Bitcoin ETFs record $458 million in inflows on October 16

On October 16, 2024, Bitcoin ETFs recorded $458.54 million in

net inflows. BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) led

with $393.4 million. Other ETFs, including Wise Origin Bitcoin Fund

(AMEX:FBTC), Bitwise Bitcoin ETF (AMEX:BITB), Franklin Templeton

Digital Holdings Trust (AMEX:EZBC), and ARK 21Shares Bitcoin ETF

(AMEX:ARKB), each reported over $10 million. Ethereum ETFs totaled

$24.22 million, with iShares Ethereum Trust (NASDAQ:ETHA) capturing

$11.89 million.

Swarm Markets launches tokenized physical gold on Bitcoin

blockchain

For the first time, physical gold can be minted and traded on

the Bitcoin blockchain through the Ordinals protocol. Swarm

Markets, a licensed real-world asset platform in Germany, has

partnered with OrdinalsBot to enable investment in gold bars

inscribed on individual satoshis. This gold will be the first

real-world asset available on Trio, a marketplace launching later

this year. The service combines physical and digital gold, offering

a secure blockchain investment method.

Kraken launches tokenized Bitcoin version kBTC

On October 17, Kraken launched Kraken Wrapped Bitcoin (kBTC), an

ERC-20 token backed 1:1 by Bitcoin stored by the company. kBTC is

interoperable with networks like Ethereum and OP Mainnet, allowing

its use in DApps. Kraken claims that kBTC brings Bitcoin’s power to

new networks and has been audited by Trail of Bits for security.

Onchain kBTC reserves can be verified by users, reinforcing

transparency at the exchange.

Robinhood announces Bitcoin, Ether futures support and new desktop

app

At the HOOD Summit, Robinhood (NASDAQ:HOOD) confirmed plans to

offer Bitcoin and Ether futures trading, expanding its derivatives

product portfolio. The company plans to launch these futures in the

coming months, with support for CME contracts, including Micro

Bitcoin and Ether Futures. Additionally, Robinhood announced the

launch of “Robinhood Legend,” a customizable new desktop app

designed for advanced traders.

Bitcoin falls below $67,000 amid economic uncertainties

Bitcoin’s price (COIN:BTCUSD) dropped to $66,770, a 1.2% decline

over the past 24 hours, amid concerns over U.S. job data. Initial

jobless claims fell short of expectations, while continuing claims

exceeded forecasts, reducing confidence in Federal Reserve rate

cuts and negatively impacting the cryptocurrency market. The U.S.

presidential election also brought added uncertainty.

Bitcoin reached a local high of $68,500 and has been gradually

declining. The spot CVD, which tracks buying pressure, points to a

decrease, indicating that retail investors are selling at higher

price ranges. Bitcoin reserves on exchanges fell to a historic low

of 2.7 million BTC, down from 3.3 million three years ago,

suggesting a long-term holding strategy by investors, potentially

creating scarcity and driving prices higher in the future. The drop

in reserves also reflects increased institutional investor

participation, signaling an accumulation phase in the current

market cycle.

However, the futures market is highly leveraged, increasing the

risk of large-scale liquidations. Bearish divergences in RSI and

MACD indicators suggest a possible 25% correction, with support

between $52,000 and $50,000, indicating short-term selling

pressure.

XRP rises as SEC case advances

XRP’s (COIN:XRPUSD) price jumped, reaching an intraday high of

$0.5664, its highest level in two weeks. The rise was driven by

rumors that the SEC may have missed a crucial deadline in its case

against Ripple, weakening the case. The token’s price saw a slight

correction at the time of writing but maintained an outperformance

relative to the sector, trading at $0.5459.

Solana drops amid low activity and memecoin decline

Solana’s token (COIN:SOLUSD) fell 4.2% over the past 24 hours,

trading at $148.23. The decline follows lower onchain activity,

reflecting reduced volumes in DApps and transactions. Additionally,

corrections in Solana’s memecoins, such as Book of Meme and

Dogwifhat, worsened the negative sentiment. If the downtrend

continues, SOL may test support at $125, with the risk of falling

to $75. Despite this, SOL gained 8.7% for the week.

Tesla moves $750 million in Bitcoin, rules out immediate sale

Tesla (NASDAQ:TSLA), led by Elon Musk, moved over $750 million

in Bitcoin after nearly two years of no changes in its reserves.

The company, the fourth-largest corporate holder of BTC,

transferred approximately 10,000 tokens to new wallets, sparking

speculation of restructuring or internal audit. However, the lack

of transfers to exchanges eased fears of a massive sale. Analysts

suggest the move may be related to UTXO consolidation to optimize

future transactions and reduce operational costs.

Centralization in Ethereum raises concerns with two builders

dominating blocks

In the first weeks of October, Ethereum block builders

Beaverbuild and Titan Builder produced 88.7% of blocks, raising

concerns about centralization on the network. Although Ethereum

separates block proposers from builders, mitigating transaction

prioritization, experts warn that the dominance of these builders

could impact decentralization. The growing use of private order

flow (XOF) also contributes to this centralization. The Ethereum

Foundation (COIN:ETHUSD) and analysts are monitoring the potential

impacts on the network’s censorship resistance and security.

Blockaid integrates advanced security technology on Stellar

blockchain

Blockaid announced the integration of its Onchain Detection and

Response (ODR) technology on the Stellar blockchain, starting with

Lobstr and Freighter wallets. The partnership will provide

real-time threat monitoring and rapid response to fraud and

attacks, protecting millions of users. According to CEO Ido Ben

Natan, the system alerts users about malicious interactions,

preventing scams and hacks. Blockaid has already scanned billions

of transactions, preventing over $4 billion in losses in

partnerships with Coinbase and Metamask.

ARK Investment bets on AI and blockchain to revitalize global

economy

ARK Investment Management, in its Q3 report, highlights that

innovation in artificial intelligence and blockchain could be

crucial for global economic recovery. According to CEO Catherine

Wood, these technologies, along with robotics and energy storage,

will drive growth in the coming years. The firm believes that

deflation in key sectors and the use of these innovations could

boost productivity and create new products, helping companies

overcome economic crises and profit margin pressure.

Marathon Digital CEO warns of risks from excessive AI

infrastructure

Fred Thiel, CEO of Marathon Digital (NASDAQ:MARA), compared

today’s AI environment to the 2000s internet boom, highlighting

that smaller companies may face financial struggles in building

infrastructure without sufficient demand. Despite the warning,

Thiel sees opportunities in integrating AI with Bitcoin mining,

leveraging low-cost energy. MARA aims to reduce mining costs by

acquiring 100% of its capacity and using stranded gas. The company

is also investing in manufacturer Auradine, focusing on immersion

cooling technologies and future diversification.

Dtravel launches AI travel agent in partnership with Fetch.ai

The decentralized platform Dtravel announced its collaboration

with Fetch.ai Foundation on October 17 and the launch of its AI

travel agent on the Fetch.ai market (COIN:FETUSD). The tool allows

developers to integrate Dtravel’s peer-to-peer system into their

projects, offering an alternative to traditional vacation rental

platforms like Airbnb. Dtravel CEO Cynthia Huang believes AI can

transform the travel industry, reducing costs and offering more

efficient, user-centered solutions.

Hacker arrested for breaking into SEC X account and causing market

manipulation

Eric Council Jr., 25, was arrested by the FBI after hacking into

the SEC’s X account in January 2024. He used a SIM swap attack to

gain access to the account and post a fake announcement about

Bitcoin ETF approval. The tweet manipulated Bitcoin’s price,

causing a $1,000 fluctuation. Council faces charges of fraud and

aggravated identity theft, after receiving payment in Bitcoin for

his role in the scheme.

Radiant Capital hacked for $50 million in multi-chain exploitation

Radiant Capital, a blockchain lending protocol, was hacked

across several networks, losing over $50 million. Hackers

reportedly gained control of three private keys, draining user

assets. The platform has suspended operations on Binance Chain and

Arbitrum networks, urging users to revoke contracts. This is

Radiant’s second significant hack in 2024, and investigations are

underway to uncover the attack’s details and prevent further

losses.

“Elvis Side $Btc” collection merges generative art and Elvis’s

legacy in Bitcoin

The “Elvis Side $Btc” collection, consisting of 1,935 generative

images, was created by the Royalty project, specializing in

Bitcoin-focused intellectual property, in partnership with the

OrdinalsBot inscription service. Inspired by Joe Petruccio’s art,

the collection uses the Ordinals protocol to inscribe data onto

satoshis, making them unique like NFTs. Part of the sales will fund

the Elvis Legacy Council, a DAO governing Elvis’s digital legacy

through a native token.

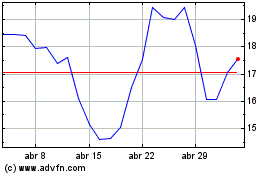

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024