Traders May Take A Breather Following Yesterday’s Rally As Jobs Data Looms

06 Junho 2024 - 10:08AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Thursday, with stocks likely to show a lack of

direction following the rally seen over the course of the previous

session.

Traders may take a step back to assess the outlook for the

markets following yesterday’s surge, which lifted the Nasdaq and

the S&P 500 to new record closing highs.

Trepidation ahead of Friday’s closely watched monthly jobs

report may also keep some traders on the sidelines, as the data

could have a significant impact on the outlook for interest

rates.

The Labor Department report is expected to show employment

increased by 185,000 jobs in May after climbing by 175,000 jobs in

April, while the unemployment rate is expected to remain at 3.9

percent.

A day ahead of the release of the monthly jobs report, the Labor

Department released a report this morning showing first-time claims

for U.S. unemployment benefits rose by more than expected in the

week ended June 1st.

The Labor Department said initial jobless claims climbed to

229,000, an increase of 8,000 from the previous week’s revised

level of 221,000.

Economists had expected jobless claims to inch up to 220,000

from the 219,000 originally reported for the previous week.

Stocks moved sharply higher over the course of the trading day

on Wednesday, adding to the modest gains posted during Tuesday’s

session. With the rally on the day, the Nasdaq and the S&P 500

reached new record closing highs.

The Nasdaq and the S&P 500 saw further upside going into the

close, reaching new highs for the session. The Nasdaq surged 330.86

points or 2.0 percent to 17,187.90 and the S&P 500 jumped 62.69

points or 1.2 percent to 5,354.03, while the narrower Dow posted a

more modest gain, rising 96.04 points or 0.3 percent to

38,807.33.

The surge by the Nasdaq came as tech stocks continued to take

their cues from Nvidia (NASDAQ:NVDA), as the AI darling soared by

5.2 percent to a new record closing high.

Last month, Nvidia announced a ten-for-one stock split, with

holders of the company’s common stock as of the close of trading on

Thursday set receive nine additional shares.

The advance by Nvidia contributed to strength in the broader

semiconductor sector, resulting in a 4.5 percent spike by the

Philadelphia Semiconductor Index.

Semiconductor equipment manufacturers Applied Materials

(NASDAQ:AMAT) and KLA Corp. (NASDAQ:KLAC) also posted standout

gains after Barclays upgraded its rating on the stocks to

Equal-Weight from Underweight.

Computer hardware stocks are also saw substantial strength on

the day, driving the NYSE Arca Computer Hardware Index up by 3.4

percent.

Shares of Hewlett Packard Enterprise (NYSE:HPE) skyrocketed by

12.0 percent after the technology company reported fiscal second

quarter results that exceeded analyst estimates on both the top and

bottom lines.

Networking, software and biotechnology stocks also saw notable

strength, while gold, housing and airline stocks turned in some of

the best performances outside the tech sector.

The strength on Wall Street also came as a report from payroll

processor ADP showing private sector job growth in the U.S. slowed

by more than expected in the month of May added to optimism about

the outlook for interest rates.

ADP said private sector employment climbed by 152,000 jobs in

May after jumping by a downwardly revised 188,000 jobs in

April.

Economists had expected private sector employment to increase by

173,000 jobs compared to the addition of 192,000 jobs originally

reported for the previous month.

Treasury yields moved lower following the release of the jobs

data, with the ten-year yield falling to its lowest levels in two

months.

Meanwhile, traders largely shrugged off a separate report from

the Institute for Supply Management showing service sector activity

returned to growth in the month of May after contracting in April

for the first time since December 2022.

The ISM said its services PMI jumped to 53.8 in May from 49.4 in

April, with a reading above 50 indicating growth in the sector.

Economists had expected the index to inch up to 50.8.

With the much bigger than expected increase, the services PMI

reached its highest level since hitting 54.1 in August 2023.

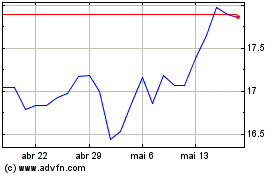

Hewlett Packard Enterprise (NYSE:HPE)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Hewlett Packard Enterprise (NYSE:HPE)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024