Nike (NYSE:NKE) – Elliott Hill, who started as

an intern at Nike in 1988, will become the next CEO on October 14,

replacing John Donahoe. Hill, with a 32-year career at Nike, is

known for his work ethic and dedication. This change comes at a

critical time, with the company facing declining sales and

increasing competition. Shares rose 6.8% in pre-market trading,

after closing up 0.1% on Thursday.

FedEx (NYSE:FDX) – FedEx reported a sharp drop

in quarterly profit and lowered its forecasts as customers opt for

cheaper shipping options. CEO Raj Subramaniam cited weaker

industrial demand and insufficient cost cuts. The company expects

low growth next fiscal year and is ending a key contract with USPS.

FedEx reported adjusted earnings per share of $3.60 in the fiscal

first quarter, below estimates of $4.75. Revenue was $21.6 billion,

also missing the $21.9 billion forecast. FedEx lowered its earnings

outlook for fiscal 2025, expecting between $20 and $21 per share.

Shares dropped 13.4% in pre-market trading, after closing up 0.7%

on Thursday.

Lennar Corp (NYSE:LEN) – Lennar reported

third-quarter earnings above expectations, driven by low housing

supply and a decline in fixed mortgage rates to about 6.1%. Despite

lower gross margins due to high costs, the company expects demand

to rise with further interest rate cuts. Lennar reported earnings

of $4.26 per share, beating LSEG estimates of $3.63. Revenue was

boosted by the delivery of 21,516 homes, up from 18,559 the

previous year. The company expects to deliver between 22,500 and

23,000 homes in the fourth quarter. Shares fell 2.5% in pre-market

trading, after closing up 2.1% on Thursday.

Macy’s (NYSE:M), United Parcel

Service (NYSE:UPS) – Macy’s announced it will hire over

31,500 employees for the holiday season, down from 38,000 last

year, reflecting a weaker labor market and cautious consumers. In

contrast, UPS plans to increase its seasonal hires to 125,000

workers. Macy’s shares are stable in pre-market trading, while UPS

shares fell 2.4%.

Amazon.com (NASDAQ:AMZN) – Amazon launched an

AI application called Amelia to help independent sellers manage

sales metrics, inventory, and advertising. The software provides

quick responses to questions and can autonomously solve issues.

Initially available to a limited group, Amelia aims to automate

customer service and improve seller experiences. Shares fell 0.3%

in pre-market trading, after closing up 1.9% on Thursday.

Mastercard (NYSE:MA) – According to Mastercard,

U.S. retail sales are expected to grow 3.2% this holiday season,

with companies offering promotions to attract shoppers during a

shorter shopping period. Online sales are expected to rise 7.1%.

Falling inflation and a strong job market are supporting this

recovery. Mastercard shares fell 0.2% in pre-market trading, after

closing down 0.4% on Thursday.

AMC Entertainment (NYSE:AMC), Cinemark

Holdings (NYSE:CNK) – Major cinema chains like AMC, Regal,

and Cinemark announced a $2.2 billion investment over the next

three years to modernize theaters in North America. Improvements

include comfortable seating, immersive sound, laser projection

technology, and facility upgrades. AMC shares rose 0.4% in

pre-market trading, while Cinemark shares remain stable.

Walt Disney (NYSE:DIS) – Walt Disney Animation

Studios has appointed Jared Bush as Chief Creative Officer. Bush,

who has worked at Disney for over a decade, is known for his role

in acclaimed films such as “Encanto,” “Zootopia,” and “Moana.” He

takes over from Jennifer Lee, who served as CCO since 2018 and

co-wrote “Frozen.” Lee will now focus on directing and co-writing

“Frozen 3” and “Frozen 4.” Bush is currently involved in producing

“Zootopia 2” and “Moana 2,” scheduled for release in 2025 and 2024,

respectively. He will oversee the creative production of the

studio’s films, series, and associated projects.

Salesforce (NYSE:CRM) – Salesforce CEO Marc

Benioff said the company’s new AI software provides a complete

solution for enterprise customers, emphasizing that users do not

need to develop their own AI. Salesforce is focusing on AI “agents”

that automate tasks without human supervision, aiming to deploy one

billion agents within a year. In other news, Walt Disney announced

it plans to discontinue using Salesforce’s Slack as a collaboration

tool after a data breach by the hacker group NullBulge exposed over

a terabyte of data. Disney CFO Hugh Johnston stated that most of

the company’s businesses would leave the service by the end of the

year, migrating to simplified corporate tools. Salesforce shares

closed up 5.4% on Thursday.

Hershey (NYSE:HSY) – Hershey laid off a small

number of employees this week, less than 1% of its 20,000 staff, as

part of organizational changes aimed at generating $300 million in

savings. These layoffs come amid rising cocoa prices and declining

sales, according to Reuters.

Coca-Cola (NYSE:KO) – Coca-Cola announced a $1

billion investment in its Nigerian operations over the next five

years, as discussed during a meeting with President Bola Tinubu.

Since 2013, the company has invested $1.5 billion in the country.

Shares rose 0.3% in pre-market trading, after closing down 1.6% on

Thursday.

Starbucks (NASDAQ:SBUX) – New Starbucks CEO

Brian Niccol believes employees should be in the office when

necessary but will not impose specific days for attendance.

Starbucks currently maintains a three-day office policy. Niccol

emphasized the value of collaboration and plans to spend more time

in the office, although his own remote work arrangement has sparked

reactions. Shares fell 0.2% in pre-market trading, after closing up

0.8% on Thursday.

Elanco Animal Health (NYSE:ELAN) – The FDA

approved Zenrelia, a new Elanco drug for treating skin diseases in

dogs. The once-daily immunosuppressant controls itching and atopic

dermatitis. Elanco plans to launch it soon at a price 20% lower

than Apoquel, a competing treatment.

Airbnb (NASDAQ:ABNB) – Airbnb has identified a

significant opportunity to expand its long-term rental business,

focusing on stays of 28 days or more, as short-term rentals face

tighter regulations in tourist destinations like Athens and

Barcelona. CEO Brian Chesky noted that these rentals now account

for 17% to 18% of the company’s bookings.

Apple (NASDAQ:AAPL) – Apple launched the iPhone

16 in nearly 60 countries, but the new model will not come with its

AI software, Apple Intelligence, pre-installed. Users will need to

download the features over time. T-Mobile CEO Mike Sievert said

iPhone 16 sales surpassed those of the iPhone 15, with consumers

opting for Pro and Max models more frequently. Meanwhile, analysts

remain optimistic about the company’s holiday season performance.

In Russia, retailers like M.Video-Eldorado and MTS launched

pre-sales of the iPhone 16 despite Apple’s export ban to the

country. Russian consumers will pay hundreds of dollars more than

Americans due to parallel imports from non-sanctioned countries

like China and Turkey. Shares fell 0.4% in pre-market trading,

after closing up 3.7% on Thursday.

Nvidia (NASDAQ:NVDA) – Nvidia has partnered

with Abu Dhabi’s G42 to create a climate technology lab focused on

AI for weather forecasting. Using the Earth-2 platform, the

companies will develop environmental solutions by leveraging vast

geophysical data. Shares fell 0.6% in pre-market trading, after

closing up 4.0% on Thursday.

OpenAI – OpenAI’s $6.5 billion fundraising

round is nearing completion, with demand far exceeding the amount

available. Investors such as Microsoft, Nvidia, and Apple are

expected to participate, while Sequoia Capital, which backed a

rival startup, will not be involved. OpenAI’s valuation could reach

$150 billion.

Live Nation Entertainment (NYSE:LYV) – Live

Nation has asked a federal judge in New York to dismiss allegations

that the company, along with Ticketmaster, inflated ticket prices

and stifled competition. The company argues that the accusations do

not show direct harm to consumers and defends its practices in

contracts with artists and venues.

Trump Media & Technology Group (NASDAQ:DJT)

– Donald Trump has stated he will not sell his $1.7 billion stake

in Trump Media after restrictions expire. However, other investors,

such as United Atlantic Ventures and Patrick Orlando, may sell

their shares soon. Trump Media shares fell 5.9% on Thursday,

reflecting concerns over insider sales pressure. Shares dropped

another 3.3% in pre-market trading on Friday.

Sunrun (NASDAQ:RUN) – Sunrun shares closed down

5.8% on Thursday after the company ended its sales partnership with

Costco. Costco disagreed with Sunrun’s subscription model, which

offers less upfront revenue. Despite a partnership lasting over a

decade, its impact on sales was limited. Shares rose 0.3% in

pre-market trading.

Shell (NYSE:SHEL) – The sale of Shell’s 37.5%

stake in the Schwedt refinery in Germany to Prax Group is delayed

due to legal proceedings, including Rosneft’s attempt to block the

deal. The sale was expected to close in early 2024 but now depends

on negotiations and court decisions. Shares fell 0.3% in pre-market

trading, after closing up 1.5% on Thursday.

ConocoPhillips (NYSE:COP) – ConocoPhillips will

supply natural gas to Uniper SE for 10 years, delivering up to 10

billion cubic meters to northwestern Europe. This deal strengthens

energy supply security in the region, which seeks alternatives to

Russian gas, highlighting the continued importance of natural gas

in Europe.

Palantir Technologies (NYSE:PLTR) – Palantir

Technologies secured a $100 million contract to expand access to

its AI platform, Maven Smart System, across all branches of the

U.S. military. The platform, which uses intelligence data and

computer vision algorithms, aids in target identification and

battlefield situation analysis. Shares fell 2.2% in pre-market

trading, after closing up 1.2% on Thursday.

Rocket Lab USA (NASDAQ:RKLB) – Rocket Lab USA

aborted a rocket launch in New Zealand on Thursday after the flight

computer halted ignition during the countdown. The rocket, intended

to launch five Kineis nanosatellites, remained intact, and the

company promised updates on a new launch date. Shares fell 0.4% in

pre-market trading, after closing up 0.7% on Thursday.

Plug Power (NASDAQ:PLUG) – Plug Power announced

a new equipment leasing platform, aiming to generate $150 million

in sales. Despite an initial share increase after the announcement,

shares closed down 1.90% on Thursday. The company faces challenges

with sales and is revising its revenue forecasts for the coming

years while attempting to develop hydrogen technologies.

Tesla (NASDAQ:TSLA) – Tesla faced controversy

at its German factory, with local residents concerned about water

shortages and contamination. The factory, which was expected to

boost the economy, has now become a contentious issue in local

elections, potentially benefiting the far-right AfD party, which

has criticized the facility. Shares fell 0.6% in pre-market

trading, after closing up 7.4% on Thursday.

General Motors (NYSE:GM) – General Motors’

autonomous driving unit, Cruise, announced it will soon begin

supervised tests with up to five autonomous vehicles in

California’s Bay Area. Following an incident that suspended

operations, the company resumed testing with human-driven vehicles.

Shares fell 1.2% in pre-market trading, after closing down 0.1% on

Thursday.

Union Pacific (NYSE:UNP) – Union Pacific

projected revenue growth outpacing volumes over the next three

years, with an annual compound growth rate for earnings per share

between high single digits and low double digits. The company also

plans to repurchase up to $5 billion in shares annually starting in

2025.

Delta Air Lines (NYSE:DAL) – Delta Air Lines

announced the suspension of flights between New York-JFK and Tel

Aviv until December 31, citing security concerns in the Middle

East. The airline issued a travel waiver and warned customers about

possible flight schedule changes and cancellations.

Caterpillar (NYSE:CAT) – Caterpillar is

reviewing its diversity, equity, and inclusion (DEI) policies after

activist Robby Starbuck warned of a possible social media attack.

Shares closed up 5.1% on Thursday.

Berkshire Hathaway (NYSE:BRK.B), Bank

of America (NYSE:BAC) – BNSF Railway, controlled by

Berkshire Hathaway, announced a five-year provisional agreement

with the SMART union, providing an average wage increase of 3.5%

per year, along with healthcare benefits and additional vacation

days for railway workers. The contract still requires union

ratification. Warren Buffett, through Berkshire Hathaway, sold $896

million worth of Bank of America shares this week. While Buffett

has not publicly explained his decision, he still holds a

significant position, which may soon fall below the regulatory

threshold of 10%. Shares of BRK.B fell 0.1% in pre-market trading,

while Bank of America shares dipped 0.4%.

JPMorgan Chase (NYSE:JPM) – JPMorgan announced

leadership changes to strengthen its healthcare and technology

investment banking sectors. Ben Carpenter and Jeremy Meilman will

become co-heads of healthcare globally, while Chris Grose and Greg

Mendelson will take on the same roles in the technology sector.

UBS Group AG (NYSE:UBS) – According to Matthew

Mish from UBS, a victory for Kamala Harris would benefit basic

industry and utilities bonds, while sectors like telecommunications

and technology could face challenges. On the other hand, a Donald

Trump victory would favor energy and defense debts. UBS anticipates

private credit deterioration but does not expect it to spread to

the broader market unless the economy slows significantly.

UnitedHealth (NYSE:UNH) – Change Healthcare,

part of UnitedHealth, secured new long-term contracts with

hospitals and clients who had temporarily left the company

following a February cyberattack. The move reflects a trend of

diversification among service providers, accelerated by the hack,

which highlighted the risks of relying on a single supplier.

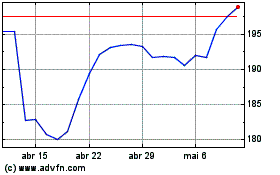

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

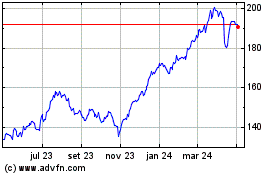

JP Morgan Chase (NYSE:JPM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024