AVAX rises with support from Grayscale and Franklin Templeton

Avalanche’s AVAX token (COIN:AVAXUSD) reached $25 before

retreating to $24.16 at the time of writing, after Grayscale and

Franklin Templeton announced expansions of their products into the

Avalanche ecosystem. This recovery reverses some of AVAX’s recent

losses, which dropped 24.2% over the past month. Grayscale launched

the Avalanche Trust, while Franklin Templeton integrated its

tokenized money market fund into the Avalanche network. Despite the

rise, AVAX remains significantly below its all-time high of $145 in

November 2021.

Ocean Protocol delays launch of Ocean Nodes Incentive Program

Ocean Protocol (COIN:OCEANUSD) has delayed the start of the

Ocean Nodes Incentive Program to August 29. The delay aims to

implement necessary updates to the monitoring system and fix bugs

to ensure a fair experience. The team also improved the Ocean Node

Dashboard with new features. The conversion of OCEAN tokens to

Fetch (COIN:FETUSD), as part of the ASI merger, has already been

completed, awaiting the final stage of the merger.

NEAR Protocol launches “Nightshade 2.0” update to enhance

scalability and efficiency

NEAR Protocol (COIN:NEARUSD) has launched “Nightshade 2.0,” a

significant update that enhances blockchain scalability and

usability. The new “stateless validation” feature allows validators

not to maintain a shard’s state locally, optimizing performance and

enabling the addition of more shards. The update also promises to

quintuple the network’s transaction capacity and reduce operational

costs for validators, promoting greater decentralization.

Record Ether ETF outflows surpassed by strong Bitcoin inflows

On August 21, Ether spot ETFs in the US recorded outflows of $18

million, marking the fifth consecutive day of outflows. On

Wednesday, Grayscale’s ETF (AMEX:ETHE) saw withdrawals of $31

million, while Fidelity (AMEX:FETH) and Franklin (AMEX:EZET) ETFs

saw inflows of $7.9 million and $1 million, respectively.

Meanwhile, Bitcoin spot ETFs in the US recorded their fifth

consecutive day of inflows, totaling $39.42 million on Wednesday.

Grayscale’s Bitcoin fund (AMEX:BTC) led the inflows with $14.2

million, while the GBTC, also from Grayscale (AMEX:GBTC), was the

only one to record outflows, with $9.82 million.

Coinbase to migrate MATIC to POL: Details and timeline of Polygon’s

update

Coinbase (NASDAQ:COIN) announced it will migrate the Polygon

(COIN:MATICUSD) ticker from MATIC to POL starting August 26. The

transition will disable sending and receiving MATIC between August

26 and September 10 to ensure a smooth change. POL, the new token,

will be supported on Ethereum until September 4 and aims to

optimize functions such as gas fees and staking on the Polygon

network.

Justin Sun projects $4 billion revenue for TRON with meme strategy

Justin Sun, founder of TRON (COIN:TRXUSD), predicts the

blockchain’s revenue could reach $4 billion next year, driven by a

meme-focused strategy. In a post, he highlighted that the network’s

daily revenue has already hit a record $5.33 million. Additionally,

Sun plans to enhance TRON’s decentralized stablecoin, USDD

(COIN:USDDUST), to compete with other stablecoins despite recent

controversies over its backing.

Stablecoins could become major holders of US Treasury bonds, says

analyst

Juan Leon of Bitwise Invest predicts that stablecoins’ share in

the US Treasury bond market, currently at 1%, could grow to 15%. In

June, Tether (COIN:USDTUSD) already held $80.9 billion in bonds,

surpassing traditional funds. Leon suggests that stablecoins could

reach $1 trillion, potentially becoming one of the top three

holders of these bonds.

Anchorage Digital launches rewards program for PYUSD holders

Anchorage Digital, an institutional cryptocurrency platform, has

introduced a rewards program for investors holding PYUSD

(COIN:PYUSDUSD), a dollar-backed stablecoin from PayPal Holdings

(NASDAQ:PYPL). Participants can earn competitive rewards without

compromising the accessibility or security of their assets, which

remain segregated and accessible. The program, initially focused on

PYUSD, may expand to other stablecoins. With PYUSD nearing $1

billion in market capitalization, the initiative aims to broaden

its utility, especially on the Solana network, where the stablecoin

has been rapidly growing.

OmegaPro co-founder arrested for $4 billion Ponzi scheme

Andreas Szakacs, co-founder of OmegaPro, was arrested in Turkey

in July for his involvement in a Ponzi scheme that allegedly

defrauded investors of $4 billion. Szakacs, who changed his name

after becoming a Turkish citizen, denies the charges. Authorities

seized computers and cold wallets, tracing $160 million in

cryptocurrencies. OmegaPro collapsed in 2022 after regulatory

warnings in several countries.

FTX secures majority support for reorganization plan as Ryan Salame

seeks agreement over Michelle Bond investigation

FTX reported that its amended reorganization plan received

majority creditor support, with over 95% of votes in favor. The

plan aims to return 100% of amounts plus interest to

non-governmental creditors but still faces opposition from

customers dissatisfied with asset valuation and potential tax

implications. Final confirmation is scheduled for October 7.

Additionally, Ryan Salame’s attorneys, the former FTX executive

sentenced to 7.5 years, are asking the court to honor an agreement

that promised to halt the investigation into his partner, Michelle

Bond, or overturn his conviction. Salame claims his confession was

induced by the promise of protection for Bond, who is under

investigation for campaign finance violations.

Hackers steal $700,000 in scam targeting McDonald’s Instagram

account

Cybercriminals hacked McDonald’s official Instagram account

(NYSE:MCD), promoting a fake token called “GRIMACE” on the Solana

network. They exploited the trust of the brand’s 5 million

followers, inflating the token’s value to $25 million before

cashing out, driving its value to nearly zero. The hackers withdrew

$700,000 in Solana (COIN:SOLUSD). McDonald’s regained control of

the account, but the incident highlighted the growing risks of

fraud in the cryptocurrency market, which recorded over $1.19

billion in losses in 2024.

Report reveals hacked cryptocurrencies face long-term price

declines

A report by Immunefi shows that most hacked cryptocurrencies do

not recover well. More than 77.8% of cryptocurrencies affected by

hacks continue to see price declines six months after the incident.

Additionally, 51.1% experienced losses greater than 50% during this

period. The financial impact and the need for reconstruction

severely hinder recovery. Centralized finance (CeFi) infrastructure

became the primary vulnerability in 2024, accounting for $636

million in losses.

Trump promotes “DeFi” cryptocurrency in new financial strategy

Former President Donald Trump, previously skeptical of

cryptocurrencies, is now promoting a “DeFi” project linked to his

name in a post on Truth Social. “For too long, the average American

has been squeezed by big banks and financial elites. It’s time we

take a stand — together. #BeDefiant,” the post read. Trump shared a

link to Telegram, highlighting financial decentralization as the

answer to big bank oppression. Trump’s adoption of cryptocurrencies

aligns with the sector’s growing political support. He owns over $1

million in cryptocurrencies and has previously been involved with

NFTs.

The importance of compliance in US cryptocurrency regulation

The growing adoption of cryptocurrencies is forcing US

regulators to tighten rules on digital asset reporting and trading.

Experts like Blake Benthall suggest that compliance companies like

Fathom(x) can educate regulators to avoid overreaching

restrictions. Coinbase and Binance are already collaborating to set

standards and improve compliance, but challenges remain. The new

bill aims to increase the Secret Service’s authority in

cryptocurrency-related crimes.

Drake and Stake partnership redefines celebrity success in Web3

A Forbes report highlights that the collaboration between rapper

Drake and cryptocurrency casino Stake challenges the common

perception that celebrity involvement in Web3 is synonymous with

scams. Since 2022, the partnership has been highly profitable, with

Drake actively promoting Stake on his social media. This alliance,

which combines cryptocurrency gambling and global visibility,

highlights the growing maturity of the Web3 industry and Drake’s

ability to strategically position himself in new trends.

Ark Labs secures $2.5 million to develop Bitcoin scalability

solution

Ark Labs, focused on Bitcoin scalability, secured $2.5 million

in pre-seed funding, led by Tim Draper. The project aims to enhance

fast and low-cost transactions, potentially benefiting billions.

Initially an alternative to the Lightning Network, Ark intends to

improve the self-custody experience and utilize trustless servers

to optimize infrastructure. The alpha version of the solution is

already available on GitHub, with a beta test scheduled for

September.

Zellic acquires Code4rena to expand blockchain security audits

Zellic has acquired Code4rena, its first acquisition, to enhance

its blockchain security audits. The merger will allow clients to

benefit from Zellic’s consultative audits and Code4rena’s broad

coverage of competitions. The new offering, called Audits+, aims to

raise the standards of comprehensive project reviews, combining the

technical expertise and creativity of both market leaders.

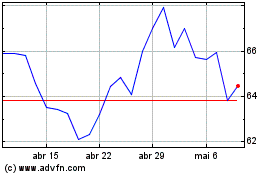

PayPal (NASDAQ:PYPL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

PayPal (NASDAQ:PYPL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024