Berkshire Hathaway (NYSE:BRK.A),

Chubb (NYSE:CB) – Chubb’s stock increased by

approximately 9.3% after Berkshire Hathaway disclosed its

acquisition of nearly 26 million shares of the property and

casualty insurer, representing a $6.7 billion investment. As a

result, Chubb became Berkshire’s ninth-largest holding by the end

of March, as recorded in a new regulatory document.

Netflix (NASDAQ:NFLX) – Netflix revealed that

40 million monthly active users have now adopted its ad-supported

plan, compared to 5 million the previous year. Netflix also

announced it will stream NFL games on Christmas this year,

extending into 2025 and 2026. This marks the first time it has

licensed league rights and streamed live football. The deal

reflects a desire to attract sports audiences and boost the

advertising market.

Comcast (NASDAQ:CMCSA) – Major League Baseball,

the National Hockey League, and the National Basketball Association

expressed concern over the imminent bankruptcy of broadcaster

Diamond Sports, stressing that the lack of a new deal with Comcast

could be fatal. The leagues, in a hearing, requested more

information on the impasse in negotiations.

Walt Disney (NYSE:DIS) – CEO Bob Iger announced

a drastic reduction in investment in programming for traditional

television networks, aiming to maximize audiences and profits in

the streaming era. Shows like “Abbott Elementary” quickly

transitioned to Hulu, attracting a younger audience.

Paramount Global (NASDAQ:PARA),

Amazon (NASDAQ:AMZN) – Paramount Global is in

talks with Amazon to strengthen ties between their media

operations, including possible combined channel and advertising

sales. It is also considering a streaming partnership with Comcast

to boost Paramount+, its already popular streaming service on

Amazon’s channel store. Meanwhile, it faces acquisition offers from

David Ellison and Apollo Global Management (NYSE:APO) to address

financial challenges, following the replacement of CEO Bob Bakish

with a new trio of leaders.

Trump Media & Technology Group (NASDAQ:DJT)

– Hudson Bay Capital Management, Geode Capital Management, and

Morgan Stanley are among the investors who acquired positions in

Trump Media & Technology Group in the first quarter, securities

records showed. On Wednesday, Trump Media informed the U.S.

Securities and Exchange Commission that it would delay its

quarterly filing due to the appointment of a new auditor after the

dismissal of the previous one, accused of fraud.

Microsoft (NASDAQ:MSFT) – Microsoft is

encouraging employees in China to consider relocating outside the

country due to increasing tensions between the U.S. and China over

technologies like artificial intelligence and semiconductors. About

700 to 800 people received the offer, mainly Chinese engineers.

Apple (NASDAQ:AAPL) – Coatue Management

dissolved its stake in Apple Inc. in the first quarter, while

Viking Global Investors built a substantial new position. Other

major investors, such as Berkshire Hathaway, also reduced their

stakes in Apple but praised the company.

Alphabet (NASDAQ:GOOGL) – Google is enhancing

security in Android 15, revealed at the annual Google I/O

conference. With anti-theft features, fraud protection, and a

private space, it targets competition from Apple. Google also

highlighted the growth of its ecosystem, including Wear OS and

Android TV.

Palo Alto Networks (NASDAQ:PANW),

IBM (NYSE:IBM) – Palo Alto is acquiring cloud

security assets from IBM, including QRadar software, strengthening

its Cortex Xsiam platform. The partnership aims to expand

consulting and customer base. Meanwhile, IBM retains QRadar for

local data centers but promotes the transition to Cortex Xsiam. The

transaction is expected to be completed by September. Additionally,

IBM plans to add 800 new employees in Ireland, marking the

country’s largest multinational sector job announcement this year.

These hires will focus on research and development, digital sales,

and consulting, boosting the Irish technology ecosystem in key

growth areas.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – A fatal explosion occurred at TSMC’s construction site

in Arizona. Cesar Anguiano-Guitron, a 41-year-old driver, was

killed while inspecting a waste tank. The local union expressed

concern for safety, while TSMC is cooperating with

investigations.

BlackRock (NYSE:BLK) – BlackRock revealed that

only about 58% of votes at its annual meeting supported executive

compensation. All 16 nominated directors received majority votes.

Proxy advisors recommended votes against, citing concerns with the

award determination processes. The company aims to engage with

shareholders to address their concerns about executive compensation

and respond to questions about its investment approach and

corporate policies.

Corebridge Financial (NYSE:CRBG) – Nippon Life

Insurance agreed to acquire 20% of Corebridge Financial for about

$3.8 billion, its largest deal to date in the U.S. The transaction

includes a strategic partnership with American International Group

(NYSE:AIG) and is subject to regulatory approval.

Goldman Sachs (NYSE:GS) – Goldman Sachs is

expanding its middle-market business to diversify revenue, after

recruiting Kerry Burke from Evercore and Eddie Rubin from Lazard,

as part of a strategy to advise mid-sized businesses on

transactions up to $2 billion.

Visa (NYSE:V) – Visa is launching an innovative

technology to share shopping preference information with retailers,

using proprietary “tokens” for security. CEO Ryan McInerney

emphasizes consumer control over shared data. Visa will also

introduce facial recognition payments and flexible credentials in

the U.S.

Anglo American (LSE:AAL) – According to

Reuters, Anglo American has suspended global hiring, aiming to

streamline and increase value, after resisting a $43 billion

acquisition offer from BHP Group (NYSE:BHP).

Refocusing on copper, the company is shutting down less profitable

businesses and facing investor pressure.

Exxon Mobil (NYSE:XOM) – Exxon requested that

proxy advisor Glass Lewis abstain from recommendations at its

upcoming shareholder meeting, citing conflict of interest due to

Glass Lewis’s affiliation with ICCR, which is critical of Exxon’s

legal actions. Glass Lewis recommended voting against independent

director Joseph Hooley.

Uber Technologies (NYSE:UBER) – Uber is

diversifying its services, now offering bus transportation to

airports and events, along with a partnership with Costco

Wholesale (NASDAQ:COST) for deliveries via Uber Eats. The

expansion aims to sustain growth, focusing on cost-effective

options and strategic partnerships. Additionally, a U.S. judge

dismissed a class action lawsuit against Uber, accused of

concealing its use of a Dutch subsidiary as a tax haven. The judge

found no evidence of false statements, noting that the company

based its European operations in Amsterdam for tax reasons, not

personal ones, as claimed.

Tesla (NASDAQ:TSLA) – A U.S. judge rejected

Tesla’s attempt to dismiss a lawsuit alleging the company misled

owners about the autonomous driving capability of its electric

vehicles. The suit, led by Thomas LoSavio, seeks compensation for

owners who believed Tesla’s claims since 2016.

Toyota Motor (NYSE:TM) – Toyota is testing its

new electric Hilux pickup truck in Thailand, aiming for local

production by 2025. With the Thai market being crucial, the

automaker faces increasing competition from Chinese electric

vehicle manufacturers. The focus is on understanding and meeting

customer needs while expanding hybrid sales in the region.

Honda Motor (NYSE:HMC) – Japan’s Honda

announced a significant increase in its investment in

electrification and software, reaching about $65 billion by 2030.

CEO Toshihiro Mibe emphasized the importance of securing reliable

batteries and reducing costs before focusing on advanced software

vehicles.

Nio (NYSE:NIO) – Nio announced the annual

launch of new models under its Onvo brand, with prices comparable

to gasoline vehicles, targeting the family market in China. The

first Onvo L60 SUV was launched at a price 12% lower than Tesla’s

Model Y. The company is also investing in electric vehicle

infrastructure, including battery swapping stations, aiming to

generate additional revenue as its user base grows.

Volaris Airlines (NYSE:VLRS) – The U.S.

Department of Transportation will impose a fine of up to $300,000

on Volaris Airlines for tarmac delays that violate federal law. In

two incidents, one in Houston in 2021 and another in St. Louis in

2022, passengers were unable to deplane due to long delays.

Pfizer (NYSE:PFE) – Pfizer agreed to pay up to

$250 million to settle over 10,000 lawsuits in the U.S. related to

the cancer risks of Zantac, according to the Financial Times. The

settlement aims to mitigate Pfizer’s liability amid concerns about

the medication.

Tyson Foods (NYSE:TSN) – CEO Donnie King of

Tyson Foods expressed uncertainty about the timing of a significant

rebuild of the U.S. cattle herd due to supply shortages, impacting

the company’s beef business. Lower feed costs and better grazing

conditions are encouraging, but high interest rates are a hurdle.

