Paramount Global (NASDAQ:PARA),

Sony (NYSE:SONY), Apollo Global

Management (NYSE:APO) – Sony Pictures Entertainment and

Apollo Global Management are in discussions for a joint bid for

Paramount Global, aiming to take the company private. The bid would

include cash for all outstanding shares. Sony would operate the

studio, while Apollo would take control of the CBS broadcast

network. Paramount’s shares rose 10.3% in pre-market trading on

Friday.

Berkshire Hathaway (NYSE:BRK.A) – On Thursday,

the shareholder advisory firm Institutional Shareholder Services

(ISS) recommended withholding votes for reelecting five directors

of Berkshire Hathaway, including Susan Decker, citing concerns

about climate change and governance. ISS criticized the company for

lack of disclosure on climate risks and executive remuneration.

Trump Media & Technology Group (NASDAQ:DJT)

– Shares of Trump Media & Technology Group experienced a 26%

jump in shares on Thursday, following a 16% gain the previous day,

reversing losses from the week.

Frontier Communications (NASDAQ:FYBR) –

Frontier Communications reported a cyberattack on Thursday,

exposing personal information, without expecting a significant

financial impact. The investigation suggests a cybercrime group as

the perpetrator. The company believes the incident has been

contained and is restoring its normal operations. Shares fell more

than 3.6% in pre-market trading.

Apple (NASDAQ:AAPL) – Apple removed WhatsApp

and Threads from Meta Platforms (NASDAQ:META) from

its Chinese App Store by government order, citing national security

concerns. Telegram and Signal were also removed. This move

highlights the growing intolerance of the Chinese government

towards foreign messaging services outside of its control. Tim

Cook, CEO of Apple, ends his trip through Southeast Asia with a

meeting in Singapore, seeking new markets and manufacturing sites.

The company is exploring the region for growth, given challenges in

China.

Microsoft (NASDAQ:MSFT) – Microsoft invested

$13 billion in OpenAI, subject to a possible EU antitrust

investigation. The EU is considering whether the partnership

distorts competition or if Microsoft’s market power affects the

market. The European Commission is evaluating evidence to determine

whether to open an investigation. Microsoft claims it does not own

parts of OpenAI.

Meta Platforms (NASDAQ:META) – On Thursday,

Meta launched Llama 3, its latest language model, and an image

generator that updates images in real time. Integrated into Meta

AI, the models aim to compete with OpenAI. Meta AI will be more

prominent in Meta apps and a new website, aiming to lead the

market.

Alphabet (NASDAQ:GOOGL) – Google fired 28

employees following protests against its cloud contract with the

Israeli government. The company stated that the protesters

disrupted work in some offices. The protesters, affiliated with the

No Tech for Apartheid campaign, called the dismissal “retaliation”.

Google maintains that the contract is non-military. Additionally,

Sundar Pichai, CEO of Alphabet, announced a restructuring of

Google’s work teams to accelerate the development of artificial

intelligence products. AI teams will be consolidated under Google

DeepMind, aiming for more efficiency. Pichai also mentioned a new

team focused on security and trust.

Taiwan Semiconductor Manufacturing Company

(NYSE:TSM) – TSMC’s shares in Taipei fell 6.7% after the company

lowered its growth expectations, maintaining its capital spending

plans. The forecast is for up to a 30% increase in the second

quarter, driven by demand for artificial intelligence chips. The

company faces challenges, including resource and leadership issues.

Foreign investors withdrew $2.6 billion from Taiwanese stocks due

to the downgrade. This is the largest foreign sell-off in over

three years.

Intel (NASDAQ:INTC) – Intel announced on

Thursday that it has become the first to use the new “High NA EUV”

lithography tools from ASML (NASDAQ:ASML), marking

a crucial advancement in the chip technology race. Intel acquired

one of the $373 million (€350 million) machines, hoping to boost

future generations of chips.

KB Home (NYSE:KBH) – KB Home announced a new

share repurchase authorization worth $1 billion. This measure

replaces a previous authorization, which still had $113.6 million

available. Additionally, KB Home raised its dividend from 20 to 25

cents per share, scheduled for payment on May 23. The builder’s

shares advanced 2.6% in pre-market trading on Friday.

