Mixed Inflation Data May Lead To Initial Pullback on Wall Street

11 Setembro 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a lower

open on Wednesday, with stocks likely to give back ground after

moving mostly higher over the two previous sessions.

The futures remained in negative territory following the release

of the Labor Department’s closely watched report on consumer price

inflation in the month of August.

While the report showed consumer prices increased in line with

economist estimates, core consumer prices rose by slightly more

than expected.

The Labor Department said its consumer price index rose by 0.2

percent in August, matching the uptick seen in July as well as

economist estimates.

However, core consumer prices, which exclude food and energy

prices, climbed by 0.3 percent in August after rising by 0.2 in

July. Economists had expected core prices to rise by another 0.2

percent.

The Federal Reserve is still likely to lower interest rates next

week, but the bigger than expected increase by core consumer prices

may be seen as reducing the chances the central bank lowers rates

by 50 basis points.

Following the report, CME Group’s FedWatch Tool is indicating an

85.0 percent chance of a quarter point rate cut and just a 15.0

percent chance of a half-point rate cut.

At the same time, the report said the annual rate of consumer

price growth slowed to 2.5 percent in August from 2.9 percent in

July. Economists had expected the year-over-year growth to

decelerate to 2.6 percent.

The annual rate of core consumer price growth was unchanged from

the previous month at 3.2 percent in August, in line with economist

estimates.

Stocks fluctuated over the course of the trading session on

Tuesday but managed to end the day mostly higher. The Nasdaq and

the S&P 500 added to the strong gains posted during Monday’s

session, although the narrower Dow bucked the uptrend.

The Nasdaq and the S&P 500 saw further upside going into the

close, reaching new highs for the session. The Nasdaq climbed

141.28 points or 0.8 percent to 17,025.88 and the S&P 500 rose

24.47 points or 0.5 percent to 5,495.52, but the Dow dipped 92.63

points or 0.2 percent to 40,736.96.

The volatility seen over the course of the trading day came as

traders looked ahead to the release of closely watched inflation

data in the coming days.

The data could impact the outlook for interest rates ahead of

the Federal Reserve’s monetary policy meeting next week.

The Fed is almost universally expected to begin lowering

interest rates next week, but there is some debate about the size

of the rate cut.

Software stocks turned in a strong performance on the day,

resulting in a 1.9 percent jump by the Dow Jones U.S. Software

Index.

Oracle (NYSE:ORCL) led the sector higher, soaring by 11.4

percent after reporting better than expected fiscal first quarter

results and announcing a strategic partnership with Amazon Web

Services.

Considerable strength also emerged among networking stocks, as

reflected by the 1.9 percent surge by the NYSE Arca Networking

Index.

Gold, commercial real and semiconductor stocks also moved

notably higher over the course of the session, while a steep drop

by the price of crude oil weighed on energy stocks.

Banking stocks also showed a significant move to the downside on

the day, dragging the KBW Bank Index down by 1.8 percent.

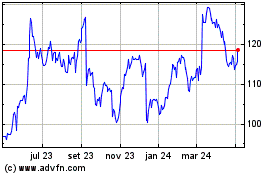

Oracle (NYSE:ORCL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

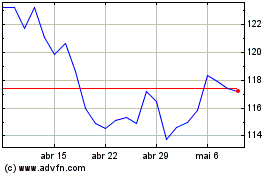

Oracle (NYSE:ORCL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025