Berkshire Hathaway (NYSE:BRK.A), Bank

of America (NYSE:BAC) – Berkshire Hathaway sold 33.9

million Bank of America shares for approximately $1 .48 billion.

After the sale, it still owns around 999 million shares in the

bank. Warren Buffett’s Berkshire has invested in BofA since 2011,

when it purchased preferred shares and warrants. Bank of America

shares fell 1.7% in premarket trading.

Ryanair Holdings Plc (NASDAQ:RYAAY) – Ryanair

fell 12.2% announced a 46% drop in quarterly profit and lower than

expected fares for the summer. Despite a 10% increase in passenger

traffic, the company cited weaker fares and falling demand over

Easter as reasons for the decline in profit. Tariffs fell by 15%,

resulting in a profit reduced to 360 million euros. The company

faces challenges such as low consumer confidence, air traffic

problems and delays in plane deliveries. Shares fell 11.7% in

premarket trading.

Delta Air Lines (NYSE:DAL) – Delta Air Lines is

still facing major problems due to a CrowdStrike software glitch,

resulting in the cancellation of 11% of its flights and additional

delays on Monday . Meanwhile, rivals like American Airlines and

United Airlines have faced fewer difficulties. The company has had

5,000 flights canceled and thousands of passengers affected since

the IT failure, and is still struggling to resolve operational

issues, particularly with its crew tracking system. Shares fell

0.1% in premarket trading.

American Airlines (NASDAQ:AAL) – American

Airlines flight attendants have reached a tentative labor agreement

after more than three years of negotiations. The agreement, which

still needs to be ratified by members, promises billion-dollar

investments in wages and working conditions. Final approval will

depend on a vote among the commissioners. The union requested a 33%

pay increase, noting that flight attendants have not had a pay

raise in more than five years and have faced significant challenges

with problem passengers during the pandemic. Shares fell 0.7% in

premarket trading.

Southwest Airlines (NYSE:LUV) – The Federal

Aviation Administration (FAA) is investigating a Southwest Airlines

flight that flew just 175 feet over Tampa Bay on July 14. The

incident is part of a series of safety problems involving the

company, including flights at dangerously low altitudes and

anomalous aircraft movements. Southwest is cooperating with the

investigation.

FedEx (NYSE:FDX), United Parcel

Service (NYSE:UPS) – FedEx and UPS warned of possible

delivery delays due to global IT failure. FedEx faced “substantial

disruptions” and said it could delay scheduled packages, while UPS

dealt with issues with its systems but continues to operate. These

issues arose in the wake of Amazon’s record Prime Day sales.

Crowdstrike (NASDAQ:CRWD),

Microsoft (NASDAQ:MSFT) – CrowdStrike reported

that many of the 8.5 million Windows devices affected by the global

software flaw have now been restored and are operational. Although

it impacted less than 1% of systems, the outage had serious

economic and social repercussions. Experts point out that the

update, intended to improve security against hackers, failed due to

inadequate testing, resulting in major outages. Banks, airlines and

hospitals were affected. In premarket trading, Crowdstrike shares

fell 2.9%, while Microsoft shares rose 0.6%.

Tesla (NASDAQ:TSLA) – Elon Musk announced that

Tesla has stopped using CrowdStrike’s software following an update

that caused global outages. In posts on X, Musk mentioned that the

problem affected the automotive supply chain. He did not confirm

whether all of his companies, such as SpaceX and Neuralink, have

abandoned the software. Shares rose 1.4% in premarket trading.

Meta Platforms (NASDAQ:META) – CrowdStrike’s

faulty update caused an outage that also affected Meta’s external

vendors responsible for content moderation on Facebook. Although

Meta classified the incident as SEV1, with high risk and need for

immediate attention, the impact on moderation was minimal. Mark

Zuckerberg praised Donald Trump’s response after the assassination

attempt, calling it “tough” and inspiring, which helps explain his

appeal to voters. While Zuckerberg doesn’t support Trump or Biden

and doesn’t plan to get involved in the election, he recognizes

Trump’s emotional impact. In Nigeria, Meta was fined US$220 million

for violating privacy laws with its 2021 data policy, forcing it to

adjust its practices and guarantee the privacy rights of Nigerian

users. Shares rose 0.8% in pre-market trading.

Nvidia (NASDAQ:NVDA) – Nvidia is adapting its

new AI chips, launched in March, to meet US export rules, targeting

the Chinese market. The “B20” chip, a modified version of the

“Blackwell”, will be distributed with the help of Inspur, its

partner in China. Sales of H20 chips, also from Nvidia, are growing

rapidly despite US export restrictions and the competitive market

with Huawei. Shares rose 1.4% in premarket trading.

Oracle (NYSE:ORCL) – Oracle agreed to pay $115

million to settle a lawsuit that alleged the company violated

privacy by collecting and selling personal information without

authorization. The agreement requires court approval and prohibits

Oracle from collecting data from websites visited and forms from

other websites.

Walt Disney (NYSE:DIS) – Walt Disney announced

that Safra Catz, CEO of Oracle, is leaving the entertainment

company’s board after six years. Disney’s board will now have 11

members following Catz’s departure. Catz was elected to Disney’s

board in 2017, during which the company was planning to acquire

Twenty-First Century Fox’s media empire.