Johnson & Johnson (NYSE:JNJ) – A Florida

jury concluded that Johnson & Johnson’s baby powder did not

cause ovarian cancer in a Florida woman who died in 2019. The

company was justified, citing decades of research. The Matthey

family respects the decision but continues to seek justice. The

controversy over talc continues, with J&J facing over 50,000

lawsuits. The company’s bankruptcy strategy briefly suspended

litigation, but trials have resumed.

Sanofi (NASDAQ:SNY) – On Thursday, the French

pharmaceutical company Sanofi revealed plans to restructure its

U.S. commercial operations for vaccines, accompanied by unspecified

job cuts. The company seeks to implement a “streamlined strategic

sales structure” to better serve customers and patients, without

providing additional details.

JPMorgan Chase (NYSE:JPM) – JPMorgan filed a

lawsuit against the Russian state bank VTB to prevent the recovery

of $439.5 million blocked after Russian sanctions due to the

invasion of Ukraine. The dispute raises tensions over the

jurisdiction of sanctions laws. Additionally, two senior executives

from JPMorgan Chase, Andy Lipsky and Haidee Lee, are leaving the

bank, according to Reuters. Lipsky, vice president of investment

banking, is returning to Goldman Sachs (NYSE:GS). The bank has

faced a series of significant departures recently.

Goldman Sachs (NYSE:GS) – The sovereign wealth

fund of Norway, one of the world’s largest investors, will support

a resolution urging Goldman Sachs to separate the roles of CEO and

chairman of the board. Consultants recommended this separation.

Norges Bank Investment Management, which owns 0.84% of the bank,

supports the measure to ensure independent leadership.

PayPal (NASDAQ:PYPL) – The Singapore-based

payments company Triple-A will expand its list of accepted tokens

to include PayPal’s stablecoin (COIN:PYUSDUSD) by June. This move

aims to challenge the dominance of Tether’s USDT and expand its

service offerings, boosting the cryptocurrency market in

Singapore.

Ibotta (NYSE:IBTA) – On its New York Stock

Exchange debut, Ibotta’s shares soared 33%, valuing the company at

$3.55 billion. The IPO, selling 6.6 million shares at $88 each,

raised $577.3 million. CEO Bryan Leach plans to invest in

AI-enabled technology.

Nike (NYSE:NKE) – Nike is close to sealing an

eight-figure sponsorship deal with basketball star Caitlin Clark

before her professional debut. The deal will include an exclusive

line of footwear. She will join Nike’s roster of young talents,

such as LeBron James and Kevin Durant.

Shopify (NYSE:SHOP) – Shopify’s shares

increased 3.25% in pre-market, reaching $71.77, after Morgan

Stanley upgraded its rating from Equal Weight to Overweight and

raised the price target from $74 to $85.

Constellation Brands (NYSE:STZ), Canopy

Growth (NASDAQ:CGC) – Constellation Brands is distancing

itself from cannabis producer Canopy Growth, converting ordinary

shares into exchangeable ones. Three board members of Canopy,

backed by Constellation, resigned. The move aims to eliminate

financial impacts and reflects the strategy of no longer investing

in Canopy.

Nordstrom (NYSE:JWN) – Nordstrom, following

interest from the founding family, formed a special committee to

consider a possible privatization. With weak sales due to inflation

and high loan costs, the company will also evaluate third-party

proposals. Shares have risen 34% over 6 months, but any offer needs

to be significantly high to be accepted.

Tesla (NASDAQ:TSLA) – T. Rowe Price,

highlighting Elon Musk’s record 2018 salary from Tesla, considered

it aligned with investor interests. This occurred after a special

vote was scheduled by Tesla to reassess the package. T. Rowe holds

22.4 million shares of Tesla.

Toyota Motor (NYSE:TM) – The latest version of

the Toyota Camry features what made it a best-seller in the U.S.,

but with a significant change: it now offers a four-cylinder hybrid

engine, ditching the V-6. It is expected to maintain the robust

sedan’s success, with 51 mpg efficiency.

Airlines – U.S. airlines saw a resurgence in

corporate travel, boosting profits. Delta (NYSE:DAL), United

(NASDAQ:UAL), and Alaska Air (NYSE:ALK) reported strong recovery in

business flights, previously down due to the pandemic. Alaska Air

noted a significant increase in corporate revenues, especially from

technology companies.

