Bitcoin nears record high after strong influx into BlackRock’s ETF

The price of Bitcoin surged to a high of $71,108.90 on Tuesday,

influenced by record inflows into BlackRock’s Bitcoin ETF

(NASDAQ:IBIT). Currently, it is priced at $70,919, marking a 3.08%

increase in 24 hours. Other cryptocurrencies, such as Ethereum

(COIN:ETHUSD), Binance Coin (COIN:BNBUSD), Solana (COIN:SOLUSD),

TON Coin (COIN:TONCOINUSD), and Uniswap (COIN:UNIUSD) also recorded

significant gains at the time of writing.

BNB on track for new record driven by platform launches

Binance’s BNB token (COIN:BNBUSD), after a rise of over 10%

since last Sunday, is close to reaching its all-time high of $705,

trading at $670 at the time of writing. The increase was driven by

demand on the Binance Launchpad and Launchpool platforms, where BNB

is needed to participate in new token offerings. Despite the

enthusiasm, caution remains in the options market, where traders

are buying put options with a strike price of $550 to $650,

anticipating potential volatility.

Uniswap delays vote on governance and fee structure update

The Uniswap Foundation (COIN:UNIUSD) has postponed a crucial

decision on revising its governance mechanism and fee structure

after receiving feedback from a significant stakeholder. The delay,

aimed at improving benefits for UNI token holders, was motivated by

the need for additional diligence given the importance of the

proposal. The organization apologized for the delay and promised to

keep the community informed of any future developments. Uniswap’s

native token reversed the losses of the past 7 days, appreciating

19.18% to $11.30 in the last 24 hours.

BlackRock’s Bitcoin ETF surpasses $20 billion in assets under

management

BlackRock’s iShares Bitcoin Fund (NASDAQ:IBIT), a US spot

Bitcoin ETF, surpassed $20 billion in assets under management,

marking 15 consecutive sessions of net inflows. According to Eric

Balchunas of Bloomberg Intelligence, the fund captured about $2.4

billion in the last month, one of the largest inflows in the ETF

market. Since May 16, the fund has averaged $140 million in daily

inflows, standing out as the leader among the top ten funds.

New Ethereum ETFs could attract up to $4.8 billion in five months

According to K33 Research, newly approved Ethereum ETFs in the

US could generate between $3.1 billion and $4.8 billion in net

inflows in the first five months. The estimate is based on the

market relationship between Bitcoin and Ether. Analysts highlight

that this would represent a significant increase of up to 1.05% of

Ether’s (COIN:ETHUSD) circulating supply, reflecting strong

institutional demand and potential price appreciation.

Thailand approves first spot Bitcoin ETFs

Thailand’s Securities and Exchange Commission has given the

green light to the country’s first spot Bitcoin ETF, managed by One

Asset Management. This product will provide broader access for

retail investors, investing in major global funds for greater

liquidity and security. The approval follows growing global

interest in Bitcoin ETFs, with a recent increase in net inflows

into US Bitcoin ETFs, highlighting continued confidence in these

financial products.

Australia launches its first spot Bitcoin ETF on the CBOE exchange

Monochrome Asset Management introduced Australia’s first spot

Bitcoin ETF, named IBTC, on the CBOE exchange. The fund, with a

management fee of 0.98%, offers investors a regulated way to invest

directly in Bitcoin, monitored by ASIC to ensure compliance and

protection. Gemini acts as the custodian, ensuring investors’ legal

rights to the Bitcoins.

CoreWeave offers $1 billion to acquire Bitcoin miner Core

Scientific

CoreWeave Inc., specializing in cloud computing, made a formal

offer of about $1 billion to acquire Bitcoin miner Core Scientific

Inc. (NASDAQ:CORZ). The proposal includes an acquisition price of

$5.75 per share, reflecting a 55% increase over Core Scientific’s

recent average price. This acquisition is part of CoreWeave’s

strategic expansion, which also includes long-term agreements for

Core Scientific to host its data center operations, strengthening

its position in the cryptocurrency and artificial intelligence

markets.

Bitpanda and Deutsche Bank partner for fiat transactions in Germany

Cryptocurrency brokerage Bitpanda announced a partnership with

Deutsche Bank (NYSE: DB) to manage fiat deposits and withdrawals in

Germany. With the agreement, Bitpanda customers gain access to

German International Bank Account Numbers (IBANs), facilitating

conversion between cryptocurrencies and fiat currency. Lukas

Enzersdorfer-Konrad, vice CEO of Bitpanda, highlighted that this

collaboration will expand the banking products available to users,

reinforcing the integration between traditional and digital

finance: “Bringing together the best parts of the industry is

where we can create real value for people… From today, we can

access a range of Deutsche Bank products, unlocking benefits for

our team and our users,” said Enzersdorfer-Konrad.

Astar Network proposes burning $38 million in tokens to revitalize

token economy

Astar Network (COIN:ASTRUSD), a Japanese dApp project and

layer-two solution, proposes burning 350 million ASTR tokens,

valued at $38 million, to strengthen its tokenomics. According to

Maarten Henskens of the Astar Foundation, this action should reduce

inflation and boost the token’s market value, encouraging

investment and realigning token supply with market conditions. The

community will vote on this proposal after a discussion period.

