Bitfarms rejects Riot Platforms’ $950 million acquisition offer

On May 29th, Bitfarms (NASDAQ:BITF) rejected a $950 million

acquisition proposal from Riot Platforms (NASDAQ:RIOT), arguing

that the offered value was insufficient. Received on April 22nd,

the offer consisted of $2.30 per share in cash and stock. The

decision was made after analysis by the Special Committee of

Independent Directors, which deemed the offer inadequate

considering the company’s growth expectations, in a period already

marked by leadership challenges and litigation.

Bitcoin and Ethereum retreat after recent highs

In the last 24 hours, the price of Bitcoin retreated by 1.4%,

falling to less than $68,000, after reaching $70,000 earlier in the

week. Currently, BTC is trading at $67,320. Concurrently, Ethereum

recorded a 2.3% decline, trading at $3,750, while the market awaits

news about the listing of Ether ETFs on the US spot market. This

expectation arises after the SEC approved, last week, some

registrations from potential providers.

Fernando Pereira, an analyst at Bitget, commented on the current

market landscape: “The Bitcoin liquidation map over a 1-day

period shows a significant liquidity range at higher levels, with

about $2 billion up to the $73,000 region, a short-term resistance

point. In the lower range, liquidity is lower, with about $1.58

billion up to the $64,000 region, indicating greater resistance to

be overcome.”

BlackRock’s iShares Bitcoin Trust becomes the world’s largest

Bitcoin fund

BlackRock Inc.’s (NYSE:BLK) iShares Bitcoin Trust (NASDAQ: IBIT)

has become the world’s largest Bitcoin fund, with nearly $20

billion in assets. Surpassing the Grayscale Bitcoin Trust

(AMEX:GBTC), the ETF fund demonstrated greater accessibility and

attractiveness to investors, contributing to a record increase in

the price of Bitcoin (COIN:BTCUSD). The SEC approved the first US

spot Bitcoin ETFs in January, boosting confidence in the

market.

Hashdex withdraws application for Ether spot ETF from the SEC

Investment manager Hashdex has withdrawn its application to

launch an Ether spot ETF with the United States Securities and

Exchange Commission (SEC), according to documents dated May 28th.

The request was canceled on May 24th, a day after the SEC approved

eight similar products. The ETF proposal combined holdings in Ether

spot with futures contracts to reduce manipulation risks. Specific

reasons for the withdrawal were not detailed.

First leveraged Ethereum ETF to be launched on CBOE in June

The Volatility Shares 2x Ether Strategy ETF (ETHU) will be

launched on the Chicago Board Options Exchange by June 4th, marking

the first leveraged Ethereum ETF in the US. This type of ETF allows

investors to amplify their market exposure with smaller initial

investments.

NYSE to introduce Bitcoin-linked financial products

The New York Stock Exchange (NYSE) plans to launch financial

products based on the Bitcoin spot price, in collaboration with

CoinDesk Indices. Utilizing the CoinDesk Bitcoin Price Index, NYSE

will develop cash-settled options, expanding risk management tools

for investors as interest in Bitcoin grows. These products are

still awaiting regulatory approval.

ARK Invest’s Cathie Wood comments on surprise approval of

cryptocurrency ETFs

ARK Invest CEO Cathie Wood revealed during the Consensus 2024

event that cryptocurrency became a relevant topic in US elections,

influencing the unexpected approval of Ether ETFs. According to

Wood, the situation was unlikely, but changes in the political

landscape, including former President Trump’s increasing support

for cryptocurrencies, played a crucial role. Additionally, the

FIT21 legislation, which promotes technological innovation, was

instrumental, receiving bipartisan support and signaling

cryptocurrency as a key electoral issue.

Ripple expands financial support for pro-crypto candidates with $25

million donation

Ripple (COIN:XRPUSD) announced a new $25 million contribution to

the Fairshake super political action committee, reinforcing its

support for crypto-friendly candidates in the 2024 US elections.

This donation, in addition to the previously donated $25 million,

aims to influence a more positive regulatory environment for

cryptocurrencies in the United States, emphasizing the critical

importance of the upcoming elections for the future of financial

and technological innovation.

Celo adopts Chainlink’s CCIP protocol to enhance blockchain

interoperability

Ethereum Layer-2 network Celo (COIN:CELOUSD) announced the

adoption of Chainlink’s (COIN:LINKUSD) CCIP protocol, aimed at

facilitating interoperability between different blockchains.

According to Celo CEO Eric Nakagawa, this integration marks a

significant step for the ecosystem, offering the highest security

in cross-chain communication. This advancement promises to drive

adoption and long-term growth of Celo, in an era where real asset

tokenization presents an expansive horizon for blockchain.

Mastercard introduces Crypto Credential to simplify P2P

transactions

Mastercard (NYSE:MA) has launched the Crypto Credential system,

facilitating the first peer-to-peer (P2P) transactions using

aliases instead of complex blockchain addresses. The system aims to

make cryptocurrency transactions more accessible to exchange users,

integrating verification standards and wallet compatibility.

