped BTC

(COIN:WBTCUSD), and wETH to a lending pool and negotiate loan terms

off-chain. The proposal also emphasizes security and transparency,

empowering practical applications and facilitating the construction

of decentralized lending apps.

Upcoming crypto token unlocks and potential market impact

This week, we will observe significant unlocks of crypto tokens

that may influence market dynamics. Unlocking is a process in which

tokens previously restricted due to funding rounds become available

for sale. This process can potentially affect token prices if

increased supply pressures sales, especially if there is limited

liquidity or if early investors decide to take profits. Key unlocks

include tokens from projects like Starknet, Arbitrum (COIN:ARBUSD),

ApeCoin (COIN:APEUSD), Pixels (GATE:PIXELUSDT), Axie Infinity

(COIN:AXSUSD), Manta Network and ImmutableX (COIN:IMXUSD).

German bank LBBW introduces cryptocurrency custody services in

partnership with Bitpanda

Landesbank Baden-Württemberg (LBBW), Germany’s largest federal

bank, revealed plans to launch an “investment-as-a-service”

infrastructure aimed at its corporate and institutional clients for

cryptocurrency custody and acquisition. In collaboration with the

Austrian exchange Bitpanda, LBBW is preparing to start a custody

pilot project in the second half of 2024, starting with bitcoin

(COIN:BTCUSD) and ether (COIN:ETHUSD). This partnership will enable

LBBW to offer trading and custody services for digital assets,

ensuring high security standards and meeting the growing demand for

digital assets among its clients.

UK prepares legislation to regulate cryptocurrencies and

stablecoins

Economic Secretary Bim Afolami announced at the Innovate Finance

Global Summit that the UK government plans to introduce legislation

covering stablecoins and other crypto activities such as staking,

exchange, and custody by mid-year. The new regulation, following a

2023 bill, will for the first time include exchanges’ operations

and custody of crypto assets within its regulatory scope. The

Financial Conduct Authority and the Bank of England have already

begun consultations on this regime.

Norway proposes legislation to regulate data centers and limit

cryptocurrency mining

The Norwegian government is introducing legislation to regulate

data centers, primarily aiming to restrict cryptocurrency mining

due to its high energy consumption. According to a report from

local news agency VG, Ministers Karianne Tung of Digitization and

Terje Aasland of Energy stated that the new law will require data

center operators to register with local regulators. Aasland

emphasized that cryptocurrency mining is unwanted in Norway due to

its significant greenhouse gas emissions. The measure aims to close

the door to businesses deemed harmful to the environment.

Adidas and Stepn launch NFT collection based on sports icons

Adidas (TG:ADS), known for its sportswear and shoes, announced a

collaboration with the fitness app Stepn, operating on the Solana

blockchain. The partnership begins with a series of 1,000 NFTs

called “Stepn x Adidas Genesis Sneakers,” inspired by Adidas’ most

famous running silhouettes. This collection marks the beginning of

several joint brand initiatives over a year, including more NFT and

physical product releases. The first series of the collection will

be launched on April 17 through the NFT marketplace Mooar, linked

to Stepn. Adidas has experience in partnerships in the web3 space,

having previously collaborated with entities such as Coinbase,

Bored Ape Yacht Club, and Bugatti. Stepn, an app that allows users

to earn cryptocurrencies by walking or running, has previously

partnered with Asics in 2022.

Avalon raises $10 million to launch crypto MMO

Avalon, a cryptographic game development studio, raised $10

million in a funding round led by Bitkraft Ventures and Hashed to

launch a massively multiplayer online game. The game, also titled

“Avalon,” is being developed in collaboration with AI pioneers

Didimo and Inworld AI. According to CEO Sean Pinnock, the game will

use Unreal Engine 5 and allow players to create game content with

AI assistance. The company also promises to release a collection of

AI-based avatar NFTs.

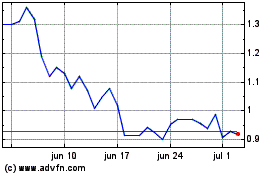

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ApeCoin (COIN:APEUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024