Inflation Data In Line With Estimates May Lead To Rebound On Wall Street

11 Dezembro 2024 - 11:02AM

IH Market News

The major U.S. index futures are currently

pointing to a higher open on Wednesday, with stocks likely to

regain ground after moving lower over the two previous

sessions.

The futures advanced following the release of closely watched

consumer price inflation data that came in line with economist

estimates.

The Labor Department said its consumer price index climbed by 0.3

percent in November after rising by 0.2 percent for four straight

months. The increase matched expectations.

The annual rate of growth by consumer prices ticked up to 2.7

percent in November from 2.6 percent in October, which was also in

line with estimates.

Excluding food and energy prices, core consumer prices still rose

by 0.3 percent in November, matching the increases seen in each of

the three previous months as well as expectations.

The Labor Department also said core consumer prices in November

jumped by 3.3 percent compared to the same month a year ago,

unchanged from October and in line with estimates.

With the data matching expectations, the report is likely to

increase confidence the Federal Reserve will lower interest rates

by another quarter point next week.

CME Group’s FedWatch Tool is currently indicating a 96.7 percent

chance the Fed will cut rates by 25 basis points at its December

meeting.

However, the FedWatch Tool also indicates a 76.7 percent chance the

central bank will then leave rates unchanged at its next meeting in

late January.

After failing to sustain an early move to the upside, stocks moved

moderately lower over the course of the trading session on Tuesday.

The major averages added to the losses posted during Monday’s

session, with the Nasdaq and the S&P 500 pulling back further

off last Friday’s record closing highs.

The major averages dipped to new lows for the session in the latter

part of the trading day. The Dow slid 154.10 points or 0.4 percent

to 44,247.83, the Nasdaq fell 49.45 points or 0.3 percent to

19,687.24 and the S&P 500 slipped 17.94 points or 0.3 percent

to 6,034.91.

The weakness that emerged on Wall Street came as

traders continued to cash in on recent strength in the markets

ahead of the release of the Labor Department’s closely watched

report on consumer price inflation on Wednesday.

“There’s been little sign of the hoped-for ‘Santa rally’ across

markets today as Wall Street continues to be distracted ahead of

tomorrow’s inflation data,” said Danni Hewson, head of financial

analysis at AJ Bell.

Computer hardware stocks moved sharply lower on the day, with the

NYSE Arca Computer Hardware Index plunging by 3.8 percent after

ending Monday’s trading at a nearly five-month closing high.

Significant weakness was also visible among semiconductor stocks,

as reflected by the 2.5 percent slump by the Philadelphia

Semiconductor Index.

Housing stocks also saw considerable weakness on the day, dragging

the Philadelphia Housing Sector Index down by 2.1 percent.

Homebuilder Toll Brothers (NYSE:TOL) led the sector lower after

reporting fiscal fourth quarter earnings and revenues that beat

estimates but weaker than expected unadjusted homebuilding gross

margin.

On the other hand airline stocks showed a strong move to the

upside, driving the NYSE Arca Airline Index up by 1.7 percent.

Alaska Air Group (NYSE:ALK) soared by 13.2 percent after raising

its fourth quarter profit forecast.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

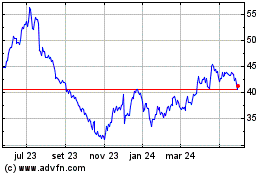

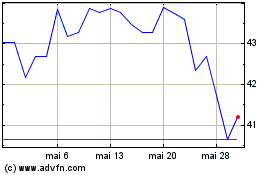

Alaska Air (NYSE:ALK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alaska Air (NYSE:ALK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024