Volatility hits cryptocurrency markets after US jobs report

The cryptocurrency market experienced a brief recovery after the

US jobs report, with bitcoin (COIN:BTCUSD) reaching a peak of

$56,995 before falling below $54,000. At the time of writing,

bitcoin was trading at $53,973.37.

The nearly 4% drop in BTC impacted other cryptocurrencies as

well. Dogecoin (COIN:DOGEUSD) dropped over 7%,

Ethereum (COIN:ETHUSD) by more than 5%,

Ripple (COIN:XRPUSD) and

Chainlink (COIN:LINKUSD) fell by over 4%.

Cardano (COIN:ADAUSD) dropped more than 3%.

Binance Coin (COIN:BNBUSD),

Solana (COIN:SOLUSD), TON (COIN:TONCOINUSD), and

Bitcoin Cash (COIN:BCHUSD) fell up to 3%.

Polkadot (COIN:DOTUSD) and

Avalanche (COIN:AVAXUSD) dropped over 1%.

The volatility triggered $50 million in liquidations, primarily

affecting leveraged traders. Major US indices also fell, with the

Nasdaq down 2.53% and the S&P 500 losing 1.74%.

The crypto fear & greed index fell to 22, signaling “extreme

fear,” while analysts warned of a bitcoin correction below $50,000,

though BTC still had support at $55,000 and $52,000.

Bitcoin, down over 12% since August and 24% since its March

peak, struggled to gain momentum. September’s history of negative

volatility heightened traders’ concerns. Although the decline

aligns with previous cycles, there’s long-term recovery potential

with bullish patterns emerging. In the short term, analysts like

Arthur Hayes predict more downward pressure.

JPMorgan (NYSE:JPM) highlights the lack of major catalysts,

making prices more sensitive to macroeconomic factors. Despite

this, trading volumes increased in August, with stablecoins showing

growth. Bitcoin and ether ETFs, however, disappointed.

Record bitcoin ETF outflows total $211 million in a day

On September 5, bitcoin ETFs faced significant outflows,

totaling $211.1 million. This marks the seventh consecutive day of

outflows, with no inflows recorded. Fidelity (AMEX:FBTC) was the

hardest hit, losing $149.5 million, followed by Bitwise (AMEX:BITB)

with $30 million, Grayscale (AMEX:GBTC) with $23.2 million, and the

Grayscale mini trust (AMEX:BTC) with $8.4 million. Since August 27,

over $1 billion has exited as bitcoin’s price dropped from $62,000

to $55,500.

Ethereum ETFs faced smaller outflows, totaling $0.2 million,

with the Grayscale ETF (AMEX:ETHE) seeing $7.4 million in outflows.

However, there was a $7.2 million inflow into other ETH ETFs. Total

outflows for ethereum ETFs reached $562.5 million, as ETH prices

declined by 36.44% over the past 6 months.

Ethereum Foundation promises financial report after controversy

The Ethereum Foundation (COIN:ETHUSD) is set to release a new

financial report in response to criticism over its spending. Justin

Drake revealed on the subreddit r/ethereum that the foundation

spends around $100 million per year and holds $650 million in

assets, with a gradually decreasing budget. Recently, the

foundation transferred 35,000 ETH ($94 million) to Kraken, sparking

discontent in the community. Aya Miyaguchi explained that the funds

are used for grants and salaries and promised that future transfers

would be gradual and planned.

VC funding for crypto sees resurgence in August

In August, venture capital funding for crypto projects grew to

$633 million, a 15% increase from July. Most investments were

directed toward blockchain infrastructure development. Luca

Prosperi of M^0 Labs believes that interest in blockchain will

continue, especially after the peak in AI investments. The return

of VC interest in the crypto sector suggests a potential future

recovery and a clear shift in investment priorities.

Cryptocurrency could meet AI economy’s needs

Analysts at Bernstein suggest that cryptocurrency could solve

micropayment challenges in the AI economy. The current financial

system is not efficient for the very small transactions needed by

AI agents, such as data streaming. Cryptocurrency offers a solution

with global digital payments, fast settlement, and low costs, ideal

for machine-to-machine transactions. This would enable AI agents to

have financial autonomy, overcoming the limitations of traditional

payment methods.

Chris Larsen, co-founder of Ripple, backs Kamala Harris for

president

Chris Larsen, co-founder of Ripple (COIN:XRPUSD), has joined a

group of business leaders endorsing Vice President Kamala Harris in

the presidential race. Larsen, known for his support of responsible

blockchain regulation, emphasized trust in Harris’s leadership in

technology and finance. This endorsement reflects a broader

movement of corporate figures who value policies that promote

innovation and fair regulation, especially in contrast to Donald

Trump’s more deregulation-focused agenda.

Telegram updates FAQ after CEO’s arrest

Following the arrest of Pavel Durov by French authorities,

Telegram updated its FAQ on moderation. On September 6, the

platform removed a section stating it would not process requests

related to private chats, now emphasizing the “report” button for

users to flag illegal content. Durov, arrested on August 24,

pledged to improve moderation, citing the app’s rapid growth and

ease of misuse by criminals. Ton’s price (COIN:TONCOINUSD) reached

$4.89 following Durov’s statement before dropping 1.6% to $4.74 at

the time of writing.

Celebrity endorsements in crypto aren’t guarantees of legitimacy

Celebrity endorsements in cryptocurrency projects can generate

significant visibility but do not guarantee their reliability. SEC

researchers, like Joshua White and Sean Wilkoff, observed that many

of these projects, especially ICOs, are fraudulent, with the number

of scams rising from 26% in 2019 to nearly 40% in 2023. Celebrities

like Shaquille O’Neal and Tom Brady supported projects that failed.

Experts warn that transparency, a strong team, and a clear roadmap

are crucial to assessing legitimacy.

Changpeng Zhao permanently banned from managing Binance

Binance confirmed that Changpeng Zhao (CZ) is permanently banned

from managing the exchange, according to an agreement released on

September 6. Despite CZ holding 90% of the company’s shares and

being able to influence major decisions, he cannot assume executive

positions at Binance. Zhao, who recently launched Giggle Academy

and is investing in blockchain, AI, and biotechnology, has no plans

to take on new executive roles. Binance Kazakhstan also obtained

full AFSA licensing to operate as a regulated trading platform.

Riot Platforms increases bitcoin reserves, faces production drop

Riot Platforms (NASDAQ:RIOT) now holds over 10,000 bitcoins, a

37% increase from last year. However, bitcoin production dropped

13% in August to 322 BTC, and the company sold no bitcoin during

the month. Challenges like high energy costs and halving rewards

are putting pressure on the company. Riot is working to optimize

costs and expand operations, including new facilities in

Kentucky.

Bitcoin mining in Russia boosts revenue and attracts investors

Sergey Bezdelov, director of the Russian Industrial Mining

Association, revealed that the country mined 54,000 BTC in 2023,

generating over $556 million in taxes. The legalization of mining,

approved by the Duma, is expected to attract investors and increase

tax revenue. Russia is expanding its crypto operations, especially

after economic sanctions. Analysts at Chainalysis warn that

exchanges like Garantex and Exved could be used to bypass

international sanctions, moving billions in transactions.

Sonic SVM to sell validator nodes to scale Solana blockchain

The Sonic SVM project, which aims to scale the Solana blockchain

for high-performance gaming, plans to sell up to $12.8 million in

validator nodes on HyperGrid, its decentralized framework. The sale

will take place on September 16, offering 50,000 “Hyperfuse nodes”

across 20 price levels. Proceeds will fund project development.

Node buyers will earn token rewards and contribute to network

security.

CryptoPunk sale highlights NFT value decline

CryptoPunk #6915, a rare ape-themed NFT, sold for about $1.48

million (620 ether) on September 5. Despite the significant price,

it represents a 78% drop from offers of up to $6 million in March

2024. The sale sparked debate in the crypto community about

potential market manipulation and the overall decline in NFT

values, with monthly digital collectible sales down 76% since the

2024 peak.

Magic Eden launches US-exclusive domain amid criticism

Magic Eden announced a new domain exclusively for US users,

offering similar services to its current .io domain but with

additional features. The change has drawn criticism from

cryptocurrency users, who fear that certain features, like

airdrops, may be excluded for US residents. The platform may be

responding to growing US regulatory pressure, similar to OpenSea’s

Wells notice. Despite innovation efforts, the community is calling

for transparency regarding the motivations behind the service

segregation. The Magic Eden Foundation also launched the ME token

for expansion and DApp integration.

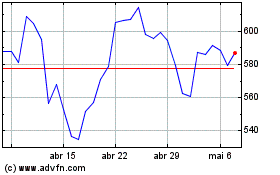

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Binance Coin (COIN:BNBUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024