Bitcoin drops as traders eye the Fed

Bitcoin (COIN:BTCUSD) fell to around $57,823, dropping 2.3% in

24 hours, after holding above $60,000 over the weekend. Ether

(COIN:ETHUSD) slipped 1.4% to around $2,288. Futures traders lost

$143 million due to the sudden drop. Increasing competition from

networks like Solana and Base pressures Ethereum. Expectations of a

federal reserve interest rate cut after four years have increased

market volatility. The Fed is expected to announce the rate cut on

September 18, with a 41% chance for a 25 bps reduction and a 59%

chance for 50 bps. Uncertainty about the size of the cut is

contributing to market fluctuations, impacting bitcoin’s recent

performance. Additionally, the accumulation trend score, which

analyzes investor behavior toward bitcoin, shows signs of selling,

which may harm BTC’s medium-term price. “We are in a

distribution phase on this indicator, which is bad for BTC in the

medium term. The last distribution cycle lasted about 2 months,

with BTC losing $10,000 in price,” said Fernando Pereira, a

Bitget analyst, suggesting a similar pattern could repeat now.

Ether faces challenges against bitcoin with 42-month lows

Ether (COIN:ETHBTC) is struggling, especially against bitcoin,

as the pair hits a 42-month low. Bitcoin dominance has risen to

58%, increasing pressure on ether. Some analysts see this as a

potential base for recovery, while others point to recent ether ETF

underperformance and a possible ongoing downtrend. The correction

may signal either a turning point or continued negative

pressure.

Bitcoin mining stocks fall with increased hash rate and prices

below $60,000

A report by JPMorgan Chase (NYSE:JPM) highlighted that bitcoin

mining stocks declined in the first half of september, as BTC’s

price remained below $60,000 and the hash rate increased by 4%. The

hash rate, reflecting mining competition, has returned to

pre-halving levels. The hash price dropped 2%, more than 50% below

pre-halving levels. US-listed miners increased their share of the

hash rate to 26.7%, but the market value of miners fell 3% to under

$20 billion.

MiCA crypto alliance launched to streamline regulatory compliance

On september 16, the DLT Science Foundation (DSF) launched the

MiCA Crypto Alliance with Hedera (COIN:HBARUSD), Ripple

(COIN:XRPUSD), and the Aptos Foundation (COIN:APTUSD) as founding

members. The alliance aims to help crypto-asset service providers

(CASPs) comply with the European Union’s MiCA regulation, which

includes climate impact reporting. DSF will provide AI tools to

facilitate compliance by standardizing white papers and

sustainability metrics. The alliance seeks to make the crypto

sector more transparent and environmentally responsible.

Chainlink CCIP enables interoperability on ZKsync with new features

for developers

Chainlink’s (COIN:LINKUSD) cross-chain interoperability protocol

(CCIP) is now live on ZKsync, a layer 2 scaling solution using

zero-knowledge (ZK) proofs. This integration allows developers to

build dapps that operate across multiple blockchains, enabling

token transfers and communication between smart contracts on

different networks. ZKsync’s interoperability is now enhanced,

driving asset tokenization and linking blockchain infrastructure

with traditional finance, further boosting the adoption of

decentralized solutions.

Tether dominates 75% of the stablecoin market after rapid growth

Tether (COIN:USDTUSD) has increased its market share from 55% to

75% over the past two years, reaching $118 billion in circulation.

This growth reflects the rising adoption of stablecoins as gateways

to crypto. In the last 30 days, Tether generated $400 million in

revenue. The company plans to double its compliance team by 2025 to

meet the growing demand for stablecoin solutions.

LimeWire launches decentralized GPU marketplace to boost AI

startups

LimeWire, known for its NFT marketplace, has unveiled a

decentralized platform connecting AI startups to on-demand GPU

resources. Companies with idle GPU capacity can rent it out in

exchange for LMWR tokens (COIN:LMWRUSD). AI startups can purchase

this computing power using cryptocurrencies, offering a flexible

and cost-effective way to access the advanced processing power

needed for their projects.

Linux Foundation launches trust for open-source code with a focus

on decentralized ecosystems

The Linux Foundation has launched the Decentralized Trust

(LFDT), an organization with over 100 members, including Hedera and

Hyperledger, to collaborate on open-source projects for

decentralized ecosystems. Hedera shared its hashgraph algorithm

with the trust. Another member, Dfns, contributed its encryption

system to strengthen security. The goal is to create reliable

standards that promote global transparency and security, with

participation from Accenture, Hitachi, and even the Central Bank of

Brazil.

Changpeng Zhao, Binance co-founder, to be released from US custody

in september

Binance co-founder Changpeng Zhao is set to be released from US

oversight on september 29, after four months of monitoring. Zhao

was transferred to the Long Beach reentry facility in California,

which assists individuals nearing release. His legal troubles began

with accusations of violating US federal laws, resulting in $4.3

billion in fines for Binance and $50 million for Zhao. Meanwhile,

Binance faces new SEC charges for violating securities laws.

BitGo simplifies digital asset management with new custody platform

BitGo has launched a platform to simplify digital asset

management for foundations and organizations, including protocols

like Worldcoin (COIN:WLDUSD) and Sui (COIN:SUIUSD). The new

solution provides a unified, regulated approach to acquisition,

vesting, and on-chain operations, filling a gap in a fragmented

market. BitGo Trust, the company’s qualified custodian offering,

enables seamless management, relieving protocols from the technical

complexity of integrating multiple solutions and facilitating the

successful launch of new tokens and protocols.

Over 40 financial firms collaborate with BIS on tokenization

project

More than 40 financial institutions will join the Bank for

International Settlements (BIS) in the Agora Project to explore

tokenization in cross-border payments. Announced on monday, the

project enters its design phase following a public selection in

May. The initiative aims to digitize real-world assets and

integrate tokenized bank deposits with central bank money on a

public-private financial platform, addressing inefficiencies and

structural challenges in international payments.

Super PACs invest millions in US senate races

The PAC Protect Progress spent around $7.8 million supporting

democratic candidates in the Arizona and Michigan senate races,

reflecting the growing impact of crypto companies in elections.

Registered on september 14, the Super PAC allocated approximately

$4.1 million for Ruben Gallego in Arizona and over $3.7 million for

Elissa Slotkin in Michigan. These expenditures aim to influence the

2024 elections, with both candidates leading in polls. Financial

backing also includes significant investments in other candidates

and campaigns.

$6 million Delta Prime hack highlights risk of upgradable contracts

A hacker stole more than $6 million from the Delta Prime DeFi

protocol by creating an astronomical number of receipt tokens. The

attacker manipulated upgradable contracts, minting trillions of

Delta Prime USD (DPUSDC) tokens and others, exchanging a small

fraction for $2.4 million in USDC and over $1 million in bitcoin

and ether. Delta Prime stated that the Avalanche version was not

affected and that protocol insurance will cover potential

losses.

Multicoin raises $10 million for Pipe content distribution network

Multicoin led a $10 million funding round for Permissionless

Labs, the developer of the Pipe Network, a cryptocurrency-based

content distribution network (CDN). Pipe plans to use tokens to

incentivize people to provide internet infrastructure, improving

access to geographically distant content. The project will use the

solana blockchain and launch a testnet at the Breakpoint conference

in Singapore, offering a decentralized alternative to traditional

CDNs.

Stokmarknes residents celebrate end of bitcoin mining, but power

bills soar

Residents of Stokmarknes, Norway, are relieved by the closure of

the KryptoVault bitcoin mining facility after three years of

complaints about excessive fan noise. The company went bankrupt in

september 2023, and the site was shut down last week. However, the

closure caused a more than 20% increase in local power bills, as

KryptoVault accounted for about 20% of Noranett’s revenue. The

municipality is seeking new projects to utilize the excess

electricity, but the impact on residents’ bills is already being

felt.

El Salvador to present a deficit-free budget for 2025, says

President Bukele

El Salvador President Nayib Bukele announced he will present a

deficit-free budget for 2025, without the need for new debt. During

the country’s 203rd independence anniversary celebration, Bukele

promised the budget will be fully funded by domestic production,

without resorting to loans to cover interest on past debts. This

marks the first time in decades that El Salvador will present a

budget without external or internal debt.

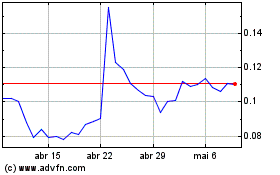

Hedera Hashgraph (COIN:HBARUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Hedera Hashgraph (COIN:HBARUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025