U.S. Stocks Shrug Off Latest Tariff Threats, Close Mostly Higher

10 Fevereiro 2025 - 6:44PM

IH Market News

After moving mostly higher early in the session, stocks continue

to turn in a strong performance throughout the trading day on

Monday. With the upward move, the major averages partly offset the

steep losses posted last Friday.

The major averages moved roughly sideways in afternoon trading,

hovering in positive territory. The Nasdaq jumped 190.87 points or

1.0 percent to 19,714.27, the S&P 500 (SPI:SP500) climbed 40.45

points or 0.7 percent to 6,066.44 and the Dow rose 167.01 points or

0.4 percent to 44,470.41.

The rebound on Wall Street may partly have reflected bargain

hunting, as traders picked up stocks at somewhat reduced levels

following the sharp pullback seen last Friday.

While Friday’s slump partly reflected new tariff threats from

President Donald Trump, traders largely shrugged off his latest

threat to impose a 25 percent tariff on all steel and aluminum

imports into the U.S.

The latest tariff threat comes after Trump said last Friday he

plans to announce reciprocal tariffs on many countries this week,

with the U.S. imposing tariffs on imports equal to the rates

imposed on American exports.

“Perhaps investors have decided not to react every time Donald

Trump yanks the steering wheel in another direction for fear of

getting whiplash, or perhaps they’ve simply remembered how to

operate in a world where volatility is baked in,” said AJ Bell head

of financial analysis Danni Hewson.

Meanwhile, amid a light day on the U.S. economic front, traders

were also looking ahead to the release of several key reports in

the coming days.

Reports on consumer and producer inflation are likely to be in

focus, while reports on retail sales and industrial production may

also attract attention.

Traders are also likely to keep a close eye on congressional

testimony by Federal Reserve Chair Jerome Powell, looking for clues

about the outlook for interest rates.

Sector News

Computer hardware stocks moved sharply higher over the course of

the session, driving the NYSE Arca Computer Hardware Index up by

4.6 percent to its best closing level in almost seven months.

Super Micro Computer (NASDAQ:SMCI) helped lead the sector

higher, soaring by 17.6 percent ahead of fiscal second quarter

business update after the close of trading on Tuesday.

Steel stocks also saw significant strength in reaction to

Trump’s tariff threat, resulting in a 3.3 percent surge by the NYSE

Arca Steel Index.

Gold stocks also saw substantial strength amid a sharp increase

by the price of the precious metal, with the NYSE Arca Gold Bugs

Index surging by 2.8 percent.

Oil producer, telecom and natural gas stocks also saw

considerable strength on the day, while financial and biotechnology

stocks bucked the uptrend.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region turned in a mixed performance on Monday. Hong Kong’s Hang

Seng Index jumped by 1.8 percent and China’s Shanghai Composite

Index climbed by 0.6 percent, while Australia’s S&P/ASX 200

Index fell by 0.3 percent.

Meanwhile, the major European markets all moved to the upside on

the day. While the U.K.’s FTSE 100 Index advanced by 0.8 percent,

the German DAX Index increased by 0.6 percent and the French CAC 40

Index rose by 0.4 percent.

In the bond market, treasuries gave back ground after an early

upward move, ending the day roughly flat. Subsequently, the yield

on the benchmark ten-year note, which moves opposite of its price,

crept up by less than a basis point to 493 percent after hitting a

low of 4.458 percent.

Looking Ahead

Amid another quiet day in terms of U.S. economic data, trading

on Tuesday may be impacted by reaction to Powell’s testimony before

the Senate Banking Committee.

SