U.S. Stocks Trim Early Losses But Still Close Notably Lower

03 Fevereiro 2025 - 6:44PM

IH Market News

Stocks moved sharply lower early in the session on Monday but

regained ground over the course of the trading day. The major

averages climbed well off their worst levels, with the Dow briefly

reaching positive territory, but ended the day in the red.

After plunging by as much as 2.5 percent in early trading, the

tech-heavy Nasdaq finished the session down 235.49 points or 1.2

percent at 19,391.96. The S&P 500 (SPI:SP500) also slid 45.96

points or 0.8 percent to 5,994.57, while the Dow fell 122.75 points

or 0.3 percent to 44,421.91.

The recovery attempt by stocks came after President Donald Trump

confirmed he has reached an agreement with Mexican President

Claudia Sheinbaum to pause recently implemented tariffs on Mexico

for one month.

The tariff pause comes after Sheinbaum said Mexico will

immediately reinforce its northern border with 10,000 members of

its National Guard to prevent drug trafficking from Mexico to the

United States, particularly fentanyl.

Stocks moved sharply lower in early trading amid concerns about

a global trade war after Trump officially imposed a 25 percent

tariff on imports from Canada and Mexico and a 10 percent tariff on

imports from China.

A statement from the White House said Trump is taking “bold

action to hold Mexico, Canada, and China accountable to their

promises of halting illegal immigration and stopping poisonous

fentanyl and other drugs from flowing into our country.”

Trump also threatened possible tariffs against the United

Kingdom and the European Union, marking a significant

escalation.

Canada and Mexico ordered retaliatory tariffs on American goods,

while China vowed countermeasures. The EU also warned of firm

retaliation if targeted.

Investors fear that a trade war could hit the earnings of major

companies and dent global growth. The tariffs could also lead to

renewed inflation fears, leading the Federal Reserve to keep

interest rates on hold for longer.

Sector News

Computer hardware stocks regained ground after an early sell-off

but still ended the day significantly lower, dragging the NYSE Arca

Computer Hardware Index down by 2.6 percent.

Considerable weakness also remained visible among housing

stocks, as reflected by the 2.4 percent slump by the Philadelphia

Housing Sector Index.

Airline, semiconductor and banking stocks also saw notable

weakness, while gold stocks moved higher along with the price of

the precious metal.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower during trading on Monday. Japan’s Nikkei

225 Index plunged by 2.7 percent, while Australia’s S&P/ASX 200

Index tumbled by 1.8 percent.

The major European markets also showed notable moves to the

downside. While the German DAX Index tumbled by 1.4 percent, the

French CAC 40 Index slumped by 1.2 percent and the U.K.’s FTSE 100

Index slid by 1.0 percent.

In the bond market, treasuries gave back ground after an early

advance but remained in positive territory. Subsequently, the yield

on the benchmark ten-year note, which moves opposite of its price,

dipped 2.6 basis points to 4.543 percent.

Looking Ahead

Trading on Tuesday may be impacted by reaction to the latest

U.S. economic data, including reports on job openings and factory

orders.

On the earnings front, Merck (NYSE:MRK), PayPal (NASDAQ:PYPL),

PepsiCo (NYSE:PEP), Pfizer (PFE) and Spotify (SPOT) are among the

companies due to report their quarterly results before the start of

trading on Tuesday.

SOURCE: RTTNEWS

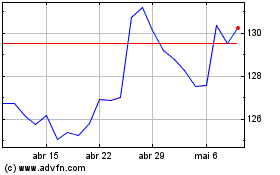

Merck (NYSE:MRK)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

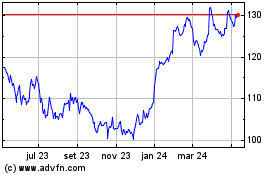

Merck (NYSE:MRK)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025