Ark Labs innovates with Bitcoin layer 2 payment protocol

Ark Labs launched an innovative Bitcoin Layer 2 payment

protocol, called Ark protocol, aiming for a more efficient

alternative to the Lightning Network. This protocol eliminates the

need for channel and liquidity management, simplifying transactions

and maintaining user autonomy over their funds. Marco Argentieri,

CEO of the company, highlighted that the Ark protocol allows fast

and continuous transactions, ideal for users seeking convenience

without relinquishing control over their cryptocurrencies.

“With the launch of Ark Labs, we are finally making Ark a

reality so that users can start immediately enjoying the benefits

of scalable and seamless transactions,” said Argentieri. The

protocol implementation is available for developers and promises to

transform the way Bitcoin payments are made.

StarkWare explores expansion to Bitcoin with scaling technology

StarkWare, a leader in Ethereum scaling solutions, announced

plans to implement its technology on Bitcoin to enhance the

cryptocurrency’s transaction capacity. Valued at $8 billion, the

company sees the current discussion on the Bitcoin OP_CAT proposal

as an opportunity to expand its operations and use its

zero-knowledge expertise to scale Bitcoin, in addition to Ethereum.

The company also plans to introduce a $1 million fund to support

related research.

Web3 Foundation injects resources into Polkadot expansion in Asia

The Web3 Foundation, responsible for Polkadot (COIN:DOTUSD),

announced a grant to PolkaPort East to expand the blockchain

network in Asia. This is the foundation’s first grant to an Asian

entity, aiming to increase decentralization and technical and

community growth. The grant is part of a program that includes an

initial $20 million and 5 million DOT tokens allocated for

Decentralized Futures, intended to support the Polkadot

ecosystem.

Worldcoin pauses operations in Spain until end of 2024

Worldcoin (COIN:WLDUSD) agreed to suspend its operations in

Spain until the end of 2024, as announced by the Spanish Data

Protection Agency. This decision follows an ongoing investigation

into the company’s data privacy practices, led by the Bavarian

authority. The company has intensified security measures, including

the possibility for users to delete their iris biometric data.

Polygon Labs expands zero-knowledge expertise with Toposware

acquisition

Polygon Labs (COIN:MATICUSD) acquired Toposware, a company

specializing in blockchain research and zero-knowledge technology.

This acquisition strengthens Polygon’s strategy to enhance its

zero-knowledge solutions, such as AggLayer, which promotes

interoperability between Ethereum Layer 2 layers. This is Polygon’s

third significant ZK technology acquisition in less than three

years, continuing its expansion and innovation in the blockchain

space.

Avail raises $43 million to boost web3 scalability solutions

Avail, a spin-off from Polygon (COIN:MATICUSD), raised $43

million in its Series A round to create a solution aimed at solving

scalability and fragmentation issues in the Web3 ecosystem. This

investment brings the total funding to $75 million. With the

support of major venture capital funds, Avail plans to implement

its Unification Layer to improve interoperability between

blockchains and advance its Fusion security mechanism. The strategy

also includes the launch of Avail Nexus, focused on addressing

cross-rollup interoperability challenges.

FTX reaches provisional $24 billion settlement with IRS; Sam

Bankman-Fried returns to Brooklyn detention center

Bankrupt cryptocurrency platform FTX has reached a provisional

settlement with the IRS, the main US tax authority, to resolve a

$24 billion dispute. The IRS initially claimed over $44 billion in

taxes. Under the agreement, subject to court approval, the IRS

would receive $200 million in priority tax credits and an

additional $685 million as subordinated credit. This settlement

covers all of FTX’s tax debts until October 2022, mitigating future

litigation risks.

Meanwhile, former FTX CEO Sam Bankman-Fried was returned to the

Metropolitan Detention Center (MDC) in Brooklyn after a temporary

stay at a transfer facility in Oklahoma. Speculations about a

possible relocation to California were dismissed. Bankman-Fried is

focused on working on his conviction appeal, and Judge Lewis Kaplan

recommended that he remain in New York to facilitate this

process.

Platform X suspends Sahil Arora’s account over fraud allegations

Social media platform X suspended Sahil Arora’s account,

“@Habibi_Comm”, for involvement in fraudulent schemes, including

the promotion of celebrity memecoins. Arora was accused of

manipulating conversations and forging fake partnerships, including

one publicly denied by the exchange BingX. Celebrities like Iggy

Azalea, Caitlyn Jenner, and Rich the Kid accused Arora of misusing

their images to promote fraudulent projects.

Watford FC offers 10% of its shares to fans and investors

Watford FC, an English second division club, is selling 10% of

its capital through the Seedrs platform, aiming to raise about 17.5

million pounds. The shares, priced at 12 pounds each, are available

to fans and global investors, with the promise of additional

benefits via digital tokens.

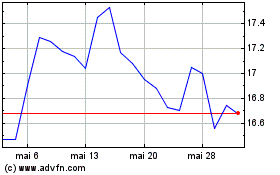

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Deutsche Bank Aktiengese... (NYSE:DB)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024