Booking.com (NASDAQ:BKNG), Ryanair

Holdings (NASDAQ:RYAAY) – A US court ruled that

Booking.com violated the Computer Fraud and Abuse Act by accessing

the Ryanair website without permission. Ryanair believes the

decision will help combat unauthorized practices of screen scraping

and ticket reselling. Booking.com plans to appeal the decision.

Starbucks (NASDAQ:SBUX) – Activist fund Elliott

Investment Management has acquired a significant stake in

Starbucks, seeking to improve the company’s stock performance. This

occurs in a context of falling company sales and profits,

especially in the US and China. Shares fell 0.8% in premarket

trading.

Vodafone (NASDAQ:VOD) – Vodafone sold 10% of

its stake in Vantage Towers for $1.4 billion, reducing its stake as

planned. The sale, part of a 2022 deal, aims to reduce Vodafone’s

debt. With the sale, Vodafone’s stake in Vantage Towers fell to

44.7%. Shares rose 0.3% in premarket trading.

Stellantis (NYSE:STLA) – Chrysler owner

Stellantis paid $190.7 million in fines for failing to meet U.S.

fuel economy requirements for 2019 and 2020, with an additional

$459.7 million outstanding. The fines highlight compliance

challenges as the company invests heavily in electric vehicle

production. Shares rose 1.4% in premarket trading.

Xpeng (NYSE:XPEV) – Xpeng and Volkswagen are

collaborating to develop a new architecture for electric vehicles

(EV) through engineering centers in China, Guangzhou and Hefei. The

objective is to start production of this new technology in two

years. The partnership aims to create more affordable electric cars

for the Chinese market. Shares rose 2.3% in premarket trading.

Boeing (NYSE:BA) – Aviation leaders will meet

at a summit in London to discuss challenges such as supply chain

disruptions and aircraft delays. The Farnborough Airshow, July

22-26, is expected to see fewer aircraft orders due to problems at

Airbus and Boeing. Boeing sees significant improvements in 737 MAX

production flow following safety crisis, with new boss Stephanie

Pope saying changes at the factory are “transformational”,

highlighting that the priority is safety and quality, not just

schedule . Boeing still faces problems with the 737 MAX 7’s

anti-icing system, which could delay certification until 2025, and

the MAX 10 awaits FAA approval. Additionally, the company is facing

delays in building Air Force One, with possible delays until 2027

or 2028, and has already lost more than $2 billion on the project

due to supply, inflation and workforce challenges. Shares rose 0.5%

in premarket trading.

Embraer (NYSE:ERJ), Gol

(NYSE:GOL) – Eve, controlled by Embraer, revealed its full-scale

“flying taxi” prototype, marking a significant advance. The

vehicle, an eVTOL (electric vertical takeoff and landing aircraft),

is scheduled for certification and operation by 2026. The company

has already raised almost US$400 million and has 3,000 potential

orders. Furthermore, Gol and LATAM Airlines are negotiating the

inclusion of Embraer planes in their fleets, driven by BNDES and

the Brazilian government. The negotiations aim to strengthen the

national manufacturer and improve regional aviation in Brazil. Both

companies, which predominantly operate with Boeing and Airbus, can

expand with Embraer models.

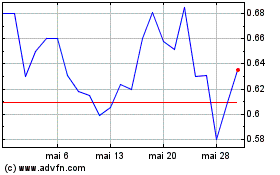

Astra Space (NASDAQ:ASTR) – Astra Space’s

capitalization deal with its founders has been completed following

a rapid decline in its valuation, which fell from $3.9 billion in

2021 to around $12.2 million in March. CEO Chris Kemp and

technology chief Adam London will buy shares in the company at 50

cents each, down from the previous sale price of 53 cents. Astra,

which has faced numerous problems and delays, now plans to develop

a new rocket and cut up to 25% of its workforce.

Exxon Mobil (NYSE:XOM) – Exxon Mobil agreed to

sell its oil and gas assets in Malaysia to state-owned Petronas,

exiting the sector in the country. Exxon seeks to focus on

production in the Americas. Petronas will take over operations,

including the Tapis field, and discuss new arrangements for the

transfer. Shares rose 0.1% in premarket trading.

U.S. Steel (NYSE:X) – Nippon Steel has hired

former U.S. Secretary of State Mike Pompeo as an advisor to support

the acquisition of U.S. Steel, highlighting economic and national

security benefits. Despite approvals outside the US, the deal faces

political resistance and objections from unions and politicians,

including Trump and Biden.

Sempra Infrastructure LLC (NYSE:SRE) – Sempra

has hired Bechtel Energy to expand its Port Arthur LNG export plant

in Texas. Bechtel is already building the first phase of the plant,

which will have a capacity of 13 million tons per year. The

expansion, which will double this capacity, has no disclosed cost

yet. The agreement includes guaranteeing project costs and

schedules.

BlackRock (NYSE:BLK) – BlackRock is expanding

its presence in the Middle East, moving senior strategist Ben

Powell to Dubai. He will lead macroeconomic and markets research

for the region and continue oversight in Asia-Pacific. The company

seeks to strengthen ties with local customers and is already

strengthening its operations in the region.

Deutsche Bank AG (NYSE:DB) – Arjun Nagarkatti,

head of Deutsche Bank’s U.S. wealth unit, plans to hire up to a

dozen private bankers this year, focusing on San Francisco and Los

Angeles. The goal is to expand its presence in the ultra-rich

market and achieve double-digit revenue growth in the coming

years.

Astra Space (NASDAQ:ASTR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Astra Space (NASDAQ:ASTR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025