Interest Rate Optimism Contributes To Strength On Wall Street

14 Outubro 2024 - 5:33PM

IH Market News

Following the strong upward move seen during last Friday’s

session, stocks saw further upside during trading on Monday. The

major averages all moved higher on the day, with the Dow and the

S&P 500 reaching new record closing highs.

The major averages reached new highs for the session late in the

day before giving back some ground going into the close. The Dow

(DOWI:DJI) rose 201.36 points or 0.5 percent to 43,065.22, the

Nasdaq jumped 159.75 points or 0.9 percent to 18,502.69 and the

S&P 500 climbed 44.82 points or 0.8 percent to 5,859.85.

The continued strength on Wall Street came amid optimism about

the outlook for interest rates following last Friday’s report on

producer price inflation.

The Labor Department report showed producer prices were

unexpectedly unchanged in September, while the annual rate price

growth slowed modestly.

While hopes the Federal Reserve will lower rates by another 50

basis points next month have largely evaporated, the data

reinforced optimism the central bank will cut rates by 25 basis

points.

CME Group’s FedWatch Tool is currently indicating an 86.1

percent chance the Fed will cut rates by a quarter point at its

November meeting.

Overall trading activity was somewhat subdued, however, with

some traders likely away from their desks due to the Columbus Day

holiday.

A lack of major U.S. economic data may also have kept some

traders on the sidelines ahead of the release of key reports on

retail sales and industrial production later in the week.

Sector News

Semiconductor stocks turned in some of the market’s best

performances on the day, with the Philadelphia Semiconductor Index

jumping by 1.8 percent.

Considerable strength was also visible among housing stocks, as

reflected by the 1.6 percent gain posted by the Philadelphia

Housing Sector Index.

Airline, utilities and banking stocks also saw significant

strength, while networking stocks showed a notable move to the

downside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Monday, with Japanese

markets closed for a holiday. China’s Shanghai Composite Index

surged by 2.1 percent, while Hong Kong’s Hang Seng Index slid by

0.8 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the German DAX Index advanced by 0.7 percent, the

U.K.’s FTSE 100 Index climbed by 0.5 percent and the French CAC 40

Index rose by 0.3 percent.

The bond markets were closed in observance of Columbus Day.

Looking Ahead

Trading on Tuesday may be impacted by reaction to earnings news

from Bank of America (NYSE:BAC), Citigroup (NYSE:C) Goldman Sachs

(GS), Johnson & Johnson (JNJ), UnitedHealth (UNH) and Walgreens

(WBA).

SOURCE: RTTNEWS

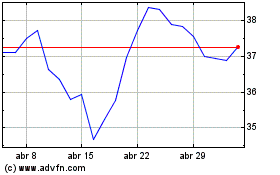

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bank of America (NYSE:BAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024