U.S. index futures rose in pre-market trading on Friday, with

the three major indices on track for their sixth consecutive week

of gains.

At 05:18 AM, Dow Jones futures (DOWI:DJI) gained 26 points, or

0.06%. S&P 500 futures rose by 0.20%, and Nasdaq-100 futures

advanced by 0.42%. The 10-year Treasury yield stood at 4.097%.

In the commodities market, Brent and WTI crude futures were

slightly positive but on course to close the week down about 6%,

the largest drop since September 2.

China’s refinery output fell for the third consecutive month due

to weak fuel consumption. Markets remain concerned about supply

disruptions driven by Middle East tensions following the death of

the Hamas leader and Hezbollah’s statements on a new phase of the

conflict with Israel.

Partial stabilization occurred after U.S. crude inventories fell

by 2.19 million barrels last week, strong U.S. retail sales data,

and new stimulus from China, though prices remain pressured by a

negative demand outlook.

West Texas Intermediate crude for November rose 0.31% to $70.88

per barrel, while Brent for December gained 0.23%, to $74.62 per

barrel.

Gold surpassed $2,700 an ounce for the first time, reaching a

high of $2,713.93 amid heightened Middle East tensions and U.S.

election uncertainties. Investors sought safety, driving gold up

around 2% for the week. A weaker dollar also contributed to the

rally. Gold (PM:XAUUSD) is currently trading at $2,710.23, up

0.61%.

On today’s U.S. economic calendar, September housing starts will

be released at 8:30 AM, with expectations of 1.34 million, slightly

below the prior figure of 1.36 million. Building permits are

projected at 1.44 million, down from 1.48 million the previous

month. At 12:10 PM, Federal Reserve Governor Christopher Waller is

set to speak.

In Asia-Pacific markets, China’s CSI 300 rose by 3.62%, while

Hong Kong’s Hang Seng gained 3.41% in late trading. Japan’s Nikkei

225 advanced 0.18%, while the Topix had a slight increase. In

contrast, South Korea’s Kospi dropped 0.59%, and the Kosdaq fell

1.55%. Australia’s S&P/ASX 200 declined 0.87%.

Chinese stocks surged after President Xi Jinping emphasized

technological development, boosting chip manufacturers like

Semiconductor Manufacturing, which soared 20%.

China’s diesel exports dropped to 350,000 tons in September, the

lowest level since June 2023, due to limited quotas and tight

margins, marking a 71% decline from the same month last year.

Refineries are grappling with weak domestic demand and shrinking

margins.

China’s economy grew by 4.6% in the third quarter, exceeding

Reuters’ forecast of 4.5% but slowing from 4.7% in the previous

quarter. In September, China’s retail sales rose by 3.2%, and

industrial output increased by 5.4%, both beating expectations.

However, property prices dropped 5.8%, a sharper decline than the

5.3% recorded in August, driven by falling new home prices.

Authorities continue to implement stimulus measures to reach the

5% target for 2024. China’s central bank introduced two new

financing programs, initially injecting $112.38 billion (800

billion yuan) into the stock market through new monetary policy

tools. The PBOC launched a $42.1 billion (300 billion yuan) credit

line to help listed companies and large shareholders repurchase

shares, boosting the market.

A swap facility was introduced, allowing institutional investors

to access central bank liquidity, increasing optimism in the

Chinese stock market.

Moreover, the PBOC is targeting inflated credit ratings, a

problem identified since 2020. On Friday, the People’s Bank of

China convened major credit rating firms to discuss the development

and challenges of the sector as part of efforts to improve rating

quality in the world’s second-largest corporate bond market.

IMF’s Kristalina Georgieva stated that China needs deeper

reforms, such as improving social security and investing in

underdeveloped sectors, to transform its economy into a

consumption-driven one.

Additionally, the United States will use restrictive measures,

such as tariffs, to counter China’s overproduction aimed at

dominating global markets. The White House’s Daleep Singh

highlighted China’s growing power in strategic sectors like

electric vehicles and semiconductors, and the need for Washington

to take steps to protect its industries.

In Japan, overall inflation for September was 2.5%, while the

core CPI rose by 2.4% year-on-year, slowing from August due to

temporary subsidies to curb energy prices. Inflation above the Bank

of Japan’s 2% target will be considered at the next monetary policy

meeting.

TSMC (NYSE:TSM) reported a 54% increase in

quarterly profit and raised its revenue forecast yesterday, after

Taiwan’s benchmark index (TWII) closed. The index rose by 1.9%

today, driven by TSMC shares, which climbed 4.8%, hitting a record

high.

In India, Infosys (NYSE:INFY) raised its growth

forecast for the second consecutive time, which could lift the mood

in the IT sector, which has lagged this year. The company also

added 2,400 employees after six quarters of cuts.

Wipro (NYSE:WIT) beat quarterly expectations. In

the automotive sector, Bajaj Auto warned of weaker

demand, affecting expectations for two-wheelers.

European markets rose on Friday as investors digest consecutive

interest rate cuts by the European Central Bank and await new

economic data while assessing quarterly earnings. Mining,

automotive, and tech stocks benefited from China’s economic

support. Luxury brands also performed well, with

Kering (EU:KER) rising 4.7% and

Burberry (LSE:BRBY) up 3.8%.

Investor attention is also focused on UK retail sales data for

September, eagerly awaited.

The European Central Bank (ECB) cut interest rates for the third

time this year, to 3.25%, aiming to control inflation in the

eurozone as economic growth remains weak. ECB President Christine

Lagarde stated that the disinflation process is underway, with

possible additional cuts in December if economic data does not

improve.

Traders have increased bets that the ECB may implement a

significant rate cut in December. Money markets now see a 20%

chance of a 50-basis-point cut, with 0.25-point cuts expected by

April 2024.

In Italy, the automotive industry faces a serious threat, with

Stellantis’ (BIT:STLAM) vehicle production falling

by 41% in the first nine months of 2023. This decline raises

concerns about potential job losses, leading to worker protests in

Rome. Small suppliers are also at risk due to falling demand and

Chinese competition.

Brunello Cucinelli (BIT:BC) posted a 12.7%

increase in revenue for the first nine months of the year, driven

by strong growth in the Americas and Asia. Third-quarter revenues

rose by 9.2%, beating analysts’ expectations. The luxury firm

projects a 10% sales increase through 2026.

AB Volvo (TG:VOL3) reported adjusted operating

profit of $1.34 billion (14.1 billion crowns) in the third quarter,

below expectations of 15.6 billion and down from 19.3 billion a

year earlier. Sales fell 12%, and heavy truck orders dropped by 7%,

reflecting customer caution.

Keywords Studios (LSE:KWS) acquired U.S.-based

developer Certain Affinity, known for working on

“Halo” and “Call of Duty.” The value was not disclosed, but it

includes an initial cash payment and an earn-out component. The

management team will remain in place.

Comet Holding (LSE:0ROQ) reported a 45.6%

increase in third-quarter sales but lowered its 2024 sales forecast

due to weakness in industrial sectors. Semiconductor demand,

especially for AI, drove growth despite weak consumer demand.

Coca-Cola Europacific (LSE:CCEP) plans to

change its UK stock listing category to make its shares eligible

for FTSE indices. The change, expected by November 15, follows a

recent reform of UK listing rules.

China approved the creation of separate insurance units by

BNP Paribas (EU:BNP) and Prudential

Financial (NYSE:PRU), aiming to expand the insurance

market for foreign firms. BNP partnered with Volkswagen Financial

Services, while Prudential was authorized to establish an asset

management firm in Beijing. China’s insurance sector reached $4.2

trillion in assets in 2023.

LVMH’s (EU:MC) head of wine and spirits,

Philippe Schaus, is set to leave the company soon, amid declining

demand for cognac and champagne in China. His departure comes after

LVMH reported a sales decline in the third quarter, with this

division being the hardest hit.

Boohoo Group’s (LSE:BOO) CEO, John Lyttle, is

stepping down as the UK fast-fashion company, which includes brands

like Debenhams and PrettyLittleThing, struggles and undergoes a

strategic review. Revenue dropped to £620 million in the first

half, and shares fell by 9%.

Future PLC (LSE:FUTR) announced that CEO Jon

Steinberg will step down at the end of next year for personal

reasons. During his twelve-month notice period, he will continue to

work with the company as they search for a successor.

On Thursday, the Dow Jones hit its fourth record in five days,

driven by stronger-than-expected retail sales. The Dow gained

161.35 points, or +0.4%, to 43,239.05 points. The Nasdaq added 6.53

points, or +0.04%, to 18,373.61, while the S&P 500 fell 1.00

point, closing at 5,841.47 points.

Retail sales rose by 0.4% in September, beating expectations,

and jobless claims unexpectedly dropped to 241,000, reflecting a

stronger labor market.

Foreign holdings of U.S. Treasury securities reached $8.503

trillion in August, up 11.5% from the previous year. Japan remained

the largest holder with $1.129 trillion, while China’s holdings

fell to $774.6 billion.

The New York Federal Reserve’s new tool, launched to monitor

market liquidity, suggests that the Fed’s balance sheet can

continue to shrink without immediate issues. The Reserve Demand

Elasticity indicator shows that bank reserves remain abundant, and

balance sheet reduction proceeds as planned.

Treasury Secretary Janet Yellen stated that Donald Trump’s

proposal to raise tariffs to isolate the U.S. economy would hurt

consumers and make businesses less competitive. Yellen advocates

for international economic cooperation to address challenges like

Russia’s invasion and China’s trade practices, emphasizing that

severing trade ties would be a mistake.

On the earnings front,

Comerica (NYSE:CMA), American

Express (NYSE:AXP), SLB (NYSE:SLB), Procter

& Gamble (NYSE:PG), Regions

Financial (NYSE:RF), Fifth Third

Bank (NASDAQ:FITB), Ally

Financial (NYSE:ALLY), Autoliv (NYSE:ALV), Simmons

Bank (NASDAQ:SFNC) and Acme United

Corporation (AMEX:ACU) are set to report before the

opening bell.

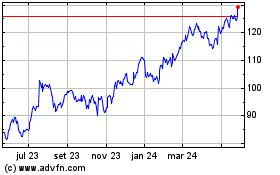

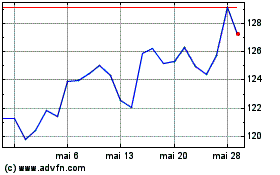

Autoliv (NYSE:ALV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Autoliv (NYSE:ALV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024