MARA Holdings, Inc. (NASDAQ: MARA) (“MARA” or the “Company”), a

global leader in leveraging digital asset compute to support the

energy transformation, today announced the closing on December 4,

2024 of its offering of 0.00% convertible senior notes due 2031

(the “notes”). The aggregate principal amount of the notes sold in

the offering was $850 million. MARA also granted the initial

purchasers an option to purchase an additional $150 million

aggregate principal amount of the notes within a 13-day period

beginning on, and including, the date on which the notes were first

issued. The notes were sold in a private offering to persons

reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”).

The net proceeds from the sale of the notes were

approximately $835.1 million, after deducting the initial

purchasers’ discounts and commissions but before estimated offering

expenses payable by MARA. MARA expects to use approximately $48

million of the net proceeds from the sale of the notes to

repurchase approximately $51 million in aggregate principal amount

of its existing convertible notes due 2026 (the “existing 2026

convertible notes”) in privately negotiated transactions with the

remainder of the net proceeds to be used to acquire additional

bitcoin and for general corporate purposes, which may include

working capital, strategic acquisitions, expansion of existing

assets, and repayment of additional debt and other outstanding

obligations.

The notes are unsecured, senior obligations of

MARA. The notes will not bear regular interest and the principal

amount of the notes will not accrete. MARA may pay special

interest, if any, at its election as the sole remedy for failure to

comply with its reporting obligations and under certain other

circumstances, each pursuant to the indenture. Special interest, if

any, on the notes will be payable semi-annually in arrears on June

1 and December 1 of each year, beginning on June 1, 2025 (if and to

the extent that special interest is then payable on the notes). The

notes will mature on June 1, 2031, unless earlier repurchased,

redeemed or converted in accordance with their terms. Subject to

certain conditions, on or after June 5, 2029, MARA may redeem for

cash all or any portion of the notes at a redemption price equal to

100% of the principal amount of the notes to be redeemed, plus

accrued and unpaid special interest, if any, to, but excluding, the

redemption date, if the last reported sale price of MARA’s common

stock has been at least 130% of the conversion price then in effect

for a specified period of time ending on, and including, the

trading day immediately before the date MARA provides the notice of

redemption. If MARA redeems fewer than all the outstanding notes,

at least $75 million aggregate principal amount of notes must be

outstanding and not subject to redemption as of the relevant

redemption notice date.

Holders of notes may require MARA to repurchase

for cash all or any portion of their notes on June 4, 2027 and on

June 4, 2029 or upon the occurrence of certain events that

constitute a fundamental change under the indenture governing the

notes at a repurchase price equal to 100% of the principal amount

of the notes to be repurchased, plus accrued and unpaid special

interest, if any, to, but excluding, the date of repurchase. In

connection with certain corporate events or if MARA calls any note

for redemption, it will, under certain circumstances, be required

to increase the conversion rate for holders who elect to convert

their notes in connection with such corporate event or notice of

redemption.

The notes are convertible into cash, shares of

MARA’s common stock, or a combination of cash and shares of MARA’s

common stock, at MARA’s election. Prior to March 1, 2031, the notes

are convertible only upon the occurrence of certain events and

during certain periods, and thereafter, at any time until the close

of business on the second scheduled trading day immediately

preceding the maturity date.

The conversion rate for the notes is initially

28.9159 shares of MARA’s common stock per $1,000 principal amount

of notes, which is equivalent to an initial conversion price of

approximately $34.5830 per share. The initial conversion price of

the notes represents a premium of approximately 40.0% over the U.S.

composite volume weighted average price of MARA’s common stock from

2:00 p.m. through 4:00 p.m. Eastern Daylight Time on Monday,

December 2, 2024, which was $24.7022. The conversion rate is

subject to adjustment upon the occurrence of certain events.

In connection with any repurchase of the

existing 2026 convertible notes, MARA expects that holders of the

existing 2026 convertible notes who agree to have their notes

repurchased and who have hedged their equity price risk with

respect to such notes (the “hedged holders”) will unwind all or

part of their hedge positions by buying MARA’s common stock and/or

entering into or unwinding various derivative transactions with

respect to MARA’s common stock. The amount of MARA’s common stock

to be purchased by the hedged holders or in connection with such

derivative transactions may be substantial in relation to the

historic average daily trading volume of MARA’s common stock. This

activity by the hedged holders could increase (or reduce the size

of any decrease in) the market price of MARA’s common stock,

including concurrently with the pricing of the notes, resulting in

a higher effective conversion price of the notes. MARA cannot

predict the magnitude of such market activity or the overall effect

it will have on the price of the notes or MARA’s common stock.

The notes were sold to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act. The offer and sale of the notes and the

shares of MARA’s common stock issuable upon conversion of the

notes, if any, have not been and will not be registered under the

Securities Act or the securities laws of any other jurisdiction,

and the notes and any such shares may not be offered or sold in the

United States absent registration or an applicable exemption from

such registration requirements. The offering of the notes was made

only by means of a private offering memorandum.

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy, the notes, nor shall

there be any sale of the notes in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful under the

securities laws of any such state or jurisdiction. Nothing in this

press release shall be deemed an offer to purchase MARA’s existing

2026 convertible notes.

About MARA

MARA (NASDAQ:MARA) is a global leader in digital

asset compute that develops and deploys innovative technologies to

build a more sustainable and inclusive future. MARA secures the

world’s preeminent blockchain ledger and supports the energy

transformation by converting clean, stranded, or otherwise

underutilized energy into economic value.

Forward-Looking Statements

Statements in this press release about future

expectations, plans, and prospects, as well as any other statements

regarding matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to MARA’s use of the

net proceeds of the offering. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various important factors, including the

factors discussed in the “Risk Factors” section of MARA’s Annual

Report on Form 10-K filed with the U.S. Securities and Exchange

Commission (the “SEC”) on February 28, 2024, as amended on May 24,

2024, the “Risk Factors” section of MARA’s Quarterly Report on Form

10-Q filed with the SEC on August 1, 2024, the “Risk Factors”

section of MARA’s Quarterly Report on Form 10-Q filed with the SEC

on November 12, 2024 and the risks described in other filings that

MARA may make from time to time with the SEC. Any forward-looking

statements contained in this press release speak only as of the

date hereof, and MARA specifically disclaims any obligation to

update any forward-looking statement, whether as a result of new

information, future events, or otherwise, except to the extent

required by applicable law.

MARA Company Contact:Telephone: 800-804-1690Email:

ir@mara.com

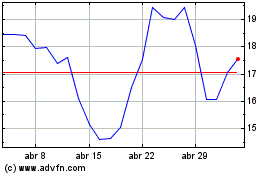

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024