Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC’s revenue rose 45% in July, indicating strong

demand for AI chips, with sales reaching NT$ 256.95 billion.

Analysts expect 37% growth in the third quarter, but concerns about

future technology and the global economy affected the company’s

stock. Shares rose 2.8% in pre-market trading.

Intel (NASDAQ:INTC), Moody’s

(NYSE:MCO) – Moody’s downgraded Intel’s rating to BAA1 due to

concerns about the company’s profitability. The outlook was changed

from stable to negative, reflecting expectations of lower

profitability over the next 12 to 18 months. Intel faces a high

debt/EBITDA ratio, expected to improve by 2025. Intel’s stock fell

0.1% in pre-market trading.

Nasdaq (NASDAQ:NDAQ) – Nasdaq is proposing

changes to expedite the delisting of penny stocks that fail to meet

the closing price criterion above $1 for 30 consecutive days. If

approved, the process will be faster, eliminating the appeal option

after 360 days and penalizing companies that execute reverse splits

to manipulate prices.

Alphabet (NASDAQ:GOOGL) – Google is being

challenged by the rising popularity of AI, such as OpenAI’s

ChatGPT, which is eroding its search market dominance. Recently,

U.S. antitrust regulators concluded that Google maintains an

illegal monopoly in search, a decision that could long-term impact

its dominance. However, the immediate impact might be less than the

AI threat, which is transforming how searches are conducted. The

rapid advance of AI could outpace regulatory actions, putting more

pressure on Google. Shares rose 0.4% in pre-market trading.

Apple (NASDAQ:AAPL) – Apple changed its policy

in the European Union, allowing developers to promote offers

outside the App Store. However, it introduced new fees: 5% for

acquiring new users and 10% for sales made by app users within 12

months. The change aims to comply with the EU’s Digital Markets

Act, but critics like Spotify argue that the fees are still

excessive. Additionally, Apple is preparing a new Mac mini, which

will be the smallest ever produced by the company. Expected later

this year, the model will have a more compact design, similar in

size to the Apple TV. It will use the new AI-focused M4 chips and

feature several design updates. Shares rose 0.2% in pre-market

trading.

OpenAI – OpenAI appointed Zico Kolter, a

computer science professor at Carnegie Mellon, to its board.

Kolter, an AI security expert, is the first computer scientist on

the company’s revamped board. He will contribute his technical

expertise and participate in the safety committee, which guides

projects like ChatGPT. OpenAI restructured its board following the

brief departure and reinstatement of CEO Sam Altman, adding new

members such as Sue Desmond-Hellmann and Paul Nakasone.

Microsoft (NASDAQ:MSFT), Palantir

Technologies (NYSE:PLTR) – Microsoft and Palantir are

integrating their cloud and AI tools to offer software, including

GPT-4, to U.S. defense and intelligence agencies. Palantir will

integrate its products with Microsoft’s Azure and use Azure OpenAI

for confidential tasks, facilitating logistics and planning. In

pre-market trading, Microsoft’s stock rose 0.3%, while Palantir’s

stock rose 2.3%.

Amazon (NASDAQ:AMZN) – Amazon has partnered

with TikTok and Pinterest to enable direct purchases from the apps,

offering prices and product details without leaving the platforms.

By linking their accounts, customers can view prices, Prime

eligibility, and product details in ads. This social shopping

strategy follows similar agreements with Meta and Snap. The company

is also using Kia Souls for same-day deliveries, replacing the Flex

service in urban areas, aiming for efficiency and cost reduction.

The $4 billion investment in Anthropic faces an investigation by

the UK’s Competition and Markets Authority, which examines its

impact on competition. Amazon expressed dissatisfaction with the

decision. Shares rose 0.4% in pre-market trading.

Alibaba (NYSE:BABA), Tencent

(USOTC:TCEHY), JD.com (NASDAQ:JD) – Alibaba,

Tencent, and JD.com will reveal insights into China’s economy and

consumer sentiment, with mixed results expected due to economic

weakening. While these tech giants focus on increasing shareholder

returns through buybacks, the Chinese economic slowdown is

pressuring their sales and margins. Tencent and Alibaba face

challenges with advertising and discounts, while JD.com’s growth is

also affected by competition and market conditions. In pre-market

trading, Alibaba’s stock fell 0.4%, while JD.com’s stock fell

0.9%.

Boeing (NYSE:BA) – Boeing’s new CEO, Kelly

Ortberg, decided to base himself in Seattle to address the safety

crisis and be closer to the production line. He plans to ramp up

737 MAX production and resolve quality issues. Ortberg will also

visit suppliers and address labor issues to restore confidence in

the company.

Archer Aviation (NYSE:ACHR),

Stellantis (NYSE:STLA) – Archer Aviation has

signed an agreement with Stellantis to receive up to $370 million

in support to expand the production of its ‘Midnight’ aircraft.

Stellantis, Archer’s largest shareholder, will receive shares in

exchange for the costs. Archer also secured an additional $230

million and plans to launch an air mobility network in Los Angeles

by 2026. In pre-market trading, Archer’s stock fell 1.8%, while

Stellantis’ stock rose 0.8%.

Ryanair (NASDAQ:RYAAY) – Ryanair announced that

it will repurchase up to 800 million euros ($872.48 million) in

shares over the next six to nine months, benefiting from a strong

financial position and aircraft delivery delays, which preserve

cash. The company plans to complete its current €700 million

buyback and ask shareholders to increase the buyback limit to 15%.

The company has also distributed around €8 billion to shareholders

over the past 15 years.

Delta Air Lines (NYSE:DAL),

CrowdStrike (NASDAQ:CRWD),

Microsoft (NASDAQ:MSFT) – Delta Air Lines revealed

that problems with CrowdStrike’s software cost the company about

$500 million, including $380 million in lost revenue due to

canceled flights and customer compensation. Additionally, it

recorded $170 million in other costs. Delta is suing CrowdStrike

and Microsoft, accusing them of not providing adequate support

during the disruption. CrowdStrike refutes the allegations and

claims to have offered extensive technical support.

JetBlue Airways (NASDAQ:JBLU) – JetBlue is

negotiating the sale of $1.5 billion in high-yield bonds with

yields between 9.5% and 10%, and considering a $1.25 billion

leveraged loan. Strong demand for the bond has already exceeded

$1.5 billion. The offering may occur on August 12.

General Motors (NYSE:GM) – General Motors

reaffirmed its commitment to making its operations in China

self-sustaining despite intense local competition. The company

plans to restructure its business and cut costs after posting a

$104 million loss in the region.

Disney (NYSE:DIS) – Disney will invest at least

$1 billion annually over the next five years in film and TV

production in Europe, the Middle East, and Africa. The investment

will cover Disney+, National Geographic, and other productions,

capitalizing on the recent success of films like “Inside Out 2.”

Shares rose 0.4% in pre-market trading.

Recursion Pharmaceuticals (NASDAQ:RXRX),

Exscientia (NASDAQ:EXAI) – Recursion

Pharmaceuticals will acquire Exscientia for $688 million in a stock

deal. The merger aims to integrate their AI technologies to

optimize drug development and clinical trials, reducing costs and

accelerating the process. The transaction is expected to close in

2025 and will expand Recursion’s portfolio with new treatments and

pharmaceutical partnerships. Recursion’s stock rose 2.41% in

pre-market trading.

Lazard (NYSE:LAZ) – Investment Bank Lazard has

hired Courtney Haydon from Guggenheim Securities to boost business

with private equity firms and alternative asset managers. The hire

is part of a broader effort by Lazard to strengthen its team and

increase financial sponsor coverage.

JPMorgan Chase (NYSE:JPM), UBS Group

AG (NYSE:UBS) – JPMorgan and UBS have downgraded their

year-end forecasts for major Japanese indices due to yen

appreciation and economic uncertainties. They expect the Topix to

reach 2,700-2,800 and the Nikkei 225 to reach 39,000-40,000,

reflecting concerns over yen strengthening and potential

recessions.

Citigroup (NYSE:C) – Citigroup is close to

selling its trust unit, part of its private banking division, as

part of its restructuring led by CEO Jane Fraser. The process,

known as “Project Mango,” aims to focus on investment management

while transferring trust fund administration. The sale, underway

for a year, may involve an undisclosed amount. The restructuring

includes the sale of operations outside the U.S. and changes in

senior management.

Mizuho Financial Group (NYSE:MFG),

Barclays (NYSE:BCS) – Mizuho Financial Group hired

George Lee and Corey LoVerme from Barclays to strengthen its

leveraged finance and financial sponsor teams in the U.S. Lee will

work in the leveraged finance group, and LoVerme in the financial

sponsor group after a leave. These hires aim to strengthen the

bank’s position after the acquisition of Greenhill & Co.

Barclays’ stock rose 1.1% in pre-market trading.

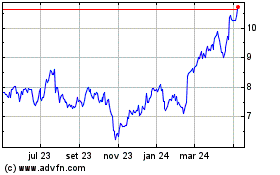

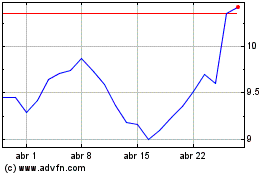

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024