U.S. index futures rose in pre-market trading on Thursday as

investors reacted to Nvidia’s earnings. Although the AI chip giant

exceeded expectations in sales and profits, the market reaction was

negative, reflecting disappointment with the growth magnitude,

illustrating the pressure on high-tech companies to consistently

surpass high expectations. Investors are also awaiting reports from

major retailers and key economic data.

As of 5:09 AM ET, Dow Jones (DOWI:DJI) futures gained 206

points, or 0.50%. S&P 500 futures gained 0.10%, and Nasdaq-100

futures advanced 0.05%. The 10-year Treasury yield stood at

3.822%.

In today’s U.S. economic calendar, at 8:30 AM ET, initial

jobless claims for the week ending August 24 are projected at

230,000, a slight decrease from 232,000 the previous week. The

second quarter’s advance GDP report is expected to confirm a 2.8%

growth. Additionally, the July goods trade balance will be closely

watched, particularly after the previous month’s $96.6 billion

deficit. Moreover, advanced data on the goods trade balance, retail

inventories, and wholesale inventories for July will be released.

At 10:00 AM, pending home sales for July are expected to show a

modest 0.1% increase, following a 4.8% rise in June.

In the commodities market, oil prices fell after two sessions of

losses, influenced by a smaller-than-expected drop in U.S. crude

oil inventories and concerns over Libyan supply. Libya is facing

production disruptions due to internal disputes, which could impact

OPEC+ supply plans.

West Texas Intermediate crude for October fell 0.44% to $74.19

per barrel, while Brent for October fell 0.55% to $78.22 per

barrel.

Aluminum (CCOM:ALUMINUM) dropped nearly 4% since Tuesday after

hitting a two-month high, due to abundant supply and weak demand in

China. The spot price discount to the three-month contract suggests

ample supplies. Other metals also retreated, influenced by reduced

risk appetite in the financial market.

Asia-Pacific markets mostly closed lower on Thursday. South

Korea’s Kospi fell 1.02% due to losses in SK Hynix and Samsung, and

the Kosdaq declined 0.85% for the seventh consecutive day. Taiwan’s

weighted index dropped 0.75%, pressured by declines in Taiwan

Semiconductor and Foxconn. Japan’s Nikkei 225 saw a slight drop,

while the Topix rose marginally. Australia’s S&P/ASX 200 fell

0.33%. Mainland China’s CSI 300 lost 0.27%. Hong Kong’s Hang Seng

recovered with a 0.47% gain in the final hour of trading.

In Japan, investors are expected to buy a record $47.3 billion

(¥6.83 trillion) in foreign bonds in August, the largest amount in

17 years. The rise in global debt and falling currency hedging

costs, coupled with the yen’s appreciation, make foreign bonds

attractive.

In China, the 2024 growth target is becoming less likely as UBS

cuts its forecasts. The real estate crisis and tight fiscal policy

are affecting growth, now estimated at 4.6% for this year and 4%

for 2025. Weak earnings reports and a lack of significant

government stimulus suggest the 5% target may not be met. The real

estate crisis and low consumer confidence contribute to economic

difficulties.

U.S. President Joe Biden and Chinese President Xi Jinping are

expected to communicate by phone in the coming weeks. U.S. National

Security Advisor Jake Sullivan is in China meeting with diplomat

Wang Yi, with discussions on artificial intelligence underway.

High-level communication between the leaders, strained by recent

tensions, is being resumed.

Chinese tech giant Huawei reported an 18% increase in net profit

and a 34% rise in revenue in the first half, reaching $7.7 billion

in profit and $58.7 billion in revenue. Growth was driven by strong

smartphone sales and success in the smart car components sector,

despite U.S. sanctions.

In South Korea, the Financial Supervisory Service (FSS), the

financial regulator, demanded that creditors resolve problematic

loans by September 6. Exposure to project financing reached $162

billion, with 9.7% considered risky. Projects with loans overdue

for more than three months should be auctioned to improve financial

health and restore confidence. Additionally, the FSS is adjusting

feasibility assessment criteria and supporting the restructuring of

unviable projects. For projects classified as “normal,” the FSS

will encourage maturity extensions to ensure business

continuity.

South Korea’s SK Hynix (KOSPI:000660) launched

the first 10-nanometer sixth-generation DRAM chip, with 9% more

energy efficiency than the previous model. The 16Gb 1c DDR5 chip

can reduce electricity costs in data centers by up to 30%,

especially useful during the AI boom. Mass production will begin

next year. Despite this, the company’s shares closed down 5.35%,

influenced by declines in Nvidia’s stock.

In Singapore, Singapore Exchange Ltd.’s head of capital markets,

Matthew Song, is leaving after one year in the role. Song, who led

the merger of SGX’s capital market divisions, resigned this week

and will depart later this year.

European markets opened higher on Thursday, boosted by the tech

sector following Nvidia’s strong earnings. Pernod

Ricard (EU:RI) shares rose 5.3% due to optimistic sales

forecasts, despite a 1% annual decline in net sales. Additionally,

China’s Ministry of Commerce opted not to impose anti-dumping

duties on EU cognac, generating optimism.

In Spain, preliminary inflation data indicated a 2.2% index in

August. In Germany, inflation fell in six key states in August,

with rates ranging from 1.5% to 2.6%. These data suggest a possible

national inflation drop to 2.3%, down from 2.6% the previous month.

Germany will release these numbers ahead of eurozone data, which is

expected to show 2.2% inflation.

European car sales grew only 0.4% to 1.03 million units in July.

Demand for electric vehicles fell, particularly in Germany, which

saw a 37% decline. Reduced incentives and economic weakness weighed

on sales, with hybrids being the biggest winners.

U.S. stocks fell on Wednesday, with tech sector weakness

weighing on markets. The Dow Jones dropped 0.39%, the S&P 500

fell 0.60%, and the Nasdaq lost 1.12%. Nvidia

(NASDAQ:NVDA), which fell 2.1%, raised concerns ahead of its

quarterly results, while other sectors, including semiconductors

and computer hardware, also saw significant declines.

Before the market opens, Best

Buy (NYSE:BBY), Dollar

General (NYSE:DG), American Eagle

Outfitters (NYSE:AEO), Ollie’s Bargain

Outlet (NASDAQ:OLLI), Campbell

Soup (NYSE:CPB), Burlington

Stores (NYSE:BURL), Birkenstock (NYSE:BIRK), 1-800-Flowers.com (NASDAQ:FLWS), Atour

Group (NASDAQ:ATAT)

and Stratasys (NASDAQ:SSYS) will report

their quarterly results.

After the close, numbers from Dell

Technologies (NYSE:DELL), Lululemon

Athletica (NASDAQ:LULU), Ulta

Beauty (NASDAQ:ULTA), Marvell

Technology (NASDAQ:MRVL), Gap

Inc. (NYSE:GPS), Autodesk (NASDAQ:ADSK), MongoDB (NASDAQ:MDB), 3D

Systems (NYSE:DDD), A-Mark Precious

Metals (NASDAQ:AMRK),

and Elastic (NYSE:ESTC), are

expected.

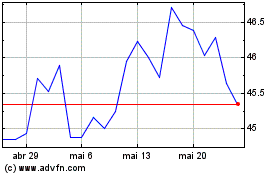

Campbell Soup (NYSE:CPB)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Campbell Soup (NYSE:CPB)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025