U.S. index futures rose slightly in Wednesday’s pre-market as

traders assessed Alphabet (NASDAQ:GOOGL)’s strong

quarterly results released post-close, while AMD

(NASDAQ:AMD) shares dropped significantly after a disappointing

revenue forecast. Investors await additional tech earnings reports

and economic growth data.

At 5:46 AM ET, Dow Jones futures (DOWI:DJI) remained stable at

42,446.00 points. S&P 500 futures gained 0.17%, and Nasdaq-100

futures rose 0.16%. The 10-year Treasury yield stood at 4.224%.

In commodities, December West Texas Intermediate crude rose

0.70% to $67.68 per barrel, and December Brent increased by 0.66%

to $71.59 per barrel.

Oil prices climbed, influenced by the potential Israel-Hezbollah

ceasefire and increased OPEC+ supply. A peace deal could reduce

Middle Eastern conflict risks. However, prices remain near monthly

lows after two consecutive declines.

Standard Chartered warned that oil markets underestimated Middle

Eastern risks, projecting potential price spikes if tensions

reemerge between Israel and Iran post-U.S. elections. The bank

estimates Brent at $89 and WTI at $86 in early 2025.

Global gold demand rose 5% in Q3, reaching a record over $100

billion, driven by strong Western investments, including

high-net-worth investors, offsetting weaker Asian demand.

Record-high gold prices were supported by investment flows and

central bank purchases.

Copper (CCOM:COPPER) rose, alongside other industrial metals,

amid rumors of a potential $1.4 trillion stimulus from China in

November, boosting metal markets. Investors are also awaiting the

Fed’s meeting next week, which may signal 2025 rate cuts.

Today’s U.S. economic calendar includes the ADP employment

report for October at 8:15 AM ET, forecasted to show 113,000 new

jobs, down from 143,000. The Q3 GDP report at 8:30 AM is expected

to show 3.2% growth, up from the prior 3.0%.

Simultaneously, September’s advanced trade balance in goods,

last at -$94.2 billion, will be released, along with retail and

wholesale inventory estimates, respectively at 0.5% and 0.1%.

Pending home sales data for September, projected to drop 0.2% after

a 0.6% gain, will be out at 10 AM.

Asia-Pacific markets mostly closed lower. Australia’s

S&P/ASX 200 fell 0.83%, Hong Kong’s Hang Seng lost 1.65% in

final trading, and China’s CSI 300 dropped 0.90%. In South Korea,

Kospi and Kosdaq declined 0.92% and 0.80%, while Japan’s Nikkei 225

rose 0.96%.

In Australia, consumer inflation hit a three-and-a-half-year low

in Q3, aided by electricity subsidies and lower gasoline prices.

CPI rose 0.2%, below the forecast of 0.3%, dropping to 2.8%

annually, within the central bank’s 2-3% target. Electricity prices

fell 17.3%, and gasoline 6.2%. Core inflation rose 0.8% quarterly

to 3.5% annually. With core inflation still high, the Reserve Bank

of Australia is expected to hold rates steady until 2024, with

potential cuts in April.

The Bank of Japan is expected to maintain stable rates following

its two-day meeting concluding Thursday, per Reuters, with

inflation near 2% and political uncertainties. While markets

anticipate hints of future hikes, the bank may exercise caution due

to global economic conditions and domestic politics. Analysts

foresee potential rate hikes only in 2025, contingent on wage

growth and economic stability.

President Xi Jinping reaffirmed the importance of achieving

China’s approximate 5% annual growth target, especially ahead of

the legislative meeting likely to approve additional fiscal

support. The government is considering measures including issuing

up to 10 trillion yuan in bonds to refinance local debts and fund

government purchases, aiming to stabilize the economy amid a

slowdown and real estate crisis.

The European Union set tariffs of up to 45.3% on Chinese

electric vehicles, including 7.8% for Tesla and 35.3% for SAIC, to

counter perceived unfair subsidies, according to Reuters. Beijing

criticized the measure and launched investigations into European

imports.

European markets are trading lower as investors examine

corporate results and await EU and eurozone growth data. The UK

government presents its budget to Parliament. Among sectors, food

and beverage led losses.

In France, Q3 2024 GDP grew by 0.4%, surpassing economists’ 0.3%

forecast, driven by consumer spending from the Paris Olympics

tourism boost. INSEE had adjusted its growth forecast to 0.4% in

September.

Among individual stocks, Roche (LSE:0TDF)

adjusted its clinical trial after a patient death in testing its

experimental Alzheimer’s drug, trontinemab.

Volkswagen (TG:VOW3) reported a 42% decline in

Q3 operating profit, impacted by weak auto division performance and

high restructuring costs. Its main unit’s operating margin fell to

2%, highlighting urgency to cut costs. Amid tense negotiations with

IG Metall, VW is considering wage cuts and factory closures to

balance finances.

Standard Chartered (LSE:STAN) surpassed Q3

profit expectations with $1.72 billion, well above the $1.49

billion forecast. The bank plans to double its wealth management

business and reduce retail operations to boost returns, aiming to

distribute $8 billion to shareholders between 2024 and 2026.

Aston Martin (LSE:AML) posted a Q3 adjusted

loss of £10.3 million, lower than analysts’ £92 million loss

forecast. The automaker maintained its full-year outlook, noting

proactive management of supply chain disruptions.

U.S. stock indexes showed mixed performance on Tuesday. The

Nasdaq rose 0.8%, supported by semiconductors and networks, while

the S&P 500 gained 0.2%, though the Dow fell 0.4% due to losses

in Home Depot (NYSE:HD) and

Coca-Cola (NYSE:KO). U.S. consumer confidence

increased to 108.7 in October, while job openings dropped to 7.44

million in September from a downwardly revised 7.86 million in

August.

Upcoming quarterly reports include Eli

Lilly (NYSE:LLY), Caterpillar (NYSE:CAT), Humana (NYSE:HUM), Global

Payments (NYSE:GPN), Trinity

Capital (NASDAQ:TRIN), Biogen (NASDAQ:BIIB), Brinker

International (NYSE:EAT), ADP (NASDAQ:ADP), Jinko

Solar (NYSE:JKS)

and Santander (NYSE:SAN) before the

open.

Post-close reports are expected from

Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Coinbase (NASDAQ:COIN), Robinhood (NASDAQ:HOOD), Sunnova (NYSE:NOVA), Etsy (NASDAQ:ETSY), Riot

Platforms (NASDAQ:RIOT), Roku (NASDAQ:ROKU), Carvana (NYSE:CVNA)

and Starbucks (NASDAQ:SBUX), and

more.

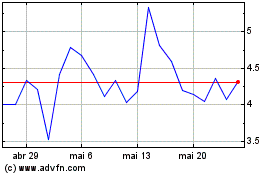

Sunnova Energy (NYSE:NOVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Sunnova Energy (NYSE:NOVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024