Interest Rate Optimism May Overshadow Negative Reaction To Nvidia Results

29 Agosto 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to move back to the upside

after ending the previous session mostly lower.

Stocks may rebound following the tech-led weakness on Wednesday

amid ongoing optimism about the outlook for interest rates.

The Dow is likely to benefit from a surge by shares of

Salesforce (NYSE:CRM), as the business software maker is jumping by

4.4 percent in pre-market trading after reporting better than

expected fiscal second quarter results and raising its full-year

profit forecast.

On the other hand, a slump by shares of Nvidia (NASDAQ:NVDA) may

limit the upside for the markets, with the AI darling tumbling by

3.1 percent in pre-market trading.

The drop by Nvidia comes even though the company reported fiscal

second quarter results that exceeded analyst expectations and

forecast fiscal third quarter revenues above estimates.

“It looks like investors might not have taken the average of

analyst forecasts to be the benchmark for Nvidia’s performance,

instead they’ve taken the highest end of the estimate range to be

the hurdle to clear,” said Dan Coatsworth, investment analyst at AJ

Bell. “The top end was $0.71 earnings per share compared to the

$0.68 earnings per share which the company achieved.”

“Another disappointment for investors was the pace of earnings

growth,” he added. “Even though Nvidia is still making more money

each quarter than the previous one, the growth rate is slowing.

That has triggered alarm bells in the market that the AI gravy

train might be losing power.”

Stocks moved mostly lower during trading on Wednesday, with

weakness in the tech sector weighing on the broader markets. With

the downward move on the day, the Dow pulled back off the record

closing high set on Tuesday.

The major averages climbed well off their worst levels in the

latter part of the session but remained in the red. The tech-heavy

Nasdaq slumped 198.79 points or 1.1 percent to 17,556.03, the

S&P 500 slid 33.62 points or 0.6 percent to 5,592.18 and the

Dow fell 159.08 points or 0.4 percent to 41,091.42.

The weakness on Wall Street partly reflected anxiety ahead of

the release of market leader Nvidia’s fiscal second quarter results

after the close of trading.

Shares of Nvidia tumbled by 2.1 percent on the day, more than

offsetting the 1.5 percent jump seen during Tuesday’s session.

Stocks were also under pressure as traders looked ahead to

Friday’s release of the Commerce Department report on personal

income and spending in the month of July, which includes readings

on inflation said to be preferred by the Federal Reserve.

Economists currently expect the annual rate of consumer price

growth to inch up to 2.6 percent in July from 2.5 percent in June,

while the annual rate of core consumer price is expected to tick up

to 2.7 percent in July from 2.6 percent in June.

While the data is not likely to affect optimism the Fed will

lower rates next month, it could impact expectations for how

quickly the central bank cuts rates.

During his speech at the Jackson Hole Economic Symposium last

Friday, Fed Chair Jerome Powell said the “time has come for policy

to adjust” but noted the “timing and pace of rate cuts will depend

on incoming data, the evolving outlook, and the balance of

risks.”

Computer hardware stocks saw substantial weakness on the day,

contributing to the steep drop by the Nasdaq. Reflecting the

weakness in the sector, the NYSE Arca Computer Hardware Index

plunged by 2.5 percent.

Super Micro Computer (NASDAQ:SMCI) led the computer hardware

sector lower, with the server maker plummeting by 19.1 percent

after saying it would delay the filing of its Annual Report on Form

10-K for the fiscal year ended June 30.

Considerable weakness was also visible among gold stocks,

resulting in a 2.2 percent slump by the NYSE Arca Gold Bugs Index.

The weakness in the gold sector came amid a decrease by the price

of the precious metal.

Semiconductor stocks also showed a significant move to the

downside on the day, dragging the Philadelphia Semiconductor Index

down by 1.8 percent. Steel, oil service and airline stocks also saw

notable weakness, moving lower along with most of the other major

sectors.

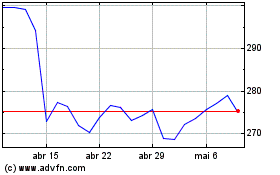

Salesforce (NYSE:CRM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Salesforce (NYSE:CRM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024