U.S. Index Futures Surge; Oil Prices Increase

20 Junho 2024 - 7:56AM

IH Market News

U.S. index futures rose in pre-market trading on Thursday

following the Juneteenth holiday.

As of 6:21 AM, Dow Jones futures (DOWI:DJI) were up 42 points,

or 0.11%. S&P 500 futures advanced 0.41%, and Nasdaq-100

futures gained 0.63%. The 10-year Treasury yield stood at

4.254%.

In the commodities market, West Texas Intermediate crude for

July rose 0.04% to $81.60 per barrel. Brent crude for August

increased by 0.21%, nearing $85.25 per barrel. Iron ore traded on

the Dalian Exchange climbed 0.36% to $113.56 per metric ton.

On Thursday’s economic agenda, the Commerce Department will

release May housing starts data at 8:30 AM. Simultaneously, the

Labor Department will publish weekly jobless claims, and the

Philadelphia Fed will release its June industrial activity index.

Later, at 11:00 AM, the Department of Energy (DoE) will present its

weekly petroleum inventory update as of last Friday.

European markets are trending higher, driven by investor

expectations regarding upcoming interest rate decisions from the

central banks of the UK and Norway. It is expected that Norway’s

central bank will keep its interest rate steady at 4.5%. Meanwhile,

the Swiss National Bank announced a 0.25 percentage point cut in

its key interest rate, now set at 1.25%, according to Reuters

forecasts.

The People’s Bank of China is maintaining its key interest rates

stable, with the Loan Prime Rates unchanged for the fourth month.

Bank President Pan Gongsheng suggested a possible shift towards a

short-term rate as a monetary policy reference. Asian markets

closed mixed: the Shanghai SE fell 0.42%, Nikkei rose 0.16%, Hang

Seng dropped 0.52%, Kospi advanced 0.37%, and ASX 200 remained

flat.

On Tuesday, the Dow Jones rose 0.15%, the S&P 500 advanced

0.25%, and the Nasdaq grew 0.16%. Volatility followed the release

of mixed economic data, with modest increases in retail sales and a

significant jump in industrial production. Investors became

optimistic after weak retail sales figures suggested that American

households are starting to control their spending – an indication

of a slowdown in economic growth that could give the Federal

Reserve room to lower interest rates. Among individual stocks,

Nvidia (NASDAQ:NVDA) made history, becoming the most valuable

company in the U.S.

In the realm of quarterly reports, scheduled to report before

the market opens are Aurora Cannabis (NASDAQ:ACB),

Accenture (NYSE:ACN), Kroger

(NYSE:KR), Darden Restaurants (NYSE:DRI),

Jabil (NYSE:JBL), Winnebago

(NYSE:WGO), Silvaco (NASDAQ:SVCO),

Commercial Metals Company (NYSE:CMC),

Gypsum Management & Supply (NYSE:GMS),

Tsakos Energy Navigation (NYSE:TNP), among

others.

After the market closes, reports are expected from Smith

& Wesson (NASDAQ:SWBI) and Algoma

(NASDAQ:ASTL).

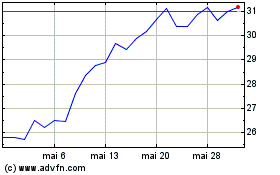

Tsakos Energy Navigation (NYSE:TNP)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Tsakos Energy Navigation (NYSE:TNP)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025