TSMC Earnings, Upbeat Economic Data May Lead To Early Strength On Wall Street

17 Outubro 2024 - 10:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Thursday, with stocks likely to extend the upward move seen

over the course of the previous session.

Tech stocks may help lead an early advance on Wall Street, as

reflected by the 0.9 percent jump by the Nasdaq 100 futures.

The upward momentum for tech stocks comes after Taiwan

Semiconductor Manufacturing Company (NYSE:TSM) reported a sharp

increase in third quarter profits.

The strong results from TSMC are likely to offset concerns about

the outlook for semiconductor demand following a warning from Dutch

chipmaker ASML (NASDAQ:ASML) earlier in the week.

“The fate of the global stock market hinged on TSMC’s results

and fortunately everything is fine in AI land,” says Dan

Coatsworth, investment analyst at AJ Bell.

Stocks may also benefit from the release of a batch of upbeat

U.S. economic data, including a Commerce Department report showing

retail sales increased by slightly more than expected in the month

of September.

The Commerce Department said retail sales rose by 0.4 percent in

September after edging up by 0.1 percent in August. Economists had

expected retail sales to rise by 0.3 percent.

Excluding sales by motor vehicle and parts dealers, retail sales

climbed by 0.5 percent in September after rising by 0.2 percent in

August. Ex-auto sales were expected to inch up by 0.1 percent.

A separate report released by the Labor Department showed an

unexpected pullback by first-time claims for U.S. unemployment

benefits in the week ended October 12th.

Stocks showed a lack of direction early in the session on

Wednesday but moved mostly higher over the course of the trading

day. With the upward move, the Dow more than offset the loss posted

during Tuesday’s session, reaching a new record closing high.

The major averages bounced back and forth across the unchanged

line in early trading but climbed more firmly into positive

territory as the day progressed.

The Dow jumped 337.28 points or 0.8 percent to 43,077.70, the

Nasdaq rose 51.49 points or 0.3 percent to 18,367.08 and the

S&P 500 climbed 27.21 points or 0.5 percent to 5,842.47.

The advance by the Dow was partly due to a strong gain by Cisco

Systems (NASDAQ:CSCO), with the networking giant surging by 4.3

percent after Citi upgraded its rating on the company’s stock to

Buy from Neutral.

The blue chip index also benefited from a rebound by health

insurance giant UnitedHealth (NYSE:UNH), which jumped by 2.7

percent after plunging by 8.1 percent on Tuesday.

The choppy trading seen early in the day came amid some

uncertainty about the near-term outlook for the markets on the

heels of Tuesday’s pullback.

The downturn on Tuesday, which was led by tech stocks after

Dutch chipmaker ASML (NASDAQ:ASML) warned of “customer

cautiousness,” came after the Dow and the S&P 500 reached

record closing highs on Monday.

Buying interest emerged over the course of the session, however,

as traders remain optimistic about the strength of the U.S. economy

ahead of the release of several key reports on Thursday.

The Labor Department released a report Wednesday morning showing

a continued decrease by prices for U.S. imports in the month of

September.

The report said import prices fell by 0.4 percent in September

after slipping by a revised 0.2 percent in August. The decline

matched economist estimates.

Compared to the same month a year ago, import prices edged down

by 0.1 percent, marking the first year-over-year decrease since

February.

“Import prices do not feed through directly to producer and

consumer prices but are a signal inflationary pressures remain

muted and adds some support to another rate cut in November,” said

Matthew Martin, Senior U.S. Economist at Oxford Economics.

The Labor Department also said export prices slid by 0.7 percent

in September after slumping by a revised 0.9 percent in August.

Economists had expected export prices to fall by 0.4 percent.

Export prices in September were down by 2.1 percent compared to

the same month a year ago, reflecting the largest year-over-year

decrease since January.

Airline stocks saw substantial strength on the day, driving the

NYSE Arca Airline Index up by 4.8 percent to its best closing level

in almost five months.

United Airlines (NASDAQ:UAL) helped lead the sector higher,

soaring by 12.4 percent after reporting better than expected third

quarter results and announcing a $1.5 billion share buyback.

Significant strength was also visible among banking stocks, with

the KBW Bank Index climbing by 1.7 percent to a two-year closing

high.

Utilities, housing and oil service stocks also saw considerable

strength on the day, moving higher along with most of the other

major sectors.

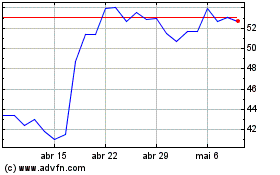

United Airlines (NASDAQ:UAL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

United Airlines (NASDAQ:UAL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024