US Futures Rise; Oil Prices Edge Higher

25 Outubro 2024 - 7:07AM

IH Market News

US index futures rose in pre-market trading Friday, with

optimism around corporate earnings and lower Treasury yields.

At 5:18 AM ET, Dow Jones futures (DOWI:DJI) were up 85 points,

or 0.20%. S&P 500 futures gained 0.25%, and Nasdaq-100 futures

advanced 0.29%. The 10-year Treasury yield stood at 4.20%.

In commodities, West Texas Intermediate crude for December

increased 0.51% to $70.55 a barrel, while December Brent rose 0.44%

to $74.71.

Traders are closely watching Middle East geopolitics, including

potential Israel-Hamas talks and possible Israeli reprisals on

Iran, which could impact global supply. Tony Sycamore of IG

suggested $70 as an ideal crude price, factoring in Israel’s

responses to Iranian attacks and China’s Standing Committee

meeting.

Today’s U.S. economic agenda includes September’s durable goods

orders report at 8:30 a.m., expected to show a 1.0% decrease after

last month’s stability. At the same time, the durable goods report

excluding transportation is expected to reflect a 0.5% previous

change. At 10:00 a.m., October’s final consumer sentiment index,

projected at 69.0, will be slightly up from 68.9 last month.

In the Asia-Pacific markets, Japan’s Nikkei 225 fell 0.60%,

while the Topix declined 0.65%. Hong Kong’s Hang Seng rose 0.52% in

final trading, and China’s CSI 300 increased 0.70%. In South Korea,

the Kospi rose marginally, while the Kosdaq fell 0.98%. Australia’s

S&P/ASX 200 edged up 0.06%.

The People’s Bank of China held its medium-term lending rate

steady at 2%, signaling a cautious approach to stimulus after a

recent record cut aimed at supporting growth. Beijing is evaluating

additional measures, including a potential reserve requirement cut

to enhance market liquidity.

Chinese solar stocks rose this week, boosted by government

intervention expectations to curb polysilicon overproduction,

strengthening the sector. Xinjiang Daqo,

Trina Solar, and Xinyi Solar led

gains. Analysts suggest supply limitations may drive further solar

stock gains, with technical patterns indicating ongoing growth

potential.

Goldman Sachs (NYSE:GS) reports global hedge

funds have shifted from Chinese and emerging markets stocks to U.S.

equities in October amid U.S. election influences. China saw major

outflows following vague stimulus, while MSCI China fell 4% in

October. Hedge funds also lowered leverage for added caution.

Tokyo’s core inflation, excluding fresh foods, rose 1.8% in

October, below the BOJ’s 2% target and down from September’s 2%.

The core-core index (excluding fresh foods and fuel) increased 1.8%

versus 1.6% in September. Service prices rose 1.1% in October,

slightly below last month’s 1.2%.

A Reuters survey indicated Japan’s industrial output likely grew

1.0% in September, driven by automotive sector recovery after a

3.3% August decline due to typhoons and low U.S. demand. Retail

sales are also expected to rise 2.3%, with unemployment steady at

2.5%.

In Singapore, home prices fell 0.7% in Q3, lower than expected,

amid higher September sales. Residential rents rose for the first

time since 2023, raising affordability concerns. The government

plans to boost supply, while developers resist price cuts, buoyed

by high-demand new projects.

Singapore’s industrial output rose 9.8% in September, surpassing

Reuters’ 3.5% forecast but below August’s revised 22% increase.

European markets traded lower Friday, impacted by disappointing

earnings from Remy Cointreau (EU:RCO) and

Mercedes-Benz (TG:MBG), weighing on market

sentiment. The Stoxx Europe 600 fell under pressure from auto and

luxury sectors, highly exposed to China’s economy. However,

Sanofi (EU:SAN) saw gains driven by vaccine

demand.

On Thursday, the Nasdaq and S&P 500 rose, while the Dow

declined for the fourth straight day. Tech rebounded with

Tesla (NASDAQ:TSLA) up 21.9% after robust

earnings. IBM (NYSE:IBM) and

Honeywell (NASDAQ:HON), however, weighed on the

Dow. Real estate stocks rose with strong home sales, while airline

stocks fell, led by Southwest (NYSE:LUV).

On the quarterly earnings front, New York Community

Bancorp (NYSE:NYCB), Colgate-Palmolive (NYSE:CL), Piper

Sandler (NYSE:PIPR), Centene (NYSE:CNC), Booz

Allen

Hamilton (NYSE:BAH), Aon (NYSE:AON), Avantor (NYSE:AVTR), Saia (NASDAQ:SAIA), Newell

Brands (NASDAQ:NWL)

and WisdomTree (NYSE:WT) are expected to

report before the open.

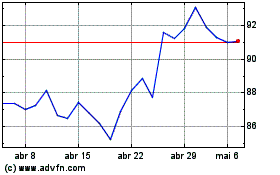

Sanofi (EU:SAN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Sanofi (EU:SAN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025