Apple (NASDAQ:AAPL) – The European Court of

Justice ruled against Apple in a tax case regarding benefits

received in Ireland, potentially leading to the recovery of up to

$14.4 billion in back taxes. This decision follows a long dispute

beginning in 2014 with an EU investigation. Apple launched the

iPhone 16 yesterday, featuring AI and Siri improvements, along with

new camera and audio features. The new iPhone 16 faced criticism in

China for its lack of AI features, especially amid increasing

competition from Huawei. Apple currently lacks an AI partner in

China, with its software available in Chinese only next year,

sparking dissatisfaction on social media. However, analysts believe

short-term sales will remain steady due to customer loyalty. On

Tuesday, Huawei launched its tri-fold Mate XT smartphone in

response to Apple’s iPhone 16. AI features for the iPhone 16 will

be gradually introduced, while Huawei already saw high demand for

its new model. Apple’s shares dropped 1.2% in pre-market trading

after closing up 0.04% on Monday.

Alphabet (NASDAQ:GOOGL) – On Tuesday, Google

lost its appeal against a $2.7 billion fine imposed by the EU in

2017 for anticompetitive practices. The court upheld the ruling

that the company abused its dominant position by favoring its own

price comparison service, harming competitors. Google now faces

$9.1 billion in antitrust fines from the EU and additional cases

related to Android and AdSense. Shares fell 0.2% in pre-market

trading after closing down 1.5% on Monday.

Oracle (NYSE:ORCL) – Oracle reported $13.31

billion in revenue for the quarter ending August 31, beating

estimates of $13.23 billion. Adjusted earnings per share were

$1.39, exceeding forecasts of $1.32. Cloud services revenue rose

21% to $5.6 billion. For the second quarter, Oracle forecasts

revenue growth between 8% and 10%, above analysts’ 8.72% estimate.

Oracle also announced a partnership with Amazon Web Services to

offer its database services on dedicated servers. Shares rose 8.5%

in pre-market trading after closing down 1.4% on Monday.

Hewlett Packard Enterprise (NYSE:HPE),

Juniper Networks (NYSE:JNPR) – Hewlett Packard

Enterprise announced a $1.35 billion convertible preferred stock

offering to fund the acquisition of Juniper Networks. The offering

will cover expenses for the $14 billion purchase aimed at boosting

its AI capabilities. The preferred shares will convert to common

stock in 2027 unless redeemed earlier. HPE shares dropped 5.7% in

pre-market trading after closing up 0.4% on Monday.

Taiwan Semiconductor Manufacturing Co.

(NYSE:TSM) – TSMC’s revenue grew 33% in August, reaching $7.8

billion (NT$250.9 billion), though growth slowed compared to the

previous month. TSMC benefits from demand for AI and smartphone

chips, with expectations of 37% growth in Q3 2024. Shares dropped

1.3% in pre-market trading after closing up 3.8% on Monday.

Edgio (NASDAQ:EGIO) – Edgio filed for Chapter

11 bankruptcy in Delaware. With $379 million in assets and $369

million in liabilities, the company negotiated a deal with its main

creditor, Lynrock Lake Master Fund LP, to sell $110 million in

assets. Lynrock will set the minimum for auction bids. Shares

dropped 1.6% in pre-market trading after closing down 80.2% on

Monday.

AngloGold Ashanti (NYSE:AU), Centamin

Plc (LSE:CEY) – AngloGold Ashanti Ltd. will acquire

Centamin Plc for around £1.9 billion ($2.5 billion), gaining

control of Egypt’s Sukari mine. The deal, representing a 37%

premium over Centamin’s share price, boosts AngloGold’s annual

production by 450,000 ounces. The transaction reflects gold

producers’ drive for expansion. AngloGold shares dropped 8.6% in

pre-market trading after closing up 1.0% on Monday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media’s shares rose 5.5% on Monday after a poll showed

Donald Trump in a close race with Kamala Harris for the presidency.

The recovery followed weeks of declines. The company is valued at

$3.6 billion, a partial rebound from its initial $10 billion

valuation at its March listing. Trump Media posted a $16.4 million

loss last quarter with revenue of just $837,000. Trump can sell his

shares starting September 20 if the price remains above $12 for 20

trading days starting August 22. Shares rose 2.3% in pre-market

trading.

News Corp (NASDAQ:NWS) – Hedge fund Starboard

Value has proposed a resolution to end News Corp’s dual-class share

structure, which allows Rupert Murdoch to control the company with

40% of the voting power despite owning just 14% of the stock. News

Corp defends the current structure, claiming it promotes stability

and success.

Boeing (NYSE:BA) – Boeing and the International

Association of Machinists and Aerospace Workers (IAM) reached a

tentative agreement that includes a 25% wage increase and the

construction of a new plane in Seattle. However, many workers

sought larger raises and the return of an old pension plan. Members

will decide on the agreement. Additionally, Boeing delayed 737 MAX

production to March 2025 from September 2024 due to safety and

regulatory challenges. The goal remains 38 jets per month by the

end of 2024. The company is also adjusting production and

reorganizing teams to improve communication with suppliers. Shares

fell 0.1% in pre-market trading after closing up 3.4% on

Monday.

General Motors (NYSE:GM) – GM and the Unifor

union began collective bargaining for workers at the CAMI plant in

Ontario, Canada. A strike mandate revealed 97% of Unifor Local 88

members support striking if no agreement is reached by September

17. GM committed to reaching a favorable deal. Shares rose 0.4% in

pre-market trading after closing up 0.6% on Monday.

Stellantis NV (NYSE:STLA) – The National

Highway Traffic Safety Administration (NHTSA) opened an

investigation into 781,000 Jeep Wranglers and Gladiators after nine

reports of fires, many with the engine off. The fires appear to

originate from an electrical connector on the power steering pump.

Stellantis is cooperating with the investigation. Shares fell 0.3%

in pre-market trading after closing up 0.3% on Monday.

Mobileye (NASDAQ:MBLY) – Mobileye is abandoning

the development of FMCW lidars for autonomous driving, claiming

their importance has decreased. This caused a drop in the company’s

stock, which initially rose 4.7% but closed down 3.5% on Monday.

The move could reduce costs and benefit lidar manufacturers, while

Tesla sees this as a validation of its camera-only strategy. Shares

rose 0.9% in pre-market trading after closing down 3.5% on

Monday.

Norfolk Southern (NYSE:NSC) – Norfolk

Southern’s CEO Alan Shaw is expected to step down due to an

investigation into possible workplace misconduct. The company is

assessing whether Shaw violated its ethics policy. This situation

follows a recent shareholder dispute and a derailment incident.

RTX Corp. (NYSE:RTX) – According to Bloomberg,

despite RTX Corp.’s efforts, its $7.6 billion GPS satellite network

faces significant issues, potentially leading to further delays in

acceptance by the U.S. Space Force. The system, with costs 73% over

budget and seven years behind schedule, continues to face criticism

for development problems and testing challenges.

Goldman Sachs (NYSE:GS) – Goldman Sachs CEO

David Solomon announced that trading revenue is expected to drop

around 10% in Q3 due to unfavorable conditions in August, following

a strong prior quarter. Solomon also mentioned the bank’s focus on

consumer business and improving private equity activity later this

year. Shares fell 0.6% in pre-market trading after closing up 1.9%

on Monday.

Bank of America (NYSE:BAC) – Savita Subramanian

from Bank of America believes that higher volatility and falling

interest rates will make utility stocks more attractive than

technology stocks. She upgraded utilities to overweight,

highlighting their outperformance against tech stocks and potential

for higher returns due to robust dividends. Bank of America also

hired Tim Carpenter, a former JPMorgan Chase executive, to co-lead

its software investment banking division. Shares rose 1.6% in

pre-market trading after closing up 1.8% on Monday.

Citigroup (NYSE:C) – Citigroup expects

investment banking fees to rise 20% in Q3 due to a recovery in debt

markets and mergers. However, market revenue is forecasted to fall

4%. The bank also faces challenges with credit card delinquencies

and data compliance issues. Shares rose 0.9% in pre-market trading

after closing up 0.8% on Monday.

HSBC (NYSE:HSBC) – HSBC is considering merging

its commercial and investment banking divisions to eliminate

redundant roles and cut costs, according to Bloomberg. The new

combined division could generate about $40 billion in annual

revenue. No final decision has been made. Shares fell 0.1% in

pre-market trading after closing up 2.0% on Monday.

UBS Group AG (NYSE:UBS) – UBS is considering

partnerships in India to expand its wealth management services,

potentially through acquiring a stake in a local firm. UBS seeks to

strengthen its presence in a competitive market facing challenges

from large local institutions. While no final decision has been

made, such a partnership could help access the growing wealth in

the country. Shares rose 0.2% in pre-market trading after closing

up 1.7% on Monday.

KeyCorp (NYSE:KEY) – KeyCorp sold $7 billion in

low-yielding investments, resulting in an approximately $700

million loss in the third quarter. The sale aims to reposition its

securities portfolio to improve profitability, following an

agreement with Scotiabank. Shares were down slightly in pre-market

trading after previous slight gains.

Nomura Holdings (NYSE:NMR) – Nomura Holdings

projects a 30% growth in trading revenue over the next three years,

driven by its expansion into hedge fund services. The markets

unit’s revenue rose by 15-20% in 2024, benefiting from enhanced

risk controls and technology improvements. The bank aims to

diversify its offerings and increase its footprint in the U.S. and

Asia.

Under Armour (NYSE:UAA) – Under Armour

announced that restructuring costs will be higher than previously

expected. The company, led once again by Kevin Plank, revised its

restructuring charge estimate to between $140-160 million, up from

the earlier forecast of $70-90 million. Shares closed down 4.2% on

Monday.

Boot Barn (NYSE:BOOT) – Boot Barn’s shares

closed up 3% on Monday following reports of a 4% growth in

same-store sales during the first ten weeks of the second fiscal

quarter. The increase was driven by a 3.4% rise in retail sales and

a 9.2% boost in online sales. The company’s stock has surged 60.73%

over the last 12 months.

Capri Holdings (NYSE:CPRI),

Tapestry (NYSE:TPR) – Capri Holdings CEO John Idol

testified that the $8.5 billion merger with Tapestry would

revitalize Michael Kors and benefit investors. The FTC, considering

the merger a competitive threat, requested a federal court in

Manhattan block the deal. The court’s decision will determine

whether the merger proceeds, combining the two fashion giants.

Church & Dwight (NYSE:CHD) – A class-action

lawsuit was filed on Monday alleging that Trojan condoms, produced

by Church & Dwight, contain PFAS, toxic chemicals linked to

cancer. The plaintiff, Matthew Goodman, claims the condoms,

marketed as safe, show traces of fluorine linked to PFAS. The

lawsuit seeks $5 million in damages.

MercadoLibre (NASDAQ:MELI) – MercadoLibre CEO

Marcos Galperin plans to triple the company’s user base and expand

services using artificial intelligence, drones, and online

payments, according to a Reuters report. The company aims to grow

organically, focusing on key markets like Brazil, Mexico,

Argentina, and Chile. Despite the economic crisis in Argentina,

Galperin remains optimistic about strategic investments.

Alibaba Group (NYSE:BABA) – Alibaba’s shares

have been added to the Stock Connect program, allowing mainland

Chinese investors to trade the company’s stock. This inclusion is

expected to attract approximately $20 billion in investments. The

move is seen as helping close the valuation gap between Alibaba and

its competitor, PDD Holdings. Shares rose 2.7% in pre-market

trading after closing up 0.3% on Monday.

Eli Lilly (NYSE:LLY) – Eli Lilly has appointed

Lucas Montarce as its new CFO, succeeding Anat Ashkenazi, who left

for Alphabet. Montarce, who has been with Eli Lilly since 2001,

will face the challenge of expanding production for its popular

diabetes and weight-loss drugs. Montarce’s base salary will be $1

million, with eligibility for an annual bonus of up to $1

million.

AstraZeneca Plc (NASDAQ:AZN), Daiichi

Sankyo (USOTC:DSNKY) – AstraZeneca and Daiichi Sankyo

shares dropped after mixed results from an advanced trial of their

lung cancer drug. Although some patients lived longer, the overall

results were not statistically significant. Despite showing

potential, the market reacted negatively. Meanwhile, Boehringer

Ingelheim reported promising results for a new oral treatment.

AstraZeneca’s shares fell 1.9% in pre-market trading after closing

down 2.6% on Monday.

SiNtx Technologies (NASDAQ:SINT) – SiNtx

Technologies shares soared 54.6% on Monday, closing at $4.36,

following the approval of a patent for a new ceramic material used

in medicine. The trading volume exceeded 63 million shares. The

patent enhances the biomedical properties of silicon nitride,

strengthening the company’s position in the biotech market. Shares

dropped 8.0% in pre-market trading.

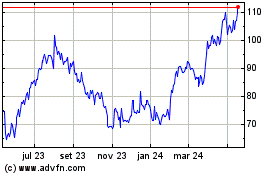

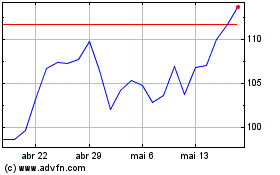

Boot Barn (NYSE:BOOT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Boot Barn (NYSE:BOOT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024