Initially available on exchanges Bit2Me, Lirium, and Mercado

Bitcoin, the feature aims to connect corridors between Latin

America and Europe, promising to expand access for 7 million users

in the coming months.

Circle announces partnership with BTG Pactual and expands

stablecoin operations in Brazil

Stablecoin issuer Circle (COIN:USDCUSD) officially started

operations in Brazil and partnered with BTG Pactual (BOV:BPAC11).

According to the company, this collaboration aims to expand access

to USDC, considering Brazil a leading market in fintech innovation.

This move coincides with the plans of the Central Bank of Brazil to

introduce cryptocurrency regulations by the end of the year.

PayPal expands use of PYUSD stablecoin on the Solana network

PayPal (NASDAQ:PYPL) announced the expansion of its PYUSD

stablecoin (COIN:PYUSDUSD) to the Solana blockchain, aiming for

faster, secure, and cost-effective transactions. The move, also

confirmed by Solana, introduces a stablecoin with “high yield and

settlement speed” and adds compliance functionalities. This

expansion aims to increase adoption of PYUSD, which is already

available with no transaction fees on wallet provider Phantom and

aims to facilitate trade and payments for its 30 million

merchants.

Sui Blockchain launches AUSD stablecoin with support from financial

giants

Sui, a Layer 1 blockchain known for its superior performance and

unlimited scalability, announced the launch of the AUSD stablecoin

for July 2024. The introduction of AUSD, backed by technology and

finance company Agora and market leaders like Nick van Eck and

Drake Evans, aims to improve liquidity and transaction efficiency

on the platform. This release marks the arrival of the second

native stablecoin in the Sui ecosystem, consolidating its rapid

expansion and strengthening its DeFi environment.

AI Token Merger: Fetch.ai, SingularityNET, and Ocean Protocol join

forces

The merger of artificial intelligence protocol tokens Fetch.ai

(COIN:FETUSD), SingularityNET (COIN:AGIXUSD), and Ocean Protocol

(COIN:OCEANUSD) is scheduled for June 13th. Under the new alliance

called the Artificial Superintelligence Alliance (ASI), the tokens

will unify on the Fetch.ai platform, which will be renamed ASI.

From June 11th, it will be possible to exchange FET tokens for ASI,

followed by AGIX and OCEAN after the merger is completed.

Sei Foundation announces second airdrop of 27 million tokens

Following the success of the v2 upgrade, the Sei Foundation

(COIN:SEIUSD) will distribute over 27 million SEI tokens to its

community. This airdrop rewards active participants in the Mainnet

Pacific-1. Additionally, the upgrade brought technological

advancements, making Sei v2 the first parallelized EVM blockchain,

with transactions confirmed in less than one second.

Gemini initiates full refund of assets in Earn program after

agreement with Genesis

Cryptocurrency exchange Gemini has started returning assets to

users of its defunct Earn program, refunding $2.18 billion in

crypto assets, representing 97% of the total owed. This refund

comes after an agreement with Genesis and other creditors during

its bankruptcy process. Gemini ensured that users would receive

back the same amount of borrowed crypto assets, including any

appreciation during the program period.

Appeal for medical assistance for Binance executive detained in

Nigeria

Yuki Gambaryan, wife of detained Binance executive Tigran

Gambaryan, urges Nigerian authorities to comply with a court order

to transfer her sick husband to a hospital. Although the court has

ordered Gambaryan to receive medical care, he remains in Kuje

prison. Yuki has also requested support from the US government to

facilitate her husband’s release.

Israel explores potential of Digital Shekel with new challenge

The Bank of Israel announced the launch of the Digital Shekel

Challenge, an initiative to explore innovative payment applications

with a digital shekel prototype. The challenge aims to integrate

payment service providers in developing features such as

micropayments and multiparticipant transactions. Still in the

research phase, the final decision on issuing the digital currency

has not yet been made.

Cristiano Ronaldo launches “Forever Worldwide” NFT collection with

global art

Cristiano Ronaldo launched on May 29th the first phase of his

new NFT collection, “Forever Worldwide: The Road to Saudi Arabia,”

depicting his journey from his early days in Madeira to success at

European clubs. Collaborating with Binance and artists from various

cities where he played, the collection offers fans unique digital

art and the chance for unique experiences with the idol.

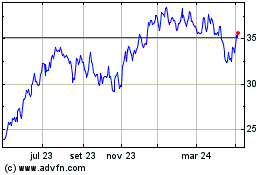

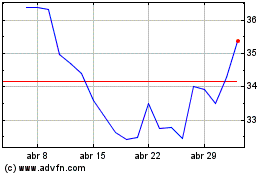

BTG PACTUAL UNT (BOV:BPAC11)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

BTG PACTUAL UNT (BOV:BPAC11)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025