U.S. Stocks May See Further Upside In Early Trading

24 Setembro 2024 - 10:07AM

IH Market News

The major U.S. index futures are currently pointing to a

slightly higher open on Tuesday, with stocks likely to add to the

modest gains posted in the previous session.

Strength in overseas markets may carry over onto Wall Street

after China’s central bank announced a slew of stimulus

measures.

At a press conference on Tuesday, People’s Bank of China

Governor Pan Gongsheng said the bank would reduce the reserve

requirement ratio by 50 basis points.

The bank also framed measures aims to support the property

market. The minimum down payment ratio for second homes will be

reduced to 15 percent from 25 percent. The bank intends to cut the

existing mortgage rates and bring it closer to the new mortgage

rates.

Further, Pan said the PBoC would establish a swap program for

securities, funds and insurance companies to secure liquidity from

the central bank through asset collateralization.

U.S. stocks closed higher on Monday and the Dow and S&P 500

posted record highs, although the gains were just marginal, as

investors largely made cautious moves ahead of some crucial

economic data and Fed speeches.

Reports on durable goods orders, new home sales and consumer

confidence are likely to attract attention this week along with a

report on personal income and spending that includes the Fed’s

preferred inflation gauge.

The Dow ended up by 61.29 points or 0.2 percent at 42,124.65.

The S&P 500 closed up 16.02 points or 0.3 percent at 5,718.57,

while the Nasdaq settled with a gain of 25.95 points or 0.1 percent

at 17,974.27.

The undertone was positive amid optimism about the outlook for

the economy following the Federal Reserve’s interest rate cut last

week.

The Fed is expected to continue lowering rates in the coming

months amid signs of slowing inflation even as the economy remains

relatively strong.

“Markets on Wall Street are still fired up after the Fed’s

outsized interest rate cut last week and the anticipation that

further cuts are on the way sooner rather than later,” said Danni

Hewson, head of financial analysis at AJ Bell.

She added, “Looking at today’s market movements investors seem

to feel the Fed’s got its playbook in order and that any cuts are

being timed to keep the economy firing and to avoid a damaging

slowdown.”

The markets also benefited from a notable advance by shares of

Intel (NASDAQ:INTC), with the semiconductor giant jumping by about

3 percent. The rally by Intel came after a report from Bloomberg

said Apollo Global Management (NYSE:APO) has offered to make a

multibillion-dollar investment in the company.

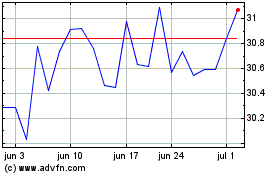

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024