Bitcoin ETFs attract investments despite price drop

In June, spot bitcoin ETFs recorded net inflows of $790 million

despite a 7% drop in BTC price. BlackRock’s iShares Bitcoin Trust

(NASDAQ:IBIT) led with over $1 billion in inflows, offsetting

outflows from Grayscale Bitcoin Trust (AMEX:GBTC). The anticipation

for a spot Ether ETF also boosted inflows. It is expected that an

Ether ETF, though less impactful, will increase the popularity of

Ether among these investors.

Bitcoin ends quarter with a drop but optimistic forecasts for the

future

Bitcoin’s price closed the quarter with a decline of

approximately 13%. Despite not surpassing resistance levels above

$64,000, there was renewed optimism among traders at the beginning

of the month.

Geoffrey Kendrick of Standard Chartered (LSE:STAN) recently

predicted that Bitcoin’s price could reach new all-time highs in

August, possibly hitting $100,000 during the US presidential

elections in November. The forecast assumes Joe Biden remains in

the race, a scenario considered favorable for Donald Trump, seen as

positive for Bitcoin due to more favorable regulation and mining

policies. If Biden exits the race, prices could drop to between

$50,000 and $55,000.

On July 2, Bitcoin’s price (COIN:BTCUSD) registered a 1.1%

decline, trading at $62,160, with a focus on changes in

macroeconomic liquidity. Bitcoin reserves decreased, indicating an

accumulation phase, which reinforces investor confidence.

Meanwhile, selling pressures, including significant movements from

a German government wallet, could still impact the market.

Fernando Pereira of Bitget notes that the “seller exhaustion

constant” analysis still shows significant potential for the price

to continue falling before reaching a point where selling pressure

diminishes and possibly stabilizes or reverses, indicating a market

bottom formation. “The seller exhaustion constant shows regions

where selling pressure is exhausting. At the moment, we are far

from it, indicating plenty of room to fall before hitting a

bottom,” said Pereira.

German government transferred 832.7 bitcoins today

The German government, through a wallet labeled “German

Government (BKA),” transferred 832.7 Bitcoins in four distinct

transactions, raising suspicions of selling its BTC holdings. The

transactions included significant transfers to known exchanges like

Coinbase, Bitstamp, and Kraken, along with a large amount to an

unknown wallet, intensifying speculations about potential market

impacts due to selling pressure.

US hedge funds increase investments in Bitcoin ETFs

More than half of the major US hedge funds have added Bitcoin

ETFs to their portfolios, with 13 of the top 25 funds recording

such investments by the end of Q1 2024. Millennium Management stood

out with 27,263 BTC, about 2.5% of its total assets. This growing

interest in Bitcoin occurs as the cryptocurrency significantly

outperforms major indices and stocks, including Apple and Tesla,

during the same period.

Worldcoin strengthens team with privacy and security experts

Tools for Humanity, the developer of the Worldcoin project

(COIN:WLDUSD), has hired four experienced leaders to enhance

critical aspects like privacy, security, and identity management.

Among the new hires are Damien Kieran, former privacy director at

Twitter and now privacy director at TFH, and Adrian Ludwig, former

Android security director, now leading information security. Ajay

Patel and Rich Heley also join, taking key roles in identity and

device development, respectively.

Cardano anticipates MiCA regulation with sustainability report

The Cardano Foundation (COIN:ADAUSD), in collaboration with the

Crypto Carbon Ratings Institute, released a sustainability report

detailing Cardano blockchain’s energy consumption and carbon

footprint. This initiative aims to align with Europe’s Markets in

Crypto-Assets (MiCA) regulation, which requires sustainability

disclosures by crypto asset issuers. The report highlights

Cardano’s energy efficiency, with the network consuming only 704.91

MWh in May 2024, or 0.192 W per transaction per second.

Polkadot stakeholders refute concerns about treasury depletion

Polkadot (COIN:DOTUSD) ecosystem stakeholders disputed a recent

report warning of possible treasury resource depletion within two

years. They explain that the treasury is continuously replenished

by network inflation and managed by a DAO, where DOT holders vote

on fund usage proposals. Expenses include marketing, DeFi

infrastructure development, and security, with ongoing discussions

to diversify treasury investments into stablecoins.

Astar Network burns 350 million ASTR tokens following governance

vote

Astar Network (COIN:ASTRUSD), a multi-chain smart contract

network, burned 350 million ASTR tokens, equivalent to 5% of its

total supply, following a governance decision. These tokens,

initially intended for Polkadot parachain auctions, will now be

removed from circulation. Token burning is seen as a positive

action for token value, as demonstrated by similar increases in the

past with other cryptocurrencies like Floki. The 350 million tokens

yielded 70 million ASTR in rewards, which will now be transferred

to the community treasury.

