Traders May Take A Breather Following Recent Strength On Wall Street

15 Outubro 2024 - 10:07AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Tuesday, with stocks likely to show a lack of

direction after ending the previous session notably higher.

Traders may take a step back to digest recent strength in the

markets, which has lifted the Dow and the S&P 500 to new record

highs.

Shares of Goldman Sachs (NYSE:GS) are likely to see initial

strength, however, with the investment bank jumping by 2.9 percent

in pre-market trading.

The surge by Goldman Sachs comes after the company reported

third quarter results that exceeded analyst estimates on both the

top and bottom lines.

Financial giant Bank of America (NYSE:BAC) may also move to the

upside after reporting better than expected third quarter

earnings.

Meanwhile, shares of UnitedHealth (NYSE:UNH) may come under

pressure after the health insurance giant reported third quarter

results that beat expectations but lowered the top end of its

full-year earnings guidance.

Following the strong upward move seen during last Friday’s

session, stocks saw further upside during trading on Monday. The

major averages all moved higher on the day, with the Dow and the

S&P 500 reaching new record closing highs.

The major averages reached new highs for the session late in the

day before giving back some ground going into the close. The Dow

rose 201.36 points or 0.5 percent to 43,065.22, the Nasdaq jumped

159.75 points or 0.9 percent to 18,502.69 and the S&P 500

climbed 44.82 points or 0.8 percent to 5,859.85.

The continued strength on Wall Street came amid optimism about

the outlook for interest rates following last Friday’s report on

producer price inflation.

The Labor Department report showed producer prices were

unexpectedly unchanged in September, while the annual rate price

growth slowed modestly.

While hopes the Federal Reserve will lower rates by another 50

basis points next month have largely evaporated, the data

reinforced optimism the central bank will cut rates by 25 basis

points.

CME Group’s FedWatch Tool is currently indicating an 86.1

percent chance the Fed will cut rates by a quarter point at its

November meeting.

Overall trading activity was somewhat subdued, however, with

some traders likely away from their desks due to the Columbus Day

holiday.

A lack of major U.S. economic data may also have kept some

traders on the sidelines ahead of the release of key reports on

retail sales and industrial production later in the week.

Semiconductor stocks turned in some of the market’s best

performances on the day, with the Philadelphia Semiconductor Index

jumping by 1.8 percent.

Considerable strength was also visible among housing stocks, as

reflected by the 1.6 percent gain posted by the Philadelphia

Housing Sector Index.

Airline, utilities and banking stocks also saw significant

strength, while networking stocks showed a notable move to the

downside.

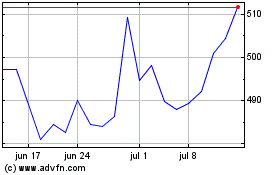

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Set 2024 até Out 2024

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Out 2023 até Out 2024