Additionally, King reported that the reintroduction of some

antibiotics is yielding positive results, with healthier birds

gaining more weight and experiencing less early mortality. The

company adjusted its antibiotic policy to focus on poultry health

and operational efficiency.

Mondelez (NASDAQ:MDLZ) – Swedish fund AP7 will

vote in favor of a resolution requiring Mondelez to conduct an

independent study on the risks of continuing operations in Russia.

The non-binding resolution will be voted on at the company’s annual

meeting.

Lululemon Athletica (NASDAQ:LULU) – Lululemon

will acquire the operations and retail stores of its franchise

partner in Mexico. The local franchisee, Lululemon Mexico, has

operated 15 stores since 2017. All employees will be absorbed by

Lululemon. Financial terms were not disclosed.

On Holding (NYSE:ONON) – Swiss shoe

manufacturer On Holding signed a sponsorship deal with 22-year-old

tennis player Flavio Cobolli, elevating him to its select group of

athletes. He will wear On apparel at the French Open in May. The

company, whose deals include Roger Federer, aims to expand its

global presence.

Victoria’s Secret (NYSE:VSCO) – Victoria’s

Secret will revive its iconic angel wing runway show in the third

quarter. After an attempt on Amazon Prime Video in 2023, the

company returns to tradition.

GameStop (NYSE:GME), AMC

Entertainment (NYSE:AMC) – GameStop recorded a 15.8% drop

in pre-market trading, following a 19% decline on Wednesday, while

AMC Entertainment saw a 12% drop in pre-market trading after a 20%

decline the previous day. Despite recent drops, both stocks still

posted significant gains over the week, driven by strong rallies on

Monday and Tuesday.

Earnings

AST SpaceMobile (NASDAQ:ASTS),

AT&T (NYSE:T) – Shares of AST SpaceMobile

jumped 36.8% in pre-market trading after announcing a commercial

agreement with AT&T to provide its satellite broadband network

directly to mobile devices. Meanwhile, AT&T shares rose 0.6%.

Additionally, AST SpaceMobile reported a loss per share of 16 cents

in the first quarter, better than the 23-cent loss in the same

period last year and estimates of a 21-cent per-share loss. The

company reported revenue of $500,000, missing revenue estimates of

$5.50 million.

Cisco Systems (NASDAQ:CSCO) – Cisco Systems

shares rose 4.5% in pre-market trading after the tech company

reported adjusted earnings of 88 cents per share in the third

fiscal quarter, with revenues of $12.70 billion. The results

exceeded analysts’ expectations of 82 cents per share and $12.53

billion in revenue, as reported by LSEG.

Baidu (NASDAQ:BIDU) – Shares of the Chinese

internet search provider rose 2% in pre-market trading, driven by

demand for its AI cloud business. Its net profit fell 6% to 5.45

billion renminbi. Excluding extraordinary items, profits would have

increased 24% to 19.91 renminbi per share, or $2.76 per U.S. share.

Revenue rose 1% to $4.37 billion (31.5 billion renminbi), with the

core Baidu and its AI service Ernie offsetting the decline in its

video streaming service iQIYI. Analysts expected a profit of $2.21

per share and sales of $4.34 billion.

B. Riley Financial (NASDAQ:RILY) – B. Riley

shares are steady in pre-market trading after reporting a loss of

$1.71 per share in the first quarter, contrasting with a net profit

of 51 cents last year. Revenue for the period was $343.03 million.

The company maintained its quarterly dividend at 50 cents per

share, after halving it in February.

Hawkins (NASDAQ:HWKN) – Hawkins shares are

steady in pre-market trading after reporting revenue of $223

million, compared to the consensus estimate of $217.49 million in

the fourth quarter, a 2% drop from the same period last year. The

company reported earnings per share of $0.66, below the $0.68

expected by analysts. Management expressed caution about the

performance of its industrial sector over the next 12 months,

noting that while moderately optimistic, they still expect economic

and competitive pressures to affect many of their clients,

impacting demand.

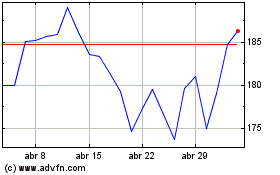

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024