Bitcoin market consolidates gains with massive liquidations and

dominance increase

In the last 24 hours, $280.71 million in cryptocurrency

positions were liquidated, impacting 79,153 traders. Bitcoin

(COIN:BTCUSD) reached an intraday high of $68,399 and is currently

trading at $67,990. The liquidations included $151.47 million in

long positions and $129.24 million in short positions, with the

largest liquidation recorded on OKX, at $6.55 million. The

significant liquidation of short positions suggests a strengthening

bullish sentiment in the market.

Bitcoin’s market dominance rose to 58.8%, the highest since

2021, following a steady increase from a low of 38% in 2022. This

growth reflects investors’ confidence in the digital asset, as

Bitcoin stands out against altcoins, especially in a macroeconomic

uncertainty environment. Historically, increasing Bitcoin dominance

indicates market consolidation or the start of new bullish

trends.

Bitcoin speculators, particularly short-term holders (STHs),

began to take profits as BTC’s price surpassed $65,000. Glassnode

data shows that 7,127 BTC were transferred to Binance on October

14, the largest transfer volume since Bitcoin reached its all-time

highs. This movement indicates healthy profit margins after months

of price lateralization, highlighting renewed interest in the asset

amid a potential bullish resurgence.

Ethereum validators grow 30%, driven by institutional adoption

The number of Ethereum (COIN:ETHUSD) validators grew more than

30% in the past year, surpassing one million in June 2024,

according to Flipside Crypto. This increase is attributed to rising

institutional interest, spurred by advances in liquid staking and

re-staking. These mechanisms offer immediate liquidity and greater

capital efficiency. The Shanghai upgrade and approval of Ethereum

ETFs also boosted Ether staking growth, reflecting growing

institutional adoption and participation in the Ethereum

network.

Trump-backed WLFI token fails to meet initial fundraising goals

The launch of the Trump-endorsed World Liberty Financial (WLFI)

token had a disappointing start. In just over 24 hours, the project

raised only $11.8 million, 4% of its tokens, well below the $300

million target. Technical issues on the website and the exclusion

of retail investors due to Regulation D restrictions, along with

the token’s nature, which doesn’t allow future speculation, may

have hurt investor interest. Additionally, the promised crypto bank

has yet to exist, limiting the token’s immediate utility.

Bitcoin ETFs attract $371 million on October 15, while Ethereum

faces outflows

On October 15, Bitcoin ETFs attracted $371.02 million in net

inflows, with BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT)

leading with $288.84 million. Fidelity’s Wise Origin Bitcoin Fund

(AMEX:FBTC) followed with $35.03 million, while ARK 21Shares

Bitcoin ETF (AMEX:ARKB) raised $14.68 million. In contrast,

Ethereum ETFs faced $12.7 million in net outflows, with Grayscale

Ethereum Trust (AMEX:ETHE) recording a significant loss of $15.29

million on the day.

STKD launches Bitcoin and gold ETF ahead of US elections

Fund issuer Stacked (STKD) launched the Bitcoin & Gold ETF

(BTGD), offering leveraged exposure to Bitcoin and gold. The fund

allows investors to hedge their portfolios against inflation and

currency depreciation by combining these two scarce assets. Each

dollar invested is split equally between Bitcoin and gold through

ETFs and futures. The launch comes amid growing demand for

“devaluation trades” due to geopolitical tensions and economic

uncertainties.

US Bitcoin miners reach 28.9% of global hashrate

JPMorgan (NYSE:JPM) revealed that 14 US-listed Bitcoin miners

now represent 28.9% of the global hashrate, an increase of nearly

8% since this year’s halving. The combined hashrate of these

companies grew by 70% in 2024, while the network’s hashrate rose by

33%. This efficiency reflects public miners’ financial advantage.

Mining profitability (hashprice) increased slightly in October, by

less than 1%, with some miners achieving significant gains. The

bank highlighted that mining stocks recovered with the rise of

Bitcoin, especially Greenidge Generation (NASDAQ:GREE) (+29%),

while Stronghold (NASDAQ:SDIG) underperformed, dropping 17%.

Marathon Digital secures $200 million credit line to expand Bitcoin

operations

Marathon Digital Holdings (NASDAQ:MARA) secured a $200 million

credit line backed by its Bitcoin holdings to finance strategic and

operational initiatives. The company, which holds 26,842 BTC, aims

to monetize its Bitcoin reserves without issuing new shares.

Marathon produced 705 BTC in September, a 5% increase from August,

and seeks to expand its hash rate to 50 EH/s by the end of the

year, strengthening its position in the sector.

Solana faces possible drop after failure to break $160

After an 18% rally in 30 days, Solana’s (COIN:SOLUSD) price

faces the risk of falling below the $150 support. If this occurs,

the asset could end October with significant losses. Analysis

suggests that if support fails, SOL could drop by as much as 10%,

reaching $136.07, with indicators such as the Chaikin Money Flow

showing increasing selling pressure. The $160 resistance remains a

major hurdle.

SingularityDAO, Cogito Finance, and SelfKey merge to create

Singularity Finance

SingularityDAO (COIN:SDAOUSD) announced a token merger with

Cogito Finance (COIN:CGVUST) and SelfKey (COIN:KEYUSD), forming

Singularity Finance (SFI), an Ethereum-based Layer-2 solution to

tokenize real-world AI economy assets. The merger will drive

innovation in AI and DeFi infrastructure. SingularityDAO’s SDAO

token surged with the announcement but later reversed into losses.

The new partnership aims to integrate tokenized assets into DeFi

infrastructure, creating new opportunities in the AI and blockchain

market.

Axelar connects TON to 68 blockchains with Mobius Development Stack

The Open Network Foundation selected Axelar’s (COIN:AXLUSD)

Mobius Development Stack (MDS) to integrate The Open Network

(COIN:TONCOINUSD) ecosystem with 68 blockchain networks. This

integration will improve scalability and usability of decentralized

applications on TON and strengthen Web3 platform connectivity.

Axelar’s Interchain Amplifier technology enables secure transfers

of assets and data between TON and blockchains such as Ethereum and

Polkadot, simplifying decentralized application creation without

the need for bridges.

Cosmos to remove Liquid Staking Module due to North Korean

developer involvement

Cosmos (COIN:ATOMUSD) developers are removing the Liquid Staking

Module (LSM) from the Cosmos Hub after discovering that North

Korean agents participated in its development. All in Bits (AiB)

issued an emergency alert about security vulnerabilities in the

LSM, which impact the entire staking system. A full audit will be

conducted to investigate developer involvement and potential

risks.

Traders adjust crypto positions ahead of US election

With less than three weeks until the US presidential election,

traders are adjusting their cryptocurrency positions, driven by

Chinese stimulus and rate cuts. The second half of October

historically brings higher bitcoin returns, according to Coinglass.

Electoral uncertainty may cause price variations of up to 10% for

bitcoin and larger movements in Cardano (COIN:ADAUSD) and Dogecoin

(COIN:DOGEUSD). The options market also shows optimism, with

significant bets on price targets of $70,000 to $100,000 by

December.

Although cryptocurrencies are not the central focus in the

elections, interest in digital assets is growing in swing states

like Pennsylvania, Wisconsin, and Michigan. According to the “State

of Crypto 2024” report by a16z, these regions have seen significant

increases in cryptocurrency searches. With over 40 million

Americans owning cryptocurrencies, crypto-friendly candidates may

win a significant number of voters in these key states.

Tether reaches 330 million wallets with USDT by Q3 2024

Tether, issuer of (COIN:USDTUSD), announced that 330 million

wallets and on-chain accounts received the stablecoin by the end of

Q3 2024. The number of users grew by 9% quarterly, with 36.25

million new users in the last period. CEO Paolo Ardoino highlighted

USDT’s role as the “digital dollar” in emerging markets.

Additionally, networks like TON and Ethereum Layer 2 boosted

growth, with net supply on TON reaching $738 million.

Thailand’s SCB launches cross-border payments with stablecoins

The Siam Commercial Bank (SCB), Thailand’s oldest commercial

bank, announced its partnership with fintech Lightnet to offer

cross-border payments with stablecoins. This service will allow

24/7 transactions with reduced transaction costs, making it

attractive for remittance recipients. The project also promotes

financial inclusion by reducing the capital requirement per

transaction. Tested in the Bank of Thailand’s regulatory sandbox,

the service aims to benefit retail, corporate, and institutional

customers with greater financial efficiency.

Italy increases crypto gains tax to 42%

Italy’s Deputy Finance Minister Maurizio Leo announced that the

government will increase the capital gains tax on cryptocurrencies

like bitcoin from 26% to 42%. According to Leo, this measure

reflects bitcoin’s growing use in the country. The change is part

of Italy’s plans to increase revenue for the 2025 budget.

Bitget expands leadership with strategic hires in Latin America and

Iberia

Bitget strengthened its team with the hiring of Alejandro Blanco

as Head of Business Development and Gildardo Herrera as Head of

Strategy and Operations for Latin America and Iberia. Blanco and

Herrera, both with experience at Binance, will lead Bitget’s

regional expansion, reflecting the company’s commitment to

strengthening its position in key markets and driving growth in the

region.

Metaplanet adjusts Bitcoin put options to $66,000

Metaplanet closed its Bitcoin put options at $62,000, adjusting

to $66,000. This strategy, called a “roll-up,” aims to increase

nominal yield on options, generating an additional premium of 57.9

million yen. The company recently acquired 106,976 more BTC,

bringing its holdings to 855,478 BTC. Metaplanet seeks

profitability by increasing its Bitcoin reserves.

Web3 gaming boom drives global crypto adoption

Reports indicate growing cryptocurrency adoption by people

unknowingly using the technology, especially through games like

Hamster Kombat. These Web3 play-to-earn games are providing

economic freedom in regions like Iran, where inflation and

sanctions limit opportunities. Children and adults are engaging en

masse, attracted by the rewards, without realizing that their

interactions are based on cryptocurrency, accelerating the global

use of these technologies.

Prosecutors seek five-year sentence for Bitfinex hacker

Ilya “Dutch” Lichtenstein, who admitted to being responsible for

the 2016 hack of the Bitfinex cryptocurrency exchange, may face

five years in prison. Along with his wife, Heather Morgan, he was

accused of laundering 120,000 stolen bitcoins, now worth around

$7.5 billion. Prosecutors argue that Lichtenstein used

sophisticated money-laundering methods and are seeking a “strong

sentence” to deter future cybercrimes. He will be sentenced on

November 14, and Morgan the following day.

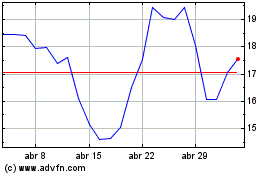

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024