Azul SA (NYSE:AZUL), Gol Linhas Aéreas

Inteligentes SA (NYSE:GOL) – Azul is in discussions for a

merger with Gol, considering a deal where Gol’s controlling

shareholder, Abra Group Ltd., would contribute its shares in

exchange for a stake in Azul. The goal is to address Gol’s

challenges, which entered bankruptcy protection, while Avianca

Holdings SA remains in focus as part of the Abra group. Regulators

would need to approve the transaction, which would reduce the

number of major local carriers from three to two in Brazil.

Northrop Grumman (NYSE:NOC) – Northrop Grumman

is collaborating with SpaceX on a spy satellite project for

high-resolution Earth imaging. Northrop’s inclusion reflects the

government’s concern in diversifying contractors. The project,

involving hundreds of satellites, aims to enhance military and

intelligence surveillance capabilities in the U.S.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

is considering a stock consolidation to maintain compliance with

New York Stock Exchange standards. The proposal, subject to

shareholder approval in June, aims to prevent delisting from the

stock exchange. The company has recently faced technical challenges

and a drop in shares. Shares fell 2.8% in pre-market trading on

Friday.

Bentley Systems (NASDAQ:BSY), Schneider

Electric (EU:SU) – Bentley Systems’ shares increased 1.8%

in pre-market following confirmation by the French industrial

company Schneider Electric that it was in discussions about a

potential strategic transaction, involving the possible acquisition

of Bentley. The value could be over $15 billion, according to the

Wall Street Journal.

Jabil Inc (NYSE:JBL) – Jabil Inc.’s shares fell

2.7% in pre-market after the announcement that its CEO is on paid

leave during an investigation into company policies. The

investigation does not affect its financial statements. CFO Michael

Dastoor will serve as interim CEO.

3M (NYSE:MMM) – 3M faces the possibility of

reducing its dividends after years of falling shares, according to

CFRA, with ongoing litigation related to chemicals and defective

earplugs. The spin-off of the health unit and settlements affect

the sustainability of dividends. Shares have fallen 47% since May

2021.

US Steel (NYSE:X) – The national security

review of the acquisition of US Steel by Nippon Steel will continue

by the Committee on Foreign Investment in the United States

(CFIUS), a White House official said on Thursday. President Biden

expressed opposition to the deal, but the course of additional

measures remains uncertain.

Exelon Corporation (NASDAQ:EXC) – Exelon

forecasts a 900% increase in energy demand from data centers in the

Chicago area, driven by artificial intelligence. About 25 projects

consume 5 gigawatts, attracting developers with low electricity

rates, nuclear power, and tax incentives. The electrical

infrastructure is being adapted to handle the growth.

Earnings

Netflix (NASDAQ:NFLX) – In the first quarter,

Netflix had earnings per share of $5.28 and revenue of $9.37

billion, exceeding analysts’ expectations surveyed by LSEG of EPS

of $4.52 and revenue of $9.28 billion. The total subscribers

reached 269.6 million, growing 16%. Netflix announced that it will

no longer disclose member numbers or average revenue per user from

2025, prioritizing profit and engagement. Shares are down 6.25% in

pre-market.

Intuitive Surgical (NASDAQ:ISRG) – Intuitive

Surgical reported adjusted earnings per share of $1.50 for the

previous quarter, surpassing the $1.41 estimate from LSEG. Its

revenue of $1.89 billion also slightly exceeded expectations. The

company’s shares increased 2.2% in pre-market.

PPG Industries (NYSE:PPG) – PPG’s shares fell

0.6% in pre-market, even as the adjusted earnings per share of

$1.86 matched expectations from LSEG. However, PPG’s revenue of

$4.31 billion fell below the $4.43 billion estimate.

Western Alliance (NYSE:WAL) – Western Alliance

reported quarterly earnings of $1.60 per share, below the consensus

estimate of $1.66 and 30.43% lower than the same period last year.

Its quarterly sales of $728.8 million exceeded expectations by

4.56%, a 32.05% increase from the previous year. Shares fell 1.4%

in pre-market.

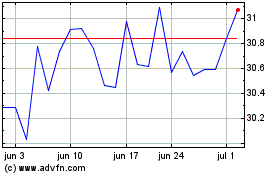

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024