Bitcoin halving may create significant supply-demand disparity

Bitfinex analysts predict that the recent halving of Bitcoin

mining rewards could result in demand up to five times greater than

supply. The block reward has decreased from 6.25 BTC to 3.125 BTC,

reducing the number of new coins available daily. With a potential

daily supply of $30 million and an estimated demand of over $150

million from spot ETFs in the US, the market may face significantly

constrained supply.

Recent movements in Bitcoin ETF market

On April 22, exchange-traded funds (ETFs) experienced a net

inflow of $62.2 million, marking the first series of inflows since

April 11. Conversely, the Grayscale ETF (AMEX:GBTC) saw a decrease

in outflows to $35 million, the lowest value since April 10,

possibly due to plans to launch a new ETF with reduced fees of

0.15%. Other data show that the ETF from BlackRock (NASDAQ:IBIT)

had an inflow of $19.7 million, maintaining its position among the

top ten ETFs with the highest inflows in the US for 70 consecutive

days. Overall, 7 out of 11 ETFs recorded net inflows, totaling

$12.388 billion in inflows.

Fidelity maintains neutral outlook for Bitcoin despite price

recovery

Fidelity Digital Assets (AMEX:FBTC) updated its medium-term

outlook for Bitcoin from “Positive” to “Neutral,” despite a

significant price recovery for Bitcoin (COIN:BTCUSD), which rose to

over $66,000 after dropping below $60,000. Fidelity’s analysis

suggests that Bitcoin is trading at a fair price, based on metrics

such as the Hashrate Yardstick, which compares to the traditional

stock market price/earnings ratio. With selling pressure increasing

and most addresses in profit, Fidelity sees Bitcoin as no longer

“cheap.” However, the short-term outlook remains positive, with

signs of strong accumulation by small investors and a continued

trend of self-custody reducing selling pressure.

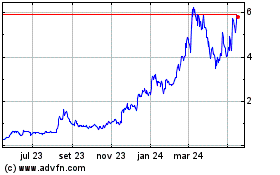

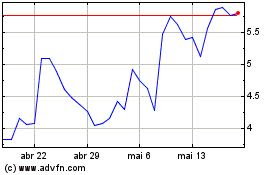

Akash Network token surges after listing on Upbit

The native token of Akash Network (COIN:AKTUSD), a decentralized

cloud computing platform, saw a significant increase of nearly 50%,

reaching almost $7, after being listed on Upbit, South Korea’s

largest cryptocurrency exchange. Prior to the listing, AKT was

trading at around $4. At the time of writing, the token was up

34.07% at $5.47, possessing a market capitalization of $1.252

billion. Akash Network, operating on the Cosmos blockchain, allows

the buying and selling of computational resources in its

decentralized marketplace.

Security flaw in Cosmos fixed before malicious exploitation

Aesthetic Research revealed it had identified and secretly

reported a critical vulnerability in the Cosmos blockchain

ecosystem (COIN:ATOMUSD), which could have compromised over $150

million in assets. The flaw, known as a “reentrancy vulnerability,”

was reported to the Cosmos development team through the HackerOne

Bug Bounty program and fixed before any exploitation could

occur.

Injective update elevates INJ to deflationary status

The Injective network (COIN:INJUSD) community approved

significant changes to the tokenomics system for its version 3.0,

aiming to make INJ one of the most deflationary assets in the

cryptocurrency market. The update, which includes a reduction in

token minting properties and adjustments to inflationary

parameters, aims to strengthen INJ compared to even Bitcoin. The

near-unanimous approval (99.99%) reflects strong community support

for the proposal.

OP and YGG tokens drop ahead of scheduled unlocks

The native tokens of Optimism (COIN:OPUSD) and Yield Guild Games

(COIN:YGGUSD) briefly fell 3.5% and 3%, respectively, due to

scheduled unlocks for the end of this week. In digital asset

markets, unlocks refer to the controlled release of tokens that

were previously restricted to increase liquidity and prevent

immediate massive sales by project teams. Generally interpreted as

a negative sign, although it may also reinforce the existing market

trend. At the time of writing, OP was slightly down 0.39% over the

last 24 hours while YGG recovered to a high of 0.52%.

More than $1 million of Vitalik Buterin’s crypto potentially stuck

in cryptocurrency bridge

A cryptocurrency wallet linked to Vitalik Buterin, co-founder of

Ethereum (COIN:ETHUSD), apparently has over $1 million stuck in the

Optimism bridge, revealed an analysis by Arkham, a blockchain

intelligence company. This situation is part of a larger issue

faced by many wallets that have significant assets stuck in bridge

contracts between different blockchain networks.

EigenLayer raises TVL to $15 billion with new updates

The Ethereum staking protocol, EigenLayer, saw its total value

locked (TVL) exceed $15 billion after implementing an increase in

its staking limits. The project, which allows staking of both

native Ether and liquid Ether for the security of other protocols,

experienced a significant increase in its TVL since its early

launch on April 9. Recently, EigenLayer reduced the minimum stake

from 320 to 96 ETH and introduced new actively validated services,

increasing functionality and security within the Ethereum

ecosystem.

