Ethereum ETFs approved but trading still pending

The SEC has given the green light to eight Ethereum ETFs from

major management firms like BlackRock (NYSE:BLK), Fidelity, and

Grayscale. However, the delay in finalizing the S-1 forms,

essential for the commencement of trading, might prolong the

process. Experts indicate that the sluggishness is due to

last-minute changes and potential political influence, unlike the

swift process observed with Bitcoin ETFs. Trading for Ethereum ETFs

could take weeks or months to start.

SEC approval of Ether ETFs doesn’t boost cryptocurrency prices

Despite the SEC approving regulatory filings for spot Ether

ETFs, the cryptocurrency market reacted with a decline. The price

of Bitcoin (COIN:BTCUSD) dropped to a low of $66,171. In the past

24 hours, Bitcoin slightly increased by 0.30% to $68,123. Ethereum

(COIN:ETHUSD), which had fallen to $3,627, mitigated losses to a

drop of -1.4% at $3,720 at the time of writing. The crypto market

had anticipated the approval, with ETH’s price rising about 26% in

the last seven days. Additionally, the lack of immediate trading

for the ETFs may have contributed to the absence of a significant

price reaction. Historically, Bitcoin also fell after the approval

of its ETFs, suggesting a similar pattern for Ethereum.

Bitcoin ETFs in the US attract $107.91 million in inflows on

Thursday

On May 23, US spot bitcoin ETFs continued to attract investors,

with $107.91 million in inflows, marking the ninth consecutive day

of gains. This streak is the longest since March. Since the SEC

approved the first ETFs in January, funds from major managers like

BlackRock and Fidelity have accumulated billions. BlackRock’s

iShares Bitcoin Trust (NASDAQ:IBIT) led with $89 million in

inflows, while the Grayscale Bitcoin Trust (AMEX:GBTC) saw outflows

of $14 million. IBIT is now just $300 million behind GBTC in

inflows to become the largest spot Bitcoin ETF.

Chainlink price jumps to $17.35 driven by increased activity

Chainlink (COIN:LINKUSD) experienced a significant price

increase while the global crypto market showed a slight retreat,

jumping from an opening price of $16.58 to a high of $17.81, quoted

at $17.35 at the time of writing. Over the week, LINK accumulated a

gain of 11.6%. The price of the cryptocurrency was boosted by a

sharp increase in network activity, indicating a strong resistance

level at $17.41.

Algorand ad criticizes rivals but receives mixed reactions

The Algorand Foundation (COIN:ALGOUSD) sparked controversy with

a new YouTube ad attacking Bitcoin (COIN:BTCUSD), Ethereum

(COIN:ETHUSD), and Solana (COIN:SOLUSD) networks for their payment

transaction limitations. The video shows buyers facing problems

using these cryptocurrencies and highlights Algorand as superior in

speed and cost. Despite over 700,000 views, the ad generated

criticism from commentators who pointed out a negative marketing

approach and questioned the effectiveness of such campaigns in

driving crypto adoption.

Dfinity launches API to connect ICP to other blockchains

The Dfinity Foundation introduced EVM RPC, a new API that

promotes interoperability between the Internet Computer

(COIN:ICPUSD) and other Ethereum Virtual Machine-compatible

blockchains, including Optimism and Arbitrum. The API will also

support Bitcoin and plans to expand to Solana. The technology

facilitates the creation of multi-chain dApps without the need for

bridges, allowing ICP smart contracts to interact directly with

various networks, simplifying development, and fostering liquidity

in the Web3 ecosystem.

Kabosu, the face of Dogecoin, dies at 17

Kabosu, the dog that inspired the meme behind Dogecoin

(COIN:DOGEUSD) and several other meme tokens, passed away on Friday

at the age of 17. Her owner announced in a blog that a farewell

party will be held on Sunday, May 26, in Narita, Japan. Kabosu

became an iconic figure in digital culture, influencing the

creation of various meme-based cryptocurrencies, including

Dogecoin, Shiba Inu (COIN:SHIBUSD), and Floki (COIN:FLOKIUSD),

becoming influential symbols in the crypto world.

US Supreme Court denies arbitration to Coinbase in Dogecoin case

The US Supreme Court denied Coinbase Global’s (NASDAQ:COIN)

motion to compel arbitration in a case related to its Dogecoin

(COIN:DOGEUSD) sweepstakes. The court upheld previous decisions,

indicating that the sweepstakes rules, which designate exclusive

jurisdiction to California courts, prevail over Coinbase’s User

Agreement that preferred arbitration. This decision marks a

significant defeat for Coinbase, emphasizing the judiciary’s rigor

in contract interpretations.

OKX withdraws license application in Hong Kong and limits

operations

OKX, one of the largest cryptocurrency exchanges, announced the

withdrawal of its license application to operate in Hong Kong.

According to a statement on the company’s website, the decision is

part of a strategic reassessment. Starting May 31, OKX will cease

centralized operations in the territory, allowing only withdrawals.

The move comes as other major exchanges face stringent regulatory

reviews from local authorities.

Trial of Binance executive in Nigeria postponed due to health

issues

The High Court of Nigeria postponed the trial of Tigran

Gambaryan, a Binance executive, to June 20 after he suffered a

health collapse during the hearing. Accused of money laundering,

Gambaryan was unable to continue the trial, leading to his transfer

to the hospital for evaluation. The defense requested the

postponement, emphasizing the need for a proper recovery before

proceeding with the case.

Sam Bankman-Fried transferred to federal transfer center in

Oklahoma

Sam Bankman-Fried, former CEO of FTX, was relocated to the

Federal Transfer Center in Oklahoma City, according to Federal

Bureau of Prisons records. The move diverges from Judge Lewis

Kaplan’s request for Bankman-Fried to remain at the Metropolitan

Detention Center in Brooklyn to facilitate access to his attorney.

This relocation occurs as he awaits possible future transfers

within the US prison system.

Judge rules SPRK tokens are securities in case against Ian Balina

The federal court in Texas ruled that Ian Balina, a

cryptocurrency influencer, illegally offered unregistered

securities by selling Sparkster (COIN:SPRKRUSD) tokens to US

investors. Judge David Alan Ezra confirmed that the tokens fall

under US securities laws, meeting the investment contract criteria

of the Howey Test. The decision marks a partial victory for the

SEC, which sued Balina for his activities related to the tokens in

2022.

Rabbit AI refutes Coffeezilla’s fraud accusations

Rabbit AI, a personal AI assistance company, contested the

accusations made by YouTube investigator Stephen Findeisen, known

as Coffeezilla, that it was involved in an NFT scheme. The company

clarified that the Gama NFT project and Rabbit are separate

initiatives, though under the same corporate umbrella. After being

accused of failing to deliver promises and masking its rebranding

from Cyber Manufacture, Rabbit stated that over 80% of the

employees were hired post-rebranding, highlighting transparency in

its processes and products, including the new Rabbit R1 AI.

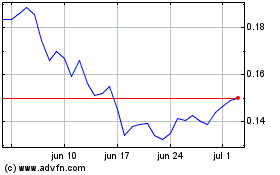

Algorand (COIN:ALGOUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Algorand (COIN:ALGOUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025