BP Plc (NYSE:BP) – BP expects a net debt

increase in Q3 due to lower refining margins and changes in asset

sale timing. The company faces reduced earnings of up to $600

million, signaling a weaker outlook for the oil industry amid

concerns about China’s demand. Shares fell 1.0% pre-market.

Tesla (NASDAQ:TSLA) – Elon Musk revealed a

robotaxi with gull-wing doors, no steering wheel or pedals, and an

autonomous robovan for up to 20 passengers. He stated production of

the “Cybercab” would begin in 2026 at a cost of under $30,000. Musk

bets on AI and cameras, predicting operating costs of 20 cents per

mile over time, with inductive charging eliminating plugs. Tesla

likely failed to impress investors, with shares falling 5.6%

pre-market. Additionally, Tesla announced it would offer permanent

jobs to 500 temporary workers at its German gigafactory starting

November 1. The factory, employing around 12,000 people, had faced

previous staff cuts.

Stellantis (NYSE:STLA) – Stellantis confirmed

CEO Carlos Tavares will retire in 2026 as the company faces

declining profits and U.S. sales. The automaker, having appointed

new executives to tackle these challenges, views reorganization as

essential for improving production and competing with Chinese EV

manufacturers, focusing on boosting EV sales by 2030. Shares fell

3.3% pre-market.

Berkshire Hathaway (NYSE:BRK.A), Bank

of America (NYSE:BAC) – Berkshire Hathaway sold 9.5

million shares of Bank of America this week, reducing its stake to

below 10%. The sale generated $382.4 million. Investors now await

upcoming quarterly reports to see if more shares were sold by the

investment giant. Bank of America shares fell 0.2% pre-market.

General Motors (NYSE:GM) – General Motors

announced that its GM Energy unit will offer solar energy storage

options for EV owners, launching the GM Energy PowerBank with

capacities of 10.6 and 17.7 kWh. The product can supply power

during outages and help reduce costs during peak hours. Shares fell

0.7% pre-market.

Toronto-Dominion Bank (NYSE:TD) – TD Bank

admitted to violating the U.S. Bank Secrecy Act, agreeing to a fine

of over $3 billion. Investigators found the bank facilitated

illicit transactions linked to drug trafficking and failed to

monitor suspicious transactions. An asset cap was imposed,

impacting its U.S. expansion, and the CEO was replaced. TD Bank

stated it would focus on restructuring its balance sheet in 2025,

planning to sell up to $50 billion in securities and reduce U.S.

assets by 10%, impacting short-term revenue. Shares rose 0.1%

pre-market.

Bain Capital (NYSE:BCSF) – Bain Capital was

forced to nearly halve the valuation of Japanese Kioxia for its

IPO, leading to the cancellation of the planned October listing.

Investors wanted a market value of 800 billion yen, while Bain

sought 1.5 trillion yen, reflecting concerns about the memory chip

market.

Citigroup (NYSE:C) – Citigroup formed a new

executive team for its corporate and investment bank, seeking to

expand its market share. The move follows the hiring of Viswas

Raghavan and includes John Chirico and Jason Rekate as

co-heads.

Mastercard (NYSE:MA) – Mastercard and Citigroup

are collaborating to offer 24/7 international payments with debit

cards, allowing consumers and businesses to conduct borderless

transactions. The service, called Mastercard Move, will facilitate

payments like insurance and reimbursements, available in 65

countries.

Shell (NYSE:SHEL) – Shell lost its bid to

access non-public documents related to Venture Global LNG’s

Calcasieu Pass facility amid a dispute over undelivered gas

cargoes. The FERC allowed access to documents from January 1, 2022,

but denied Shell’s request for earlier files. Shares fell 0.4%

pre-market.

Duke Energy (NYSE:DUK) – Duke Energy faced

major challenges restoring power with two severe storms affecting

the U.S. Southeast. The company was nearly finished recovering from

2 million outages caused by Hurricane Helene when Hurricane Milton

hit Florida, prompting new efforts. Infrastructure damage may

result in higher rates for consumers.

First Solar (NASDAQ:FSLR) – First Solar and the

solar sector shares dropped on Thursday amid concerns over project

delays. Jefferies analysts warned that these delays, caused by long

interconnection queues and supply chain issues, could impact the

company’s finances, leading to a target price cut. First Solar

shares rose 0.6% pre-market after closing down 9.3% on

Thursday.

Boeing (NYSE:BA) – Boeing filed an unfair labor

practice charge against the union representing its striking workers

on the U.S. West Coast, claiming the union did not bargain in good

faith. The 33,000-member strike is in its fifth week, causing

frustration and financial pressure. Shares fell 0.1%

pre-market.

Spirit AeroSystems (NYSE:SPR) – Airbus is

facing challenges with essential part supplies from Spirit

AeroSystems, which may delay deliveries, including the A350 next

year. The company is increasing its presence at suppliers to

mitigate the impact. Fuselage and wing production issues with the

A220 are further straining the supply chain.

Aehr Test Systems (NASDAQ:AEHR) – Aehr Test

Systems reported quarterly profits of $660,000 (2 cents per share),

down from $4.7 million (16 cents) a year earlier. Revenue fell 36%

to $13.1 million. Adjusted earnings were 7 cents per share. The

company maintains an annual revenue forecast of at least $70

million. Shares rose 12.5% pre-market.

Delta Air Lines (NYSE:DAL),

CrowdStrike (NASDAQ:CRWD) – Delta Air Lines warned

that Q4 revenue would be impacted by the U.S. presidential

election, as consumers cut spending and prefer to stay home.

However, the company expects it to be one of its most profitable

quarters, driven by strong holiday travel bookings and higher

pricing power. A software update disruption at CrowdStrike caused a

45-cent per share loss in its Q3 earnings. Delta shares fell 0.2%

pre-market.

United Airlines (NASDAQ:UAL) – United Airlines

stated that the Boeing workers’ strike would not affect its summer

flight schedule, including new routes. Despite the strike, the

airline plans to expand transatlantic operations and introduce

flights to new destinations, maintaining confidence in resolving

the conflict. Shares fell 0.1% pre-market.

Apple (NASDAQ:AAPL) – Malala Yousafzai, Nobel

Peace Prize winner, is expanding her Hollywood career with the

documentary “The Last of the Sea Women,” available on Apple TV+.

The visually stunning film portrays the haenyeo, Korean female

divers who collect seafood without oxygen tanks. Critics say the

film lacks depth in personal stories and the challenges the divers

face. Shares fell 0.1% pre-market.

Comcast (NASDAQ:CMCSA) – Comcast CEO Brian

Roberts stated that the company is prepared for more cord-cutting

among TV subscribers but believes it will benefit from offering

broadband internet and NBA games online.

Sony Music Group (NYSE:SONY) – Rob Stringer,

chairman of Sony Music Group, confirmed the purchase of Pink

Floyd’s rights, calling the band’s catalog invaluable. He

highlighted the importance of music in the digital age and

expressed concerns about streaming service algorithms limiting new

music discovery. Shares rose 0.2% pre-market.

AT&T (NYSE:T) – AT&T, which lost appeal

among dividend investors after a 2022 cut, saw its shares rise 13%

over three months, driven by the completion of its exit from

entertainment. While it still faces challenges, the company offers

a 5.2% yield, attractive in a declining interest rate environment.

Shares rose 0.2% pre-market.

Advanced Micro Devices (NASDAQ:AMD) – AMD

shares closed down 4% on Thursday, its biggest decline in a month,

after launching new AI chips but providing no details on customers

or financial performance. CEO Lisa Su highlighted that the MI325X

chips would outperform Nvidia’s, with a growing market outlook.

Shares rose 0.4% pre-market.

Alphabet (NASDAQ:GOOGL) – Matt Brittin, who

oversaw Google’s operations in Europe, the Middle East, and Asia

for a decade, is stepping down. Brittin, who joined the company in

2007, will remain in the role until a successor is named. Shares

rose 0.1% pre-market.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group shares gained 17.3% on

Thursday, marking the highest close in six weeks, with a 46% gain

for the week. Trading volume was three times the average. Trump’s

election victory odds have also increased recently, according to

PredictIt. Shares rose 3.2% pre-market.

Pfizer (NYSE:PFE) – The conflict between Pfizer

and Starboard Value escalated when Starboard called for an

investigation into the pressure former Pfizer executives faced,

leading them to withdraw support for Starboard’s campaign.

Starboard, with a $1 billion stake in Pfizer, alleges the former

executives were threatened with litigation.

Sanofi (NASDAQ:SNY) – Sanofi is in talks with

private equity firm Clayton Dubilier & Rice to sell 50% of its

consumer healthcare division, Opella. The deal, valued at $16.41

billion (€15 billion), has not yet disclosed financial details,

with updates expected soon. The French pharmaceutical company aims

to focus on developing new drugs. The deal could be announced soon,

according to Bloomberg. Shares rose 0.5% pre-market.

Johnson & Johnson (NYSE:JNJ) – A Johnson

& Johnson subsidiary may proceed with a new attempt to settle

thousands of lawsuits over talc products allegedly causing cancer,

following a Texas bankruptcy judge’s decision. This is the

company’s third attempt, proposing a $9 billion settlement to

compensate victims.

Teva Pharmaceutical (NYSE:TEVA) – Teva

Pharmaceutical agreed to pay $450 million to resolve allegations of

using charities to pay kickbacks and boost sales of its drug

Copaxone, as well as conspiring to fix generic drug prices. The

company, which admitted no wrongdoing, will pay the amount over six

years, the U.S. Department of Justice announced.

Mattel (NASDAQ:MAT) – Mattel is recalling all

models of its Fisher-Price Snuga infant swings following five

deaths related to suffocation risks between 2012 and 2022. The

swing, which should not be used for sleeping, will be recalled, and

Fisher-Price will offer a partial refund of $25 to consumers.

Nike (NYSE:NKE) – Nike appointed Tom Peddie as

vice president and general manager of North America following his

return to the company. Peddie, who retired in 2020, will replace

Scott Uzzell and report to Craig Williams. His experience is seen

as crucial for recovering retail partnerships and driving

sales.

McDonald’s (NYSE:MCD) – McDonald’s CEO Chris

Kempczinski stated that low-income customers will continue to face

financial difficulties next year. The company plans to keep

offering strong value propositions, including affordable meal

options like chicken, which is cheaper than beef. Shares fell 0.4%

pre-market.

PepsiCo (NASDAQ:PEP) – PepsiCo may have to

lower prices after pandemic-era increases, as TD Cowen analysts

downgraded its stock from “Buy” to “Hold.” They noted that

PepsiCo’s product prices have risen 41% since 2020, while grocery

store prices increased 25%, raising concerns about demand.

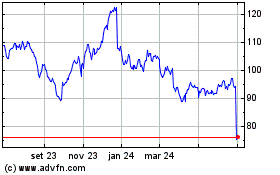

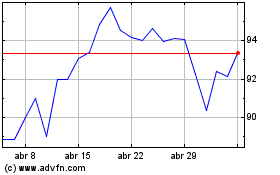

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024