Intel (NASDAQ:INTC) – Intel was sued by

shareholders who allege the company concealed financial problems

that led to poor results, layoffs, and dividend suspension,

resulting in a $32 billion market value loss in a single day. The

lawsuit, filed in San Francisco, accuses Intel of misleading

information that inflated stock prices. Since the bad news, Intel’s

stock has dropped 34.6%. Additionally, Intel missed the opportunity

to invest in OpenAI in 2017-2018, when the AI startup was emerging.

Intel discussed acquiring 15% of OpenAI for $1 billion and

providing hardware at cost but declined, believing generative AI

wouldn’t be profitable short-term. Now, OpenAI is valued at $80

billion. Shares rose 0.4% pre-market.

JPMorgan Chase (NYSE:JPM) – JPMorgan increased

the probability of a U.S. recession by the end of the year to 35%

due to labor market weakness. Despite this, the bank reduced the

chance of prolonged high-interest rates to 30%, predicting cuts in

September and November. Additionally, JPMorgan reported that

three-quarters of global carry trade operations were closed,

erasing this year’s gains. Returns on carry trade strategies have

fallen about 10% since May due to a recent sell-off and increased

market volatility. The current environment does not offer a good

risk-reward for these strategies.

Roblox (NYSE:RBLX) – Turkey blocked Roblox,

alleging that platform content could lead to child abuse, according

to an internet regulation law. Justice Minister Yilmaz Tunc stated

that protecting children is a state obligation. This block follows

a similar action against Instagram. Shares rose 0.7%

pre-market.

Micron Technology (NASDAQ:MU) – Micron

Technology resumed its share buyback after almost two years, citing

improved market conditions. The company, a leading AI memory

supplier, expects a significant increase in HBM3e chip sales.

Shares rose 0.2% pre-market.

Juniper Networks (NYSE:JNPR), Hewlett

Packard Enterprise (NYSE:HPE) – The UK antitrust authority

approved Juniper Networks’ $14 billion acquisition by Hewlett

Packard Enterprise, allowing expansion in networking. The EU has

already approved, but the U.S. Department of Justice is still

reviewing the deal. The closing is expected by late 2024 or early

2025.

Lumen Technologies (NYSE:LUMN) – Lumen

Technologies shares surged 33% on Wednesday, nearly fivefold since

July, driven by a partnership with Microsoft. However, concerns

about the sustainability of this growth remain, given high debt and

challenges in the traditional communications sector. Shares fell

0.9% pre-market.

Apple (NASDAQ:AAPL) – Analysts suggest Apple

may charge between $10 and $20 for advanced AI features in its new

system, Apple Intelligence, to be launched this year. The company,

which already raised $24.2 billion in services last quarter, may

integrate these features into Apple One. Apple’s AI aims to

increase user loyalty by offering personalized and premium

functionalities. Shares fell 0.2% pre-market.

Toyota Motor (NYSE:TM) – Toyota reduced its

global production target for 2024 by 5%, from 10.3 million to 9.8

million vehicles. The reduction is due to suspended production at

factories in Japan, marking the first annual production drop in

four years.

Delta Air Lines (NYSE:DAL) – Passengers sued

Delta Air Lines, alleging the company did not provide full refunds

after flight delays and cancellations caused by a system failure in

July. They also seek compensation for additional expenses like

hotels and meals. Delta says refunds and compensations are

available for those affected.

LATAM Airlines (NYSE:LTM),

Embraer (NYSE:ERJ) – LATAM Airlines is considering

adding smaller aircraft like Embraer’s E2 and Airbus’s A220 to its

fleet to support growth. The plan aims to mitigate delays in new

jet deliveries and aircraft inspections, but no final decisions

have been made.

Boeing (NYSE:BA) – NTSB Chief Jennifer Homendy

stated that the Alaska Airlines Boeing 737 MAX 9 incident could

have been avoided if unauthorized production issues had been

detected earlier. The FAA has intensified oversight and audits

following the accident, but concerns remain about the effectiveness

of Boeing’s supervision. Additionally, Boeing announced an increase

in PAC-3 seeker production, essential for Patriot missiles,

predicting over 20% growth this year to meet rising demand,

especially due to supply issues affecting Patriot missile

production in Japan.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens is evaluating selling or restructuring VillageMD due to

its high capital needs. VillageMD, part of Walgreens’ expansion,

plans to close underperforming clinics. The company also reached a

forbearance agreement after VillageMD failed to pay a $2.25 billion

credit line.

Nike (NYSE:NKE) – During the Summer Olympics,

Nike saw increased site visits and sales, outperforming competitors

like Adidas and Puma. Site visits reached 2 million after victories

by sponsored athletes. The company is heavily investing to revive

sales and compete with rivals.

VF Corp. (NYSE:VFC) – After a year as CEO,

Bracken Darrell believes VF Corp. has overcome its worst period. He

has worked to recover the company by reducing debt, selling the

Supreme brand for $1.5 billion, and closing unprofitable Vans

stores. Although revenue has improved, sales still decline.