Ripple Labs contests $2 billion fine proposed by SEC

Ripple Labs (COIN:XRPUSD) filed a document on Monday opposing

the SEC’s request for a New York judge to impose a fine of nearly

$2 billion on the company for violations related to XRP Ledger

sales. The SEC sought $1.95 billion in fines and restitution,

including restitution of $876 million, pre-judgment interest of

$198 million, and an equivalent civil penalty. Ripple argued for a

maximum penalty of only $10 million, criticizing the SEC’s demands

as an example of regulatory overreach.

Blockchain associations challenge SEC rule in court

Blockchain groups, including the Blockchain Association and the

Crypto Freedom Alliance of Texas, filed a lawsuit against a new SEC

regulation that expands the definition of “dealer” to include

certain participants in the digital asset market. They allege that

the rule improperly covers traders who do not act as traditional

dealers and that the SEC ignored public feedback and failed to

conduct the necessary economic analysis. The lawsuit, filed in the

Northern District Court of Texas, seeks to prevent the SEC from

enforcing the rule, arguing that it is arbitrary and exceeds the

legal authority of the agency.

Binance launches copy trading services while facing regulatory

challenges in the Philippines

Binance, a leading cryptocurrency trading platform, announced

the launch of a new spot copy trading feature, allowing users to

automatically copy trades from top-performing traders on the

platform. Inspired by user feedback, the service aims to facilitate

access to advanced trading strategies and risk management. Leading

traders can now register their portfolios for copy trading starting

today, with the feature gradually being rolled out in May. In other

news, the Securities and Exchange Commission of the Philippines

(SEC) is collaborating with Google (NASDAQ:GOOGL) and Apple

(NASDAQ:AAPL) to remove the Binance app from their respective app

stores in the country as part of measures against unregulated

activities. The SEC argues that Binance offers unregistered

securities and operates without authorization, violating local

laws. The move follows similar actions to block online access and

halt targeted advertising to Filipinos amid global regulatory

challenges faced by the platform.

Crypto.com postpones launch in Korea after money laundering

inspection

Crypto.com delayed the launch of its service in South Korea,

initially scheduled for April 29, following reports of an emergency

inspection by the South Korean Financial Intelligence Unit (FIU)

due to money laundering concerns. The exchange, which already had

approval from local regulators, stated it would use this time to

ensure that authorities fully understand its anti-money laundering

policies and systems, considered gold standard in various global

jurisdictions.

PDVSA considers Tether use to bypass US sanctions

PDVSA, Venezuela’s state-owned oil company, is exploring the use

of the Tether stablecoin (COIN:USDTUSD), the largest dollar-pegged

stablecoin, to circumvent recent US sanctions, according to

Reuters. The company seeks to adopt USDT to shield its operations

from account freezes abroad. Reports indicate that PDVSA utilizes

intermediaries in cryptocurrency transactions to maintain

anonymity.

PayPal promotes eco-friendly Bitcoin mining with cryptocurrency

rewards

PayPal (NASDAQ:PYPL) is encouraging bitcoin miners to adopt more

sustainable practices through a new clean energy validation

platform developed in partnership with EnergyWeb. The platform

monitors and rewards miners using low-carbon methods in their

operations, offering rewards in bitcoin. The initiative aims to

mitigate the environmental impact of bitcoin mining, which is

notoriously energy-intensive and has been criticized for

contributing significantly to global carbon emissions.

Canaan executives plan stock purchase

Two executives of Canaan (NASDAQ:CAN), a major Bitcoin mining

hardware manufacturer, announced plans to acquire at least $2

million in company stock. Nangeng Zhang, CEO, and James Jin Cheng,

CFO, believe Canaan is “deeply undervalued.” They view the

acquisition as an attractive investment opportunity, especially

after the recent Bitcoin halving, which they believe will bring new

opportunities to the sector. Canaan also reported significant

advancements in the production of its new mining platforms.

Lisbon Blockchain Conference launches startup competition with

renowned judges

The Lisbon Blockchain Conference is gearing up to be a crucial

stage for cryptocurrency startups, featuring an exclusive

competition where founders can showcase their innovations to

influential investors. At the event, which includes figures like

Subvisual CEO Robert Machado and AgileGTM partner Fillipo Chisari,

startups will have the chance to gain visibility and potentially

attract funding. Additionally, the event will offer various

networking activities, providing a rich experience for all

participants.

Turnkey raises $15 million to develop blockchain wallet

infrastructure

Turnkey, a startup specializing in wallet infrastructure for

blockchain developers, raised $15 million in a Series A funding

round. The round was led by Lightspeed Faction and Galaxy Ventures,

with participation from Sequoia and other notable investors.

Co-founded by former Coinbase (NASDAQ:COIN) employees, the company

aims to make it easier for developers to create secure and

user-friendly blockchain wallets.

Akash Network (COIN:AKTUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Akash Network (COIN:AKTUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025