U.S. Stocks Close Little Changed After Seeing Modest Strength For Most Of The Day

17 Outubro 2024 - 5:31PM

IH Market News

Stocks saw modest strength for much of the session on Thursday

before giving back ground late in the trading day to close roughly

flat. The Dow still managed to reach a new record closing high.

The Dow ended the day up 161.35 points or 0.4 percent at

43,239.05, while the Nasdaq crept up 6.53 points or less than a

tenth of a percent to 18,373.61 and the S&P 500 edged down 1.00

point or less than a tenth of a percent to 5,841.47.

Strength among semiconductor stocks supported the markets for

much of the session before a late-day pullback, although the

Philadelphia Semiconductor Index still ended the day up by 1.0

percent.

The strength in the sector came after Taiwan Semiconductor

Manufacturing Company (NYSE:TSM) reported a sharp increase in third

quarter profits.

The strong results from TSMC offset concerns about the outlook

for semiconductor demand following a warning from Dutch chipmaker

ASML (NADAQ:ASML) earlier in the week.

“The fate of the global stock market hinged on TSMC’s results

and fortunately everything is fine in AI land,” says Dan

Coatsworth, investment analyst at AJ Bell.

Positive sentiment was also generated in reaction to a batch of

largely upbeat U.S. economic data, including a Commerce Department

report showing retail sales increased by slightly more than

expected in the month of September.

The Commerce Department said retail sales rose by 0.4 percent in

September after edging up by 0.1 percent in August. Economists had

expected retail sales to rise by 0.3 percent.

Excluding sales by motor vehicle and parts dealers, retail sales

climbed by 0.5 percent in September after rising by 0.2 percent in

August. Ex-auto sales were expected to inch up by 0.1 percent.

A separate report released by the Labor Department showed an

unexpected pullback by first-time claims for U.S. unemployment

benefits in the week ended October 12th.

The report said initial jobless claims fell to 241,000, a

decrease of 19,000 from the previous week’s revised level of

260,000.

Economists had expected jobless claims to inch up to 260,000

from the 258,000 originally reported for the previous week.

With the unexpected pullback, jobless claims gave back ground

after reaching their highest level since hitting 261,000 in the

week ended June 17, 2023.

Meanwhile, the Federal Reserve released a report showing

industrial production in the U.S. fell by slightly more than

expected in the month of September.

The Fed said industrial production decreased by 0.3 percent in

September after rising by a downwardly revised 0.3 percent in

August.

Economists had expected industrial production to dip by 0.2

percent compared to the 0.8 percent increase originally reported

for the previous month.

The slightly bigger than expected decline by industrial

production partly reflected a strike at Boeing (NYSE:BA) and the

effects of Hurricanes Helene and Milton.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower during trading on Thursday. Japan’s

Nikkei 225 Index slid by 0.7 percent, while China’s Shanghai

Composite Index slumped by 1.1 percent.

Meanwhile, the major European markets have moved to the upside

after the ECB lowered interest rates. While the French CAC 40 Index

jumped by 1.2 percent, the German DAX Index advanced by 0.8 percent

and the U.K.’s FTSE 100 Index climbed by 0.7 percent.

In the bond market, treasuries gave back ground after trending

higher over the past few sessions. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, is up

by 7.7 basis points at 4.093 percent.

Looking Ahead

Reaction to the latest earnings news may impact trading on

Friday, with streaming giant Netflix (NASDAQ:NFLX) among the

companies due to report their quarterly results after the close of

today’s trading.

SOURCE: RTTNEWS

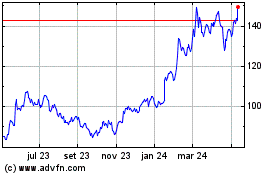

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

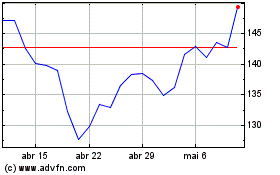

Taiwan Semiconductor Man... (NYSE:TSM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025