Under Armour (NYSE:UA) – Under Armour hired

Eric Liedtke, former Adidas executive, as Chief Brand Officer after

acquiring his plant-based fashion startup, Unless Collective.

Liedtke, who helped Adidas grow, will report to CEO Kevin Plank and

focus on brand recovery and consumer engagement.

Kellanova (NYSE:K) – Mars is considering

acquiring Kellanova, a U.S. snack maker valued at $31 billion.

Experts believe the transaction has a good chance of approval by

antitrust regulators since product overlap is limited, and

competition in the sector will remain intense.

Kroger (NYSE:KR) – Kroger won a lawsuit

alleging deception by using the “farm fresh” label for eggs from

industrially caged hens. The judge ruled that the term refers only

to the eggs’ freshness and origin, not to the hens’ living

conditions, as suggested by the complaint.

Costco Wholesale (NASDAQ:COST) – Costco will

raise membership fees and implement scanning devices at store

entrances to enhance security. Members will need to scan their

physical or digital cards to enter, and guests must be accompanied

by a member. This measure aims to combat card misuse. In July, the

company reported sales of $19.26 billion, up 7.1% year-over-year.

Same-store sales rose 5.3% in the U.S., 6.3% in Canada, and 3.7%

internationally. E-commerce grew 20.2%.

Walt Disney (NYSE:DIS),

Comcast (NASDAQ:CMCSA) – Disney may have to pay up

to $5 billion more to buy Comcast’s stake in Hulu, depending on RBC

Capital’s valuation. The dispute arose after differing assessments,

with Comcast valuing the stake at over $40 billion, while Disney’s

advisor valued it below $27.5 billion. If the lower value is

upheld, Disney pays the agreed $8.6 billion. The final decision is

expected in 2025. Disney shares fell 0.2% pre-market.

Amazon (NASDAQ:AMZN) – Mike Hopkins transformed

Prime Video from a subscriber perk into a significant media

platform. Under his leadership, the service expanded its portfolio

with original content, live sports, and increased investments,

rivaling giants like Netflix and YouTube. Amazon aims to make Prime

Video a comprehensive entertainment hub, offering a wide range of

content and services to attract a broad audience. This includes

original series, live sports, and a vast array of movies, aiming to

boost the platform’s profitability and market position. Shares fell

0.3% pre-market.

BHP Group (NYSE:BHP) – BHP Group is considering

selling copper and gold assets in Brazil, acquired with the

purchase of Oz Minerals. The mining company hired Banco Santander

to advise on negotiations. The sale is part of a strategic

reevaluation after abandoning the Anglo American purchase.

Bunge Global SA (NYSE:BG), Moolec

Science (NASDAQ:MLEC) – Bunge and Moolec Science will edit

safflower genes to improve the oilseed for biofuels. The

partnership aims to increase productivity and explore new

sustainable raw material options. The project may also include

soybeans, while Moolec has already developed other genetic

modifications in plants.

Morningstar (NASDAQ:MORN) – Investors are suing

TIAA and Morningstar, alleging their partnership was manipulated to

direct funds to TIAA’s expensive products. The lawsuit, seeking

compensation for losses, claims the RAFV recommendation tool was

designed to favor TIAA products. TIAA denies the allegations.

Bank of America (NYSE:BAC) – Bank of America

warned shareholders about potential legal risks related to

low-interest rates on cash sweep accounts, where uninvested money

is transferred to low-yielding bank deposits. The company may face

similar issues to competitors like Morgan Stanley, which are

already under investigation. Shares fell 0.5% pre-market.

Berkshire Hathaway (NYSE:BRK.B) – Warren

Buffett may take advantage of the drop in Japanese trading houses’

shares as an opportunity to buy more after an initial loss of $6.7

billion (¥980 billion), which fell to about $3.8 billion (¥550

billion). With cheaper valuations and a robust cash reserve of

$276.9 billion, Berkshire Hathaway may increase its stakes.

Equity Residential (NYSE:EQR),

Blackstone (NYSE:BX) – Equity Residential bought

11 properties from Blackstone for $964 million. The portfolio

includes 3,572 apartments in cities like Atlanta and Denver,

targeting high-end renters. The acquisition aims to increase

revenue in strong growth markets while the U.S. apartment supply

dwindles.

BlackRock (NYSE:BLK) – BlackRock selected James

Raby, current operations director for Asia-Pacific, to replace Una

Neary as global head of compliance. Raby, who will move to New

York, assumes the role in September. The change comes amid an

evolving regulatory environment and new challenges for the world’s

largest asset manager.

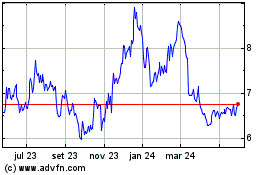

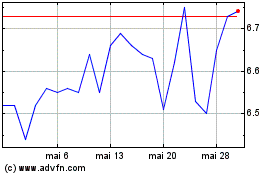

Under Armour (NYSE:UA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Under Armour (NYSE:UA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025