Adobe (NASDAQ:ADBE) – Adobe exceeded

expectations in the last quarter with revenue of $5.31 billion,

above analysts’ consensus polled by FactSet of $5.29 billion.

Adjusted earnings were $4.48 per share, surpassing estimates of

$4.39. The company raised its revenue outlook to $21.4 billion to

$21.5 billion and adjusted earnings to $18 to $18.20 per share for

the fiscal year. Shares jumped 14.9% in pre-market trading.

Visa (NYSE:V), Mastercard

(NYSE:MA) – The $30 billion antitrust agreement proposed by Visa

and Mastercard, aimed at reducing card fees for merchants, is at

risk of rejection. New York judge Margo Brodie indicated she’s

unlikely to approve it, citing significant concerns in the nearly

19-year-old case. The proposed agreement sought to settle a

long-standing dispute over the high fees merchants pay to accept

credit card payments. It would have allowed merchants to charge

consumers extra fees on card transactions and use pricing

strategies to incentivize the use of cheaper cards.

Microsoft (NASDAQ:MSFT) – Microsoft has

postponed the launch of “Recall,” an AI tool that monitors computer

activities, originally scheduled for next week. Instead, the

technology will be tested in a smaller group through the Windows

Insider Program due to privacy concerns.

Apple (NASDAQ:AAPL) – On Thursday, a

class-action proposal was filed against Apple, accusing it of

underpaying over 12,000 female employees in California compared to

men in similar roles, alleging systematic wage discrimination in

its engineering, marketing, and AppleCare divisions.

Alphabet (NASDAQ:GOOGL) – Alphabet’s Waymo unit

announced the recall of 672 autonomous vehicles due to incidents

including collisions and erratic driving behavior. Following a May

crash, NHTSA investigated 22 reports of issues. Waymo has

implemented software and mapping updates to improve detection and

safety. In other news, Google partnered with NV Energy and startup

Fervo Energy to operate data centers using geothermal electricity.

This energy, derived from underground heat, offers a stable,

carbon-free source unlike solar and wind, supporting Google’s

climate goals by 2030.

Snowflake (NYSE:SNOW) – Snowflake is wrapping

up its investigation into a hacker attack affecting up to 165

customers. The incident involved the use of stolen credentials,

highlighting the importance of multi-factor authentication. The

company is collaborating with Mandiant and CrowdStrike to mitigate

damage and enhance security measures.

Arm Holdings (NASDAQ:ARM), Sirius XM

Holdings (NASDAQ:SIRI) – Arm Holdings will replace Sirius

XM Holdings in the Nasdaq 100 Index on June 24 due to its higher

market value. The change, announced by Nasdaq, reflects minimum

market capitalization criteria for the index. Inclusion could boost

demand for Arm’s shares among index-linked investors.

Tesla (NASDAQ:TSLA) – Tesla shareholders

approved a $56 billion pay package for CEO Elon Musk, reinforcing

support for his leadership. Despite opposition from some

institutional investors and proxy firms, retail investors—often

Musk enthusiasts—backed the proposal. Norway’s wealth fund, Tesla’s

largest shareholder with a significant stake, will continue

constructive dialogue despite voting against the pay package.

Approval comes amid ongoing litigation in Delaware, where a judge

criticized the board for being overly tied to Musk. In other news,

China’s market regulator announced on Friday that Tesla will update

the software of 5,836 imported Model 3, S, and X cars starting July

due to safety issues. Additionally, Canadian Klaus Pflugbeil

pleaded guilty in New York to stealing Tesla’s trade secrets on

electric vehicle battery manufacturing and attempting to sell them

to undercover FBI agents. He faces up to 10 years in prison.

Ford Motor (NYSE:F) – Ford Motor will allow all

its dealers to sell electric vehicles starting July 1, removing

previous requirements for investment in training and

infrastructure. The move aims to boost sales after

slower-than-expected adoption, easing access to models like the

F-150 Lightning and Mustang Mach-E. According to Reuters, the

automaker had introduced rules in 2022 requiring dealers to spend

between $500,000 to about $1 million on charging equipment and

other programs. Approximately half of its 2,800 dealerships have

joined the program since then.

Stellantis NV (NYSE:STLA) – Stellantis is

considering shifting production of Leapmotor vehicles from China to

Europe due to new tariffs on EV imports by the European Union. CEO

Carlos Tavares indicated that extra costs could accelerate this

move as they seek to avoid growing global trade tensions.

Boeing (NYSE:BA) – Boeing is investigating a

quality issue on the 787 Dreamliner after discovering hundreds of

fasteners were improperly installed on some undelivered jet

fuselages. This is the latest in a series of manufacturing issues

involving improperly torqued fasteners, which do not pose an

immediate safety concern for flight. The head of the Federal

Aviation Administration (FAA) admitted the agency failed in

overseeing Boeing before a serious incident involving an Alaska

Airlines 737 MAX 9 in January. The FAA is now ramping up on-site

inspections and investigations into Boeing, seeking accountability

for violations and improving safety culture.

Royal Caribbean (NYSE:RCL) – The cruise

industry is recovering robustly post-pandemic, with high demand and

higher prices. Some analysts highlight Royal Caribbean as a leader,

expecting the sector as a whole to continue advancing.

JPMorgan Chase (NYSE:JPM) – JPMorgan and Greek

fintech Viva Wallet, led by Haris Karonis, settled a London court

dispute over the company’s valuation. The court dismissed claims of

value manipulation by the bank, potentially allowing Viva to be

sold based on a fair valuation before July 2025.

Wells Fargo (NYSE:WFC) – According to

Bloomberg, Wells Fargo fired over a dozen employees for alleged

keyboard activity simulation in its wealth and investment

management unit, creating an impression of active remote work.

Goldman Sachs (NYSE:GS) – Goldman Sachs plans

to increase lending to ultra-rich clients with over $10 million,

aiming to double this area over the next five years. The strategy

aims to offer financing for large purchases, from real estate to

sports teams, bolstering its wealth management operations and

leveraging growing deposits.

New York Community Bancorp (NYSE:NYCB) – On

Thursday, New York Community Bancorp announced the acquisition of

assets from bankrupt Signature Bank, valued at $37.8 billion. The

transaction includes primarily cash, cash equivalents, and

loans.

3M (NYSE:MMM) – 3M plans to transfer $2.5

billion in pension obligations to Metropolitan Tower Life

Insurance, affecting 23,000 retirees in the US. This move, expected

in October, will result in a pension settlement charge of up to

$900 million next quarter.

Walmart (NYSE:WMT) – Walmart will relaunch ‘No

Boundaries,’ its fashion brand for Generation Z, with affordable

and sustainable products like a bra made from sugarcane. The goal

is to attract young consumers with prices below $15 and a strong

campaign on TikTok, Roblox, and Instagram to boost sales.

GameStop (NYSE:GME) – GameStop’s virtual annual

shareholder meeting was postponed to June 17 due to technical

difficulties with the third-party hosting site, with no business

conducted. Keith Gill, known as “Roaring Kitty,” apparently

liquidated his options position in GameStop, converting them into

over nine million common shares. His Reddit screenshot showed a

significant drop in his cash balance, suggesting reinvestment. The

move impacted the market alongside GameStop’s postponed shareholder

meeting.

Starbucks (NASDAQ:SBUX) – The US Supreme Court

ruled in favor of Starbucks, overturning an order to rehire fired

employees in Memphis during a unionization attempt. The court

argued that the standard used to issue the injunction was

inadequate, requiring stricter criteria for future decisions on

contested labor practices.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle’s

shares are rising despite controversies over portion sizes.

Consumers are using social media to complain about portion sizes,

but the company denies any changes. Investors and analysts maintain

confidence, reflected in a 42% rise in shares this year,

outperforming the S&P 500. Additionally, positive outlook and

planned stock split sustain market optimism.

Tyson Foods (NYSE:TSN) – On Thursday, Tyson

Foods suspended its CFO, John R. Tyson, following his arrest for

driving under the influence. Curt Calaway will assume the role

temporarily. Tyson is the great-grandson of the company’s founder,

and this was Tyson’s second arrest in less than two years.

Signet Jewelers (NYSE:SIG) – Signet Jewelers

CEO Gina Drosos stated the company is confident in its second-half

forecasts, dismissing concerns about excessive discounts that

caused a drop in shares. She emphasized they are prepared to

effectively compete in the market, maintaining competitive pricing

and launching new designs. The company reported adjusted earnings

per share of $1.11 and sales of $1.511 billion in the first

quarter. EPS beat Wall Street’s forecast of 85 cents but fell short

of revenue estimates of $1.516 billion. Same-store sales in the

period declined 8.9%, missing forecasts.

RH (NYSE:RH) – In the first quarter, home décor

retailer RH reported a loss of $3.6 million, or 20 cents per share,

below analysts’ expectations of a 13-cent loss per share. Revenue

reached $726.9 million, slightly above the $725 million

expectation. For the second quarter, the company forecasts sales

growth of 3% to 4%, against an expectation of 7.5%. RH maintains

its annual growth forecast of 8% to 10%, despite a challenging real

estate market. Shares fell 11.2% in pre-market trading.

Teva Pharmaceuticals (NYSE:TEVA) – Teva

Pharmaceuticals sued Corcept Therapeutics and distributor Optime

Care for monopolistic practices in the Korlym market, a drug for

Cushing’s syndrome. Allegations include bribing doctors to maintain

exclusive prescriptions, preventing more affordable generics from

entering the market and affecting patients with the rare

disease.

Pfizer (NYSE:PFE), Sarepta

Therapeutics (NASDAQ:SRPT) – Pfizer’s failure in a gene

therapy trial for DMD has devalued its prospects but may benefit

Sarepta Therapeutics. Analysts note that unlike Pfizer, Sarepta

already has accelerated approval for its treatment, Amondys, and

expects to expand this approval. This contrast could enhance

Sarepta’s market position.

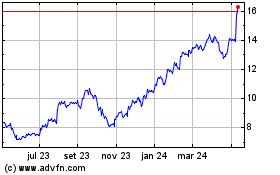

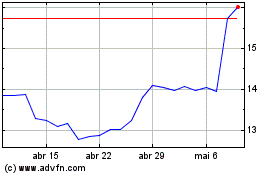

Teva Pharmaceutical Indu... (NYSE:TEVA)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024