Bitcoin Stabilizes at $62,000, SEC Delays Exodus NYSE Listing, and More Crypto News

09 Maio 2024 - 4:28PM

IH Market News

Bitcoin hovers at $62K amid favorable macroeconomic data

On May 9, Bitcoin (COIN:BTCUSD) is showing signs of recovery as

new U.S. macroeconomic data revealed an unexpected rise in

unemployment claims, hitting a nine-month high. At last check, the

cryptocurrency was up 1.4% over the last 24 hours at $62,038. This

situation is generating expectations of interest rate cuts by the

Fed due to tensions in the labor market.

SEC delays listing of Exodus

Exodus (USOTC:EXOD), a provider of cryptographic wallets,

announced that the U.S. Securities and Exchange Commission (SEC)

has caused an unexpected delay in its NYSE listing scheduled for

May 9. The SEC is reviewing the company’s registration statement,

which has delayed the process. Despite the setback, Exodus reported

strong revenue growth in the first quarter and continues to operate

on the OTCQX under the ticker EXOD.

Robinhood records robust growth driven by cryptocurrencies; CEO

criticizes SEC

In the last quarter, Robinhood Markets (NASDAQ:HOOD) saw

significant growth, primarily driven by an increase in

cryptocurrency transactions. Revenue rose 40% year-over-year, with

crypto transactions more than tripling. Adjusted earnings before

interest, taxes, depreciation, and amortization (EBITDA) were $0.05

per share. The company also added 500,000 new accounts, the largest

addition since the first quarter of 2022, and saw robust deposit

growth. Cryptocurrency transactions more than tripled compared to

the previous year, and new products and increased EBITDA margins

also contributed to success.

During a May 9 interview on CNBC, Vlad Tenev, CEO of Robinhood,

expressed concerns about the restrictions on Americans’ access to

cryptocurrencies, criticizing the SEC’s “regulation by enforcement”

approach. Tenev highlighted the lack of progress after several

meetings with the SEC, culminating in a Wells Notice indicating the

possibility of enforcement actions against the company for selling

alleged unregistered securities. Tenev calls for regulation that

facilitates, rather than restricts, access to cryptocurrencies.

JPMorgan sees no regulatory hurdles for Ether ETFs after SEC’s

warning to Robinhood

Despite the SEC’s intimidation of Robinhood regarding potential

irregular securities offerings, JPMorgan (NYSE:JPM) believes this

will not affect the approval of future spot Ethereum ETFs.

According to analysts led by Nikolaos Panigirtzoglou, the situation

could mirror that of the futures-based Bitcoin ETFs already

approved. Even if the SEC initially refuses, it will face legal

challenges and may eventually approve the spot Ether ETFs. The

SEC’s Wells Notice to Robinhood seems more a reinforcement of the

view that various cryptocurrencies should be considered securities,

but this does not imply that Ether is a security.

Digital Currency Group reports revenue growth in the first quarter

The Digital Currency Group (DCG), parent company of Grayscale,

announced an 11% increase in quarterly revenue, reaching $229

million. Grayscale contributed $156 million, remaining stable

despite challenges such as intense redemptions and a reduction in

the management fee following its Bitcoin Trust’s conversion into an

ETF. Other group companies, like Foundry and Luno, also saw

significant revenue increases, marking a strong start to the year

for DCG.

Binance fires employee after discovering market manipulation by VIP

client and faces $4.3 million fine in Canada

Binance terminated an employee who identified market

manipulation by DWF Labs, a cryptocurrency investment firm that is

a client of the exchange, according to the Wall Street Journal. The

former team member and Binance’s surveillance team detected

irregular activities, including pump-and-dump schemes and wash

trading involving large investors. Despite the evidence presented,

Binance found insufficient proof for action and ultimately

dismissed the head of the investigation team.

In response to the Wall Street Journal’s accusations of market

manipulation, both Binance co-founder Yi He and DWF Labs vehemently

denied the allegations. Yi He, in a post on X, described the

article as beneficial for Binance’s visibility, while criticizing

the emotional and biased basis of the media. He also highlighted

Binance’s support for authorities in investigations, which is

rarely reported, and defended the integrity and transparency of its

operations.

In Canada, Binance was penalized by regulators with a fine of

approximately $4.3 million (C$6 million) for two separate

violations of the country’s financial regulations. The Financial

Transactions and Reports Analysis Centre of Canada (FINTRAC) stated

that Binance failed to register as a foreign money services

business despite several warnings to do so. Additionally, Binance

failed to report 5,902 cryptocurrency transactions, each exceeding

$10,000, including the necessary customer knowledge (KYC) data from

June 1, 2021, to July 19, 2023, according to FINTRAC’s blockchain

analysis.

Cardano to include CIP-69 improvement in upcoming Chang hard fork

Charles Hoskinson, founder of the Cardano blockchain

(COIN:ADAUSD), announced the integration of the Cardano Improvement

Proposal (CIP) 69 in the upcoming Chang hard fork. In a statement

via X, he responded to the demands of the community and the Cardano

Foundation. Despite being a last-minute addition, Hoskinson assures

that this should not significantly delay the release of Chang,

although he acknowledges that unexpected adjustments in the roadmap

may present risks. CIP-69 aims to simplify interactions in the

platform’s smart contracts, eliminating certain complications and

improving the security and effectiveness of decentralized

applications.

Ripple and partners form alliance to facilitate digital asset

recovery

Ripple (COIN:XRPUSD) and XRPL Labs have teamed up with Swirlds

Labs, creator of Hedera (COIN:HBARUSD), and the Algorand Foundation

(COIN:ALGOUSD) in the Decentralized Recovery (DeRec) Alliance. This

alliance, founded by Leemon Baird of Hedera, aims to develop an

open-source system for digital asset recovery, improving

interoperability and security for users, especially those new to

cryptocurrencies. The initiative also includes other organizations

such as Acoer and BankSocial, collaborating to establish standards

for digital asset recovery.

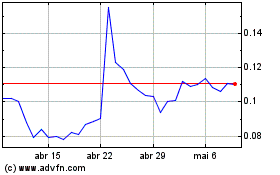

Hedera Hashgraph (COIN:HBARUSD)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Hedera Hashgraph (COIN:HBARUSD)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024