With a leading U.S. economy, WFII believes stock rally will

broaden, long-term yields will rise, the commodities bull-cycle

will resume, and alternatives will shift for recovery

Wells Fargo Investment Institute (WFII) today released its “2025

Outlook: Charting the Economy’s Next Chapter.” WFII’s global

economic outlook is that the U.S. economy’s continued expansion

will lead the world economy. As well, the U.S. stock market rally

will broaden, with earnings being the primary driver of prices

across equity asset classes.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241211401607/en/

Wells Fargo Investment Institute 2025

Outlook: Charting the economy's next Chapter (Photo: Wells

Fargo)

WFII expects equity market leadership breadth to continue to

widen, including extended participation by more cyclically oriented

areas of the market, such as small-cap equities and the Financials,

Communication Services, Industrials, and Energy sectors of the

S&P 500 Index.

“We continue to believe that equity markets look attractive for

2025, with broader sector leadership and participation, thanks to

improving fundamentals and a policy tailwind,” said Darrell Cronk,

chief investment officer for Wells Fargo Wealth & Investment

Management. “The incoming administration and congressional leaders

want a fast start, with likely policy priorities including

extending tax benefits, deregulation, tariffs, and tighter border

control. We expect that these policies will support our

guidance.”

Outlook on global economy and asset groups:

- Global economy: We believe the U.S. economy will lead the

global economy, as economic recoveries in Europe, China, and

emerging markets face significant headwinds.

- Global equities: We expect returns to be driven mainly by

earnings growth, but valuations should remain supportive.

- Global fixed income: Short-term U.S. Treasury rates likely will

fall with the Federal Reserve policy rate, but longer-term rates

should rise with economic growth, tariffs, and immigration

restrictions.

- Global real assets: We believe commodities are well-positioned

to benefit from slow supply growth and a global demand rebound that

is driven by a modest international economic recovery and lower

global interest rates.

- Global alternative investments: Global alternative investments

are likely to benefit from a pickup in merger and acquisition

activity, lower cost of borrowing, and increasing confidence that

economic growth is sustainable.

Top portfolio ideas:

- Prepare for abundant liquidity to diversify investment

opportunities

- Position for a cyclical recovery but remain tilted toward U.S.

assets

- Rethink investment income

- Consider expanding opportunities in artificial

intelligence

- Keep extreme risks in perspective

Highlights of WFII’s forecast:

- The anticipated U.S. GDP (gross domestic product) growth target

for 2025 year-end is 2.5%.

- The target for U.S. consumer price inflation in 2025 is

3.3%.

- The S&P 500 Index price target range is 6,500 – 6,700 for

year-end 2025.

- The Federal funds rate forecast for 2025 is 4.00% – 4.25%, with

10- and 30-year U.S. Treasury yield forecasts of 4.50%-5.00% and

4.75%-5.25%, respectively.

The full report provides guidance for investors to help navigate

the next 12 months, long-term themes that WFII believes are

investable now, a closer look on sector and sub-sector preferences,

as well as U.S. and international political risks that could impact

investment returns. Please see the full report for detailed

information.

Join the WFII 2025 Outlook call today, December 11, at 4:15 p.m.

Eastern Time. Dial-in: 877-601-6604; Passcode: 71-306-44.

A summary of the WFII 2025 Outlook is available (PDF).

Investment and Insurance Products

are:

• Not Insured by the FDIC or Any

Federal Government Agency

• Not a Deposit or Other Obligation of,

or Guaranteed by, the Bank or Any Bank Affiliate

• Subject to Investment Risks,

Including Possible Loss of the Principal Amount Invested

Risk Disclosure Forecasts and targets are based on

certain assumptions and on our current views of market and economic

conditions, which are subject to change.

All investing involves risks, including the possible loss of

principal. There can be no assurance that any investment strategy

will be successful and meet its investment objectives. Investments

fluctuate with changes in market and economic conditions and in

different environments due to numerous factors, some of which may

be unpredictable. Asset allocation and diversification do not

guarantee investment returns or eliminate risk of loss.

Stock markets, especially foreign markets, are volatile. A

stock’s value may fluctuate in response to general economic and

market conditions, the prospects of individual companies, and

industry sectors. International investing has additional risks

including those associated with currency fluctuation, political and

economic instability, and different accounting standards. This may

result in greater share price volatility. These risks are

heightened in emerging and frontier markets. Investments in

fixed-income securities are subject to market, interest rate,

credit, liquidity, inflation, prepayment, extension, and other

risks. Bond prices fluctuate inversely to changes in interest

rates. Therefore, a general rise in interest rates can result in a

decline in the bond’s price.

The information contained herein constitutes general information

and is not directed to, designed for, or individually tailored to,

any particular investor or potential investor. This report is not

intended to be a client-specific suitability analysis or

recommendation, an offer to participate in any investment, or a

recommendation to buy, hold, or sell securities. Do not use this

report as the primary basis for investment decisions. Consider all

relevant information, including your existing portfolio, investment

objectives, risk tolerance, liquidity needs, and investment time

horizon.

About Wells Fargo Investment Institute

Wells Fargo Investment Institute, Inc. is a registered

investment adviser and wholly owned subsidiary of Wells Fargo Bank,

N.A., a bank affiliate of Wells Fargo & Company.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial

services company that has approximately $1.9 trillion in assets. We

provide a diversified set of banking, investment and mortgage

products and services, as well as consumer and commercial finance,

through our four reportable operating segments: Consumer Banking

and Lending, Commercial Banking, Corporate and Investment Banking,

and Wealth & Investment Management. Wells Fargo ranked No. 34

on Fortune’s 2024 rankings of America’s largest corporations. In

the communities we serve, the company focuses its social impact on

building a sustainable, inclusive future for all by supporting

housing affordability, small business growth, financial health, and

a low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

Additional information may be found at

https://www.wellsfargo.com/ LinkedIn:

https://www.linkedin.com/company/wellsfargo

PM-06042026-7408492.1.1

News Release Category: WF-ERS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211401607/en/

Media Sarah Kerr, 917-588-5919

sarah.kerr@wellsfargo.com

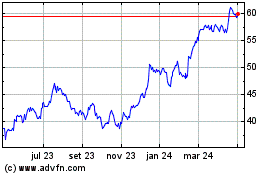

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

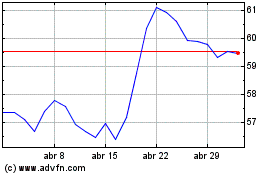

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025