U.S. Markets Await Fed Decision and Empire State Report Amid Global Economic Shifts; Oil Prices Rise Slightly

16 Setembro 2024 - 7:04AM

IH Market News

On Monday, the main highlight of the U.S. economic agenda is the

Empire State Manufacturing Survey for September, which will be

released at 8:30 AM ET. The market expects a reading of -5.0,

compared to -4.7 in August. The Fed’s two-day policy meeting is set

to begin on Tuesday, with the interest rate decision expected at 2

PM on Wednesday.

In the commodities market, oil prices edged up slightly on

Monday, supported by expectations of a potential U.S. rate cut.

However, gains were limited by weak data from China, including a

slowdown in industrial production and a decline in refinery output.

Additionally, around 20% of crude oil production and 28% of natural

gas production in the Gulf of Mexico remain offline due to

Hurricane Francine.

West Texas Intermediate crude for October rose 0.47% to $68.99

per barrel, while Brent for November increased 0.38% to $71.88 per

barrel.

Asia-Pacific markets advanced, with Hong Kong’s Hang Seng rising

0.13% in late trading. Australia’s S&P/ASX 200 gained 0.27%,

and Taiwan’s Weighted Index increased 0.42%. Markets in mainland

China, South Korea, and Japan were closed.

In China, industrial production slowed to a five-month low in

August, growing by 4.5%, with retail sales rising just 2.1%, and

new home prices also weakening. These weak figures add pressure on

the government to implement aggressive stimulus measures to support

the economy, which faces growing challenges.

Goldman Sachs and Citigroup have cut their growth forecasts for

China’s economy to 4.7% following the weak industrial production

data. The sluggish economic activity has heightened the need for

more stimulus to boost demand. Goldman Sachs also sees an

increasing risk of missing the 5% growth target for this year.

In August, new home prices in China fell by 5.3% year-over-year,

marking the largest drop in over nine years, according to official

data. The monthly decline was 0.7%, continuing a 14-month trend.

Support measures have not been sufficient to reverse the real

estate sector’s downturn.

From January to August, foreign direct investment in China

amounted to $81.80 billion (580.19 billion yuan), a 31.5% drop

compared to last year, according to the Ministry of Commerce,

exceeding the 29.6% decline recorded through July.

China will announce its one- and five-year loan prime rates on

Friday. Currently, the one-year rate, which affects most new and

outstanding loans, stands at 3.35%. The five-year rate, which

influences mortgage pricing, is 3.85%.

In Japan, the BOJ will meet this week, and interest rate

decisions could impact the yen carry trade, which caused market

turbulence in August. Unexpected rate changes could influence the

attractiveness of this trade, which involves borrowing yen at low

rates and investing in higher-yielding assets.

Sanae Takaichi, a candidate for the Liberal Democratic Party

leadership, argued for keeping interest rates low to support

economic recovery, stating that the Bank of Japan’s recent hikes

were premature. She believes the central bank should maintain an

accommodative monetary policy.

European markets declined, with the Stoxx 600 falling due to

losses in sectors such as mining and automobiles. Investors are

awaiting earnings from H&M and Italian inflation data in a week

marked by important monetary policy decisions. On Thursday, the

Bank of England will meet to decide on its monetary policy, with

markets uncertain about a potential second rate cut in two

months.

On Friday, U.S. stocks closed higher, with the Dow Jones rising

297.01 points (0.72%), the S&P 500 up 30.26 points (0.54%), and

the Nasdaq climbing 114.30 points (0.65%). Optimism over interest

rate cuts fueled the market. Goldman Sachs advocated for a 0.25

percentage point cut at the upcoming Fed meeting, while Bill Dudley

suggested a more aggressive 0.50 point cut. Real estate, gold, and

steel stocks led sector gains, while the 10-year Treasury yield

fell to 3.650%.

Adding to the sentiment, the University of Michigan released a

report showing an improvement in U.S. consumer sentiment in

September, with the index rising to 69.0, up from 67.9 in August

and exceeding economists’ expectations of 68.0. Additionally, the

report revealed a drop in inflation expectations for the coming

year, which fell to 2.7%, the lowest level since December 2020. The

Department of Labor also reported that import prices fell more than

expected in August.

On Sunday, Secret Service members confronted a possible shooter

with a rifle near former President Donald Trump in Palm Beach. The

incident, following a similar shooting in Pennsylvania, may impact

the presidential race and shift the negative perception of Trump’s

campaign. The suspect, Ryan Routh, was detained, and further

details about the motive are awaited.

Companies reporting their quarterly earnings on Monday include

ImmunoPrecise Antibodies (NASDAQ:IPA) before the market opens; and

High Tide (NASDAQ:HITI), RF Industries (NASDAQ:RFIL) and Vince

Holding Corp (NYSE:VNCE) after the market closes.

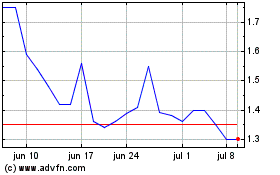

Vince (NYSE:VNCE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Vince (NYSE:VNCE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024