U.S. index futures rose in Friday’s pre-market, fueled by

anticipation of key earnings reports from Chevron and Exxon Mobil,

as investors awaited the crucial jobs report and the conclusion of

the most intense week of S&P 500 earnings season.

At 6:08 AM, Dow Jones futures (DOWI:DJI) rose 108 points, or

0.26%. S&P 500 futures gained 0.34%, and Nasdaq-100 futures

advanced 0.41%. The 10-year Treasury yield stood at 4.297%.

In commodities, West Texas Intermediate crude for December rose

2.70% to $71.13 per barrel, while January Brent rose 2.51% to

$74.64 per barrel.

Oil prices surged on reports of a potential Iranian attack on

Israel from Iraq. Markets responded to signs of possible

hostilities, with Israel pledging a strong response to any new

attacks. Middle East tensions and potential OPEC+ production delay

kept the market heated despite forecasted weekly losses.

Gold (PM:XAUUSD) rebounded after a sharp drop, rising 0.16% to

$2,750.79 per ounce.

Palm oil climbed to a two-year high, driven by strong demand and

limited supply. Malaysian exports rose 11% in October, and biofuel

demand is growing. Indonesia plans to increase palm oil usage in

biodiesel blending, sustaining the rise through 2025.

Today’s U.S. economic agenda includes the October jobs report at

8:30 AM, with 110,000 job creations expected, down from 254,000

previously. Unemployment is forecasted to remain at 4.1%, and

hourly wages are projected to rise 0.3%, with an annual rate of

4.0%.

At 9:45 AM, October’s final manufacturing PMI will be released,

with a previous reading of 47.8%. At 10:00 AM, September

construction spending is expected to hold steady, and October’s ISM

manufacturing index should edge up to 47.6%. October’s auto sales

will be announced throughout the day, after reaching 15.8 million

last month.

Asia-Pacific markets closed mixed. China’s CSI 300 dipped

slightly to 3,890.02 after intraday gains. Hong Kong’s Hang Seng

rose 0.93%, while Japan’s Nikkei and Topix fell 2.63% and 1.52%,

respectively. South Korea’s Kospi dropped 0.54%, and Australia’s

ASX 200 declined 0.5%.

Asian industrial activity stalled in October, with China’s

recovery offering limited boost to the region. Japan’s industrial

PMI fell from 49.7 in September to 49.2, reflecting weak demand.

South Korea’s PMI held at 48.3, indicating contraction for a second

consecutive month. Nevertheless, China’s PMI rose to 50.3,

signaling expansion after economic stimulus.

China’s new home prices accelerated in October, indicating an

early impact from recent stimulus in the crisis-hit real estate

sector. Across 100 cities, average prices rose 0.29%, compared to

0.14% last month, with large cities like Shanghai showing the

largest increases. Year-over-year, the average price increased by

2.08%, compared to 1.85% growth in September.

South Korea’s exports grew 4.6% in October, marking the smallest

gain in seven months at $57.52 billion, below Reuters’ forecast of

6.9%. Weak global demand and U.S. electoral uncertainty affected

trade, while daily exports dropped for the first time since

September 2023.

Australia’s producer price index rose 3.9% in Q3 year-over-year,

slowing from 4.8% last quarter. Quarter-on-quarter, it grew 0.9%,

slightly below the previous 1% rise, according to the Australian

Bureau of Statistics.

A record 5.1% increase in Japan’s minimum wage is expected by

March 2025, benefiting low-wage regions. The Bank of Japan reports

that the wage hike will boost inflation, particularly in services,

bringing it closer to the 2% target. Inflation, currently at 2.4%,

reflects more labor cost increases than raw materials.

European markets traded higher, with investor optimism ahead of

the U.S. jobs report, with oil and gas stocks leading gains.

Shares of Reckitt Benckiser Group Plc (LSE:RKT)

surged 9% after a U.S. jury acquitted the company and

Abbott Laboratories (NYSE:ABT) of allegations

related to hidden risks in formulas for premature infants. This

unexpected victory lifted shares up to 10.9%, alleviating concerns

of potential liabilities of up to $1 billion for Abbott.

Boohoo Group (LSE:BOO) appointed former

Debenhams CEO Dan Finley as its new CEO, replacing John Lyttle and

thwarting billionaire Mike Ashley, founder of Frasers

Group (LSE:FRAS), who had sought control.

Shares of Secure Trust Bank (LSE:STB) dropped

13.4% after the bank announced that pre-tax profits would fall

short due to issues in its vehicle finance sector. A disruption in

collections, triggered by a review by the UK Financial Conduct

Authority, affected the recovery of defaulted balances, which is

expected to extend into 2025.

Shares of Aker Horizons (AQEU:AKHO) fell 2.5%

after reporting third-quarter losses of €134 million, impacted by

assets in Chile and non-essential investments.

U.S. stocks fell Thursday, with the Nasdaq dropping 2.8%,

reflecting a tech sell-off after Microsoft’s

(NASDAQ:MSFT) disappointing revenue forecast and a 4.1% drop in

Meta (NASDAQ:META). The PCE price index rose 0.2%

in September, with core PCE growth, excluding food and energy,

steady at 2.7% year-over-year, intensifying concerns about a

gradual slowdown in rate cuts.

Upcoming quarterly reports include

FuboTV (NYSE:FUBO), Chevron (NYSE:CVX), ExxonMobil (NYSE:XOM), Wayfair (NYSE:W), Dominion

Energy (NYSE:D), Charter

Communications (NASDAQ:CHTR), Oxford

Lane

Capital (NASDAQ:OXLC), LyondellBasell (NYSE:LYB), Air

Canada (USOTC:ACDVF) and Butterfly

Network (NYSE:BFLY) before the open.

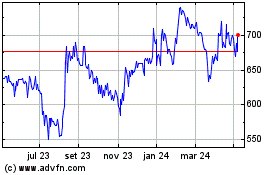

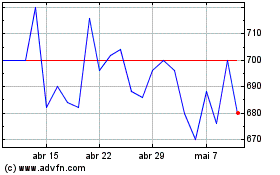

Secure Trust Bank (LSE:STB)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Secure Trust Bank (LSE:STB)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024