Kraken explores nuclear power for data centers due to growing

crypto and AI demand

Kraken, a cryptocurrency exchange, is considering using nuclear

power to fuel its data centers in light of expected growth in

decentralized finance (DeFi) and increased demand for its services,

revealed Vishnu Patankar, the company’s CTO. Instead of building

its own reactors, Kraken is considering partnerships with suppliers

offering small modular reactors (SMRs), which can be integrated

into data centers. This measure aims to ensure a stable and

continuous power source, essential for the uninterrupted operation

of the exchange and to support the growth of the crypto sector,

especially with the expansion of AI and high-performance computing

adoption.

Robinhood expands services to new markets

Robinhood announced the expansion of its services to Hawaii,

Puerto Rico, and the US Virgin Islands following a regulatory

change that waives money transmission licenses for cryptocurrency

services in Hawaii. The platform is considering using Bitstamp

licenses, acquired for $200 million, to offer crypto futures in the

US and Europe.

DeSci: The revolution of decentralized science in Web3

Web3, often criticized for seeming like a solution in search of

a problem, is poised to have a significant impact through DeSci, or

Decentralized Science. DeSci uses blockchain technology to reshape

scientific research, creating a more equitable and efficient

system. This movement aims to improve all aspects of research, from

funding to publication and data storage, using tools like tokens

and NFTs. Emphasizing collaboration and transparency, DeSci could

transform funding, intellectual property, and data reproducibility,

making science more accessible and innovative.

Cartesi and Avail announce partnership to drive Web3 innovations

Cartesi and Avail, two innovative platforms in the Web3 space,

announced a collaboration to advance the development of

decentralized applications. This partnership aims to integrate

Cartesi’s Linux RISC-V based execution technology with Avail’s

robust data availability solutions, creating a more intuitive and

accessible development environment. This modular integration

promises to simplify dApp development, reduce costs, and accelerate

deployment, particularly benefiting the gaming and DeFi

sectors.

Singapore raises risk level of digital payment token services

The Monetary Authority of Singapore (MAS) increased the risk

level of Digital Payment Token (DPT) service providers to

medium-high, reflecting concerns about terrorism financing. The

review also highlighted cross-border online payments as potential

risk channels. Singapore’s largest bank, DBS, will custodian Paxos’

stablecoins, reinforcing the country’s pro-crypto stance.

Paxos receives regulatory approval in Singapore for stablecoin

services

Paxos International, specializing in blockchain and

tokenization, received regulatory approval from the Monetary

Authority of Singapore to operate as a payment institution,

allowing it to launch stablecoin services in the country. This

approval, including the issuance of the Pax Gold stablecoin

(COIN:PAXGUSD), marks Paxos’ expansion into its third international

market, following the US and UAE. The company also partnered with

DBS, Southeast Asia’s largest bank, for cash management and

custody.

Aave launches GHO stablecoin on Arbitrum blockchain

Aave DAO (COIN:AAVEUSD) is expanding its GHO stablecoin

(COIN:GHOUST) to the Arbitrum blockchain, marking the start of a

cross-chain expansion strategy. Using the Chainlink Cross-Chain

Interoperability Protocol, GHO will be implemented across multiple

networks, starting with Arbitrum. This expansion aims to reduce

transaction costs, speed up processing, and increase liquidity,

paving the way for new uses like digital payments.

Tether EDU and BTguru partner for digital asset education in Turkey

Tether EDU and BTguru signed a Memorandum of Understanding to

promote digital asset education in Turkey. The partnership aims to

explore the use of blockchain and peer-to-peer technologies, as

well as study the tokenization of real assets for banks and payment

networks. This agreement is part of Tether’s strategy to expand its

educational and technological impact globally, responding to

Turkey’s growing interest in crypto transactions.

Celsius sues account holders for preferential withdrawals

Celsius Network’s litigation administrator is suing account

holders who did not settle preferential transfers made 90 days

before bankruptcy, focusing on amounts above $100,000. The action

aims to recover funds for creditors, following successful

agreements that returned $100 million. The reorganization plan

intends to return up to 85% of holdings to creditors.

Silvergate Bank settles $63 million fines to resolve federal

investigation

Silvergate Bank, formerly a key institution in the

cryptocurrency sector, agreed to pay $63 million to settle federal

and state investigations. The settlement includes fines imposed by

the Federal Reserve, the Securities and Exchange Commission (SEC),

and the California Department of Financial Protection and

Innovation, due to compliance program failures and misleading

statements about the bank’s financial stability. The resolution is

part of the bank’s efforts to wind down operations following the

collapse of FTX.

Binance money laundering trial in Nigeria postponed

The trial in Nigeria against Binance and two executives was

postponed to July 5. During the proceedings, concerns emerged about

the health of Tigran Gambaryan, detained since February and facing

poor conditions in prison. Judge Emeka Nwite ordered the submission

of Gambaryan’s medical records by Friday. Meanwhile, another

executive, Nadeem Anjarwalla, has fled the charges. The case raises

questions about Binance’s operations and the fairness in the

treatment of its detained executives.

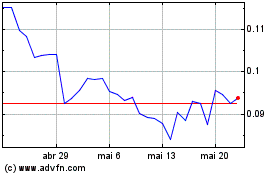

Astar (COIN:ASTRUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Astar (COIN:ASTRUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024