U.S. index futures were little changed in pre-market trading on

Wednesday, with attention on the minutes from the Federal Reserve’s

latest meeting and earnings reports. Investors are eagerly awaiting

statements from Fed Chair Jerome Powell, who will speak at the

Jackson Hole Economic Symposium on Friday.

At 5:29 AM ET, Dow Jones futures (DOWI:DJI) rose 51 points or

0.12%. S&P 500 futures gained 0.02%, while Nasdaq-100 futures

dipped 0.06%. The yield on the 10-year Treasury note stood at

3.816%.

At 2 PM ET, the minutes from the Federal Open Market Committee

(FOMC) meeting in July will be released. Investors will focus on

how policymakers assessed the U.S. economy and the future direction

of interest rates. The FOMC kept the interest rate between 5.25%

and 5.50% in July, waiting for more data before making adjustments.

The minutes will not include recent jobs and inflation data, which

emerged after the meeting.

In the commodities market, oil prices stabilized after

significant declines due to rising U.S. crude inventories and

easing tensions in the Middle East. Data indicates that crude

inventories rose by 347,000 barrels last week, while gasoline and

distillate stocks fell. Additionally, visits by mediators to the

Middle East, including U.S. Secretary of State Antony Blinken,

sparked expectations of a possible ceasefire in Gaza, also

contributing to the drop in prices.

West Texas Intermediate crude for October advanced 0.31% to

$73.40 per barrel, while Brent for October increased 0.38% to

$77.49 per barrel.

Iron ore prices rose for the third day, recovering from last

week’s 9% drop, on expectations that China will implement measures

to stimulate its struggling real estate market. The commodity

advanced in Singapore amid rumors that the government may allow the

purchase of unsold properties through special bonds. Iron ore had

fallen 30% this year due to economic slowdown and a lack of new

construction projects.

Asia-Pacific markets closed mixed on Wednesday, impacted by the

end of a winning streak in U.S. indexes. Japan’s Nikkei 225 fell

0.29% to close at 37,951.8, while the Topix lost 0.21% to 2,664.86.

Mainland China’s CSI 300 dropped 0.33% to close at 3,321.64. South

Korea’s Kospi rose 0.17%, and Australia’s S&P/ASX 200 advanced

0.16%. Hong Kong’s Hang Seng was down 0.82% in the final hour of

trading, highlighted by a decline in JD.com shares after Walmart

announced the sale of its 9.4% stake in the Chinese company.

In Japan, July exports grew less than expected, raising doubts

about the country’s economic recovery. While exports rose 10.3%

year-on-year, shipment volumes fell 5.2%, indicating weakness in

global demand. The trade balance registered a deficit of $4.28

billion (621.8 billion yen).

According to a Reuters survey, more than half of economists

believe the Bank of Japan will raise interest rates by the end of

the year, with most expecting the increase in December. They

anticipate the BOJ will continue adjusting monetary policy, despite

expectations of cuts by other central banks. The forecast is for

the rate to rise to 0.50%, a 25 basis point increase.

In Australia, expectations of cuts by other central banks

increase pressure on the Reserve Bank of Australia (RBA) to act.

The RBA faces pressure to reduce interest rates as data next week

is expected to show that government grants lowered overall

inflation to the target range of 2-3%. However, underlying

inflation remains high.

In China, the China Association of Automobile Manufacturers

(CAAM) criticized the European Union’s proposed punitive tariffs of

up to 36.3% on Chinese electric vehicles. CAAM states that the

tariffs create risks and uncertainties for Chinese investments in

the EU and could harm the European automotive industry.

China adjusted its daily reference rate for the yuan, aligning

it with market expectations, signaling acceptance of the currency’s

current levels following a recovery. This comes after the yuan lost

ground against the dollar, which has since retreated. Analysts

predict that the PBOC will intervene to prevent excessive yuan

appreciation, which could harm exporters and hinder economic

recovery.

European markets opened slightly higher on Wednesday, with

positive performance in the mining sector, while the

telecommunications sector declined.

UK public sector net debt increased to $4.037 billion (£3.1

billion) in July, exceeding forecasts of £2.5 billion, marking a

£1.8 billion increase compared to the previous year. In the first

four months of the year, debt exceeded expectations by £4.7

billion. Preliminary Purchasing Managers’ Index (PMI) figures for

the eurozone are scheduled for Thursday.

In Switzerland, an instant payment system that allows

transactions to be completed in seconds was implemented on Tuesday.

The new system by the Swiss National Bank and SIX Stock Exchange

will cover 95% of retail transactions, with 60% of banks already

processing payments within 10 seconds, 24/7. The innovation

promises to accelerate processes and create new opportunities for

businesses and banks.

Europe’s natural gas reserves were 90% full as of August 19,

surpassing the European Union’s target for November 1. This has

helped contain a recent price surge. Despite high levels, supply

risks remain due to potential interruptions and maintenance in

Norway.

U.S. stocks ended slightly lower on Tuesday, reflecting possible

profit-taking after recent gains. The Dow Jones fell 0.15%, while

the S&P 500 and Nasdaq ended an eight-day winning streak,

dropping 0.20% and 0.33%, respectively. Activity was subdued, with

investors cautious ahead of the Fed minutes and the Jackson Hole

Symposium.

The CME Group’s FedWatch Tool indicated a 73.5% chance of a

quarter-point rate cut next month and a 26.5% chance of a

half-point cut.

On the earnings front, companies reporting before the market

opens include

Target (NYSE:TGT), Baidu (NASDAQ:BIDU), OSI

Systems (NASDAQ:OSIS), Peloton (NASDAQ:PTON), Advance

Auto Parts (NYSE:AAP), BJ’s Wholesale

Club (NYSE:BJ), Williams-Sonoma (NYSE:WSM), Canadian

Solar (NASDAQ:CSIQ), NetEase

Games (NASDAQ:NTES), TD

Bank (NYSE:TD), Viking

Holdings (NYSE:VIK), among others.

After the close, results are expected from

CAVA (NYSE:CAVA), Workday (NASDAQ:WDAY), Bill.com (NYSE:BILL), Intuit (NASDAQ:INTU), Ross

Stores (NASDAQ:ROST), Red

Robin (NASDAQ:RRGB), Macro

Bank (NYSE:BMA), American

Software (NASDAQ:AMSWA), and more.

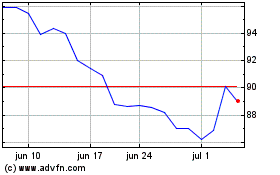

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025