Bitcoin faces optimistic pre-election outlook

Bitcoin (COIN:BTCUSD) has risen by 3.6% in the last 24 hours,

reaching $70,223, driven by investor optimism surrounding the

upcoming US presidential election. This election will determine

control of the White House and Congress, which will directly impact

cryptocurrency regulations.

The presidency and Congress will shape whether the crypto market

will be regulated more favorably or restrictively, affecting

investors and businesses. If one party controls all branches,

legislation may be delayed until 2025, while a divided Congress

could accelerate regulation for or against the crypto sector.

Although Kamala Harris is viewed as a potential threat to the

crypto industry, Donald Trump is seen as supportive of it.

On Polymarket, Donald Trump leads Kamala Harris in presidential

election predictions, but payouts will only be made if the

Associated Press, Fox, and NBC agree on a clear winner. Otherwise,

the market will remain open until the inauguration on January 20,

2025. A parallel market will close after the final count if there

is consensus. Historically, results can take time, as seen in the

Bush-Gore case in 2000 due to recounts and judicial

interventions.

Bitcoin and Ethereum ETF outflows ahead of US election

On November 4, institutional investors withdrew large volumes

from Bitcoin and Ethereum ETFs, marking the biggest outflows since

May for BTC and since September for ETH. After Bitcoin spot ETFs

saw $2.2 billion in net inflows last week, they lost $541.07

million on Monday, while Ethereum ETFs reported $63.22 million in

outflows. BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) had an

inflow of $38.42 million, while Grayscale’s (AMEX:GBTC) and Ark’s

(AMEX:ARKB) ETFs had outflows of $63.7 million and $138.3 million,

respectively. Fidelity (AMEX:FBTC) also reported outflows totaling

$169.6 million.

Partnership for Global Dollar Network aims to expand USDG

stablecoin usage

Anchorage Digital, Bullish, Galaxy Digital (TSX:GLXY), Kraken,

Nuvei, Paxos, and Robinhood (NASDAQ:HOOD) have joined forces to

launch the Global Dollar Network, promoting global stablecoin

adoption. The initiative offers the USDG stablecoin, backed by US

dollars with reserves held by DBS Bank. The network aims to meet

strict corporate standards and encourage stablecoin use in sectors

like payments and investments. Paxos plans to expand the consortium

to include new partners and drive global stablecoin adoption. The

network, available to qualified financial firms, also provides a

competitive alternative to USDT on Ethereum.

Chainlink, Swift, and UBS complete tokenized fund settlement test

Chainlink (COIN:LINKUSD), Swift, and UBS (NYSE:UBS) successfully

completed a pilot to settle and redeem tokenized funds with fiat

currency, part of Singapore’s Monetary Authority’s Project

Guardian. The test demonstrated Swift’s infrastructure can settle

off-chain tokenized funds, bridging blockchain with Swift’s

network. According to Chainlink co-founder Sergey Nazarov, the

pilot allows traditional investors to invest in tokenized funds

using Swift transfers, fostering blockchain adoption among large

investors.

Marathon and Riot report record Bitcoin production post-halving

Bitcoin miners Marathon Digital (NASDAQ:MARA) and Riot Platforms

(NASDAQ:RIOT) reached record production levels in October following

April’s halving, which reduced rewards. Marathon produced 717 BTC,

driven by a hash rate above 40 EH/s and high transaction fees,

while Riot mined 505 BTC, benefiting from an increase to 29.4 EH/s.

Both companies maintain ambitious hashrate goals, with Riot

targeting 100 EH/s by 2027 and Marathon aiming for 50 EH/s by

2025.

Binance and Changpeng Zhao seek dismissal of SEC complaint

Binance and Changpeng Zhao have requested the court dismiss the

SEC’s amended complaint, arguing that the commission ignores a

prior court ruling that excludes cryptocurrencies from securities

classification. Binance claimed the SEC lacks a legal basis to

treat tokens sold on exchanges as investment contracts. Zhao also

argued that BNB’s (COIN:BNBUSD) “blind transactions,” where buyers

and sellers trade anonymously, lack investment contract

characteristics, contesting demands for disgorgement and market

restrictions.

MicroStrategy faces risks in aggressive Bitcoin expansion

MicroStrategy’s (NASDAQ:MSTR) plan to acquire an additional $42

billion in Bitcoin relies on favorable financing conditions and

strong demand for its convertible notes. The company recently

announced a $21 billion equity offering to finance the purchase but

faces growing risks due to rising debt costs and dependency on

Bitcoin’s appreciation. If MicroStrategy decides to sell part of

its holdings, it may face tax implications and market value loss,

warned CoinShares.

Metaplanet joins CoinShares Block Index, strengthens blockchain

presence

Japanese early-stage investment firm Metaplanet has joined the

CoinShares Blockchain Global Equity Index (BLOCK Index), a

benchmark for blockchain and cryptocurrency companies. Led by CEO

Simon Gerovich, Metaplanet aims to expand its global reach and

attract investors interested in the growing Asian crypto market.

With Bitcoin acquisitions totaling 1,108 BTC, the firm follows

MicroStrategy’s model, using “BTC Yield” to assess shareholder

value from its Bitcoin holdings.

Mt. Gox signals creditor repayment with billions in Bitcoin

transfer

On November 4, the bankrupt Mt. Gox exchange transferred $2.2

billion in BTC to three new wallets, some of which were moved to

the OKX and B2C2 exchanges. This transfer suggests that

compensation to its 127,000 creditors is underway after a 10-year

wait. Currently, Mt. Gox’s wallets hold $825 million in BTC. With

Bitcoin prices high since its collapse, there are concerns that

significant creditor sales could pressure the market.

MakerDAO community considers rebrand to “Sky” in vote

MakerDAO (COIN:MKRUSD) token holders are voting on whether to

keep the recent “Sky” brand as part of the “Endgame” strategy,

which introduced the USDS stablecoin. The non-binding poll shows

support for the Sky name but with low participation. MakerDAO

founder Rune Christensen emphasized that the decision should focus

on product and growth. The rebrand has faced challenges, including

a 40% drop in MKR token value, causing confusion with the

dual-token structure and impacting community confidence.

TON Foundation and Curve Finance launch DeFi expansion with swap

development competition

TON Foundation (COIN:TONCOINUSD) has declared 2025 the year of

DeFi on the TON blockchain, beginning partnerships with Curve

Finance (COIN:CRVUSD). Both hosted a competition where DeFi teams

developed stable asset swaps using Curve technology, including loan

and staking solutions. Torch Finance and Crouton Finance won, each

securing $150,000 for audits, initial liquidity, and integration

with CrossCurve. Seven venture capital firms also committed $2.3

million to boost DeFi infrastructure on TON.

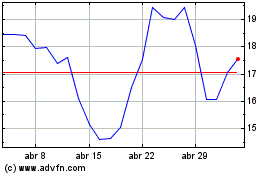

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MARA (NASDAQ:MARA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024