Bitcoin faces selling pressure with resistance at $63,000

Bitcoin (COIN:BTCUSD), after reaching $64,448 on October 7,

briefly dipped below $62,000, currently trading at $62,200, nearly

unchanged over the last 24 hours. Selling pressure observed on

Coinbase, along with China’s underwhelming economic stimulus,

suggested a bearish outlook. The National Development and Reform

Commission (NDRC) briefing lacked clear details, frustrating

investors, impacting the digital asset market. Despite significant

inflows into ETFs on Monday, Bitcoin struggles to stay above its

50- and 100-day moving averages, facing resistance around

$63,000.

Bitcoin ETFs attract new investments, while Ethereum ETFs remain

neutral

On October 7, 2024, Bitcoin ETFs began the week with strong

optimism, receiving $235.19 million in new investments. Fidelity’s

Wise Origin Bitcoin Fund (AMEX:FBTC) led with $103.68 million,

followed by BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) with

$97.88 million. Other funds, like Bitwise’s (AMEX:BITB) and ARK

21Shares (AMEX:ARKB), also recorded inflows, strengthening

confidence in the market. Meanwhile, Ethereum ETFs remained

completely neutral, with all nine ether ETFs registering zero

flows. The last occurrence was on August 30.

Bitcoin miners face revenue decline despite rising hash rate

In September, publicly traded Bitcoin miners experienced their

third consecutive month of daily revenue decline, impacted by

increasing network difficulty. The network’s hash rate grew by 2%

compared to August, but earnings per EH/s dropped 6%, averaging

$42,100. Despite Bitcoin gaining 7% in value, miners like Marathon

Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT) excelled in

production, while companies like Cipher Mining (NASDAQ:CIFRW) sold

much of their BTC.

BitcoinOS and B² Network collaborate to integrate ZK-based

trustless bridge

BitcoinOS (COIN:BOSUSD) is partnering with B² Network to launch

the Grail bridge by the end of 2024. This integration will enable

secure BTC asset movement between networks using zero-knowledge

(ZK) proofs. It will also strengthen Bitcoin’s Layer 2

infrastructure, allowing faster and more secure transactions, while

supporting applications like DeFi and NFTs. The partnership

enhances DeFi security and scalability on Bitcoin, with B² Network

benefiting from EVM compatibility and high speed.

Scroll to launch SCR token for decentralization and governance

Scroll, a Layer 2 scalability solution for Ethereum’s blockchain

ecosystem, announced the launch of its SCR token. The token will be

used for governance and decentralization of its Layer 2 network.

The launch is set for October 22, with 7% of the tokens distributed

via airdrop. SCR will also support the decentralization of prover

and sequencer components. The team plans to distribute 15% of

tokens via airdrops, while 5.5% will be allocated to Binance

Launchpool.

Vulnerability in NEAR protocol could have frozen the entire network

The NEAR Protocol (COIN:NEARUSD) had a severe vulnerability that

allowed an attacker to freeze all network nodes, potentially

shutting it down. Discovered by Zellic and fixed in January, the

flaw involved SECP256K1 signature verification, causing node

crashes. While no attack occurred, the issue was described as a

“Web3 Ping of Death.” The NEAR team rewarded Zellic with $150,000

for the discovery and quietly applied the patch.

Crypto.com sues SEC to defend cryptocurrency industry in the US

Crypto.com filed a lawsuit against the US Securities and

Exchange Commission (SEC) on October 8. CEO Kris Marszalek stated

the lawsuit aims to combat the SEC’s “regulation by enforcement,”

which he argues harms millions of crypto holders. The exchange also

requested the SEC and CFTC to categorize crypto derivative

products. The lawsuit follows Crypto.com receiving a Wells notice

from the SEC.

Reconciliation failure exposes inadequate control at FalconX and

Binance

Crypto brokerage FalconX held 1.35 million Solana tokens (COIN),

valued at $190 million, without control for years. Binance, a

liquidity partner, recently claimed ownership of the tokens.

According to CoinDesk, both companies confirmed a “reconciliation

anomaly” and returned the assets to Binance. The incident

highlights fragile controls in the crypto sector, where major audit

firms like PwC point to an immature control environment in digital

finance.

Alchemy Pay integrates cryptocurrency payments into Samsung Pay

Alchemy Pay, a leading crypto payments provider, integrated its

virtual cards into Samsung Pay, allowing 500,000 users to make

crypto payments. This feature follows Alchemy Pay’s recent

integration with Google Pay and extends its services to retailers

like Amazon, Netflix, and Apple Store. The company anticipates

significant demand from this partnership, enhancing its presence in

digital payments and expanding support for Visa, Mastercard, and

other networks.

HBO documentary fuels speculation about Nick Szabo being Satoshi

Nakamoto

HBO’s documentary The Bitcoin Mystery has reignited

theories about the true identity of Satoshi Nakamoto, pointing to

cryptographer Nick Szabo as a possible candidate. Szabo, known for

creating the Bit Gold concept, a precursor to Bitcoin, and for his

contributions to blockchain technology, has often been linked to

Nakamoto due to similarities in their work. Szabo denies being

Satoshi, while his expertise continues to fuel speculation in the

crypto market. Although Satoshi’s identity remains unknown, their

anonymity is seen as essential to Bitcoin’s decentralized ethos.

With a fortune estimated at 1 million bitcoins, revealing Satoshi’s

identity could impact the market, but many believe preserving their

anonymity is crucial for Bitcoin’s integrity.

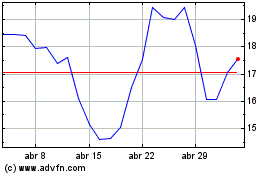

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024