H&R Block Shares Surge 10% on Profit and Dividend Boost, Applied Materials Drops 3% Despite Strong Earnings, Latest in Earnings

16 Agosto 2024 - 6:57AM

IH Market News

H&R Block (NYSE:HRB) – The tax preparation

services company reported fourth-quarter fiscal revenue of $1.063

billion and earnings per share of $1.89, exceeding forecasts of

$1.028 billion and $1.74, respectively. For 2025, the company

projects revenue between $3.69 billion and $3.75 billion, with

earnings per share between $5.15 and $5.35, also above estimates.

The company also announced a 17% dividend increase and a $1.5

billion share repurchase. Shares closed up 1% on Thursday and rose

9.6% in pre-market.

Applied Materials (NASDAQ:AMAT) – The

semiconductor equipment company reported adjusted earnings per

share of $2.12, beating estimates of $2.03, with revenue of $6.78

billion, above the forecast of $6.68 billion. Demand for artificial

intelligence chips drove growth. The company projects revenue of

$6.93 billion and earnings per share between $2 and $2.36 in the

next quarter. Shares fell 3.2% in pre-market after rising 5.1% on

Thursday.

Coherent (NYSE:COHR) – The optical and laser

solutions company for industries reported fourth-quarter fiscal

adjusted earnings of 61 cents per share on revenue of $1.31

billion. These results surpassed FactSet analysts’ expectations of

60 cents per share and $1.28 billion in revenue. Shares rose 0.03%

in pre-market after a 6.4% increase on Thursday.

Amcor (NYSE:AMCR) – The sustainable packaging

company reported $3.54 billion in revenue for the quarter, below

FactSet analysts’ expectations of $3.57 billion. However, Amcor

posted adjusted earnings of 21 cents per share, slightly above the

market estimate of 20 cents. Shares closed up 1.8% on Thursday and

fell 0.7% in pre-market.

ReNew Energy Global (NASDAQ:RNW) – The

renewable energy and sustainable solutions company reported

break-even quarterly earnings, below the estimate of $0.08 and last

year’s $0.09, with revenue of $299 million, 13.23% below

expectations.

Despegar (NYSE:DESP) – The leading travel

agency in Latin America reported 12% revenue growth, reaching $185

million in the second quarter, with adjusted net income rising 397%

to $30.2 million. Adjusted EBITDA increased 22%, driven by

operational efficiency and Travel Package sales. The company

revised its annual revenue forecast to $760 million and adjusted

EBITDA to $160 million, reflecting an optimistic outlook for 2024.

Shares are stable in pre-market after a 3% rise on Thursday.

Alvotech (NASDAQ:ALVO) – The biotechnology

company focused on biosimilar medicines reported record revenue of

$236 million in the first six months of 2024, a significant

increase from the previous year, with earnings of $65.2 million in

the second quarter. However, the second-quarter loss per share was

-$0.61, below expectations. The company attributed the loss to

financial costs but highlighted strong growth in orders and product

launches. Shares are stable in pre-market after an 8% rise on

Thursday.

Globant (NYSE:GLOB) – The digital technology

and innovation services company reported adjusted earnings per

share of $1.51 in the second quarter, above the estimate of $1.49,

and revenue of $587.5 million, an 18.1% year-over-year increase.

For the third quarter, Globant projects revenue between $611

million and $617 million, with adjusted EPS of $1.60-$1.64. Shares

are stable in pre-market after a 1.7% rise on Thursday.

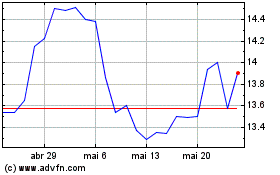

Alvontech (NASDAQ:ALVO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Alvontech (NASDAQ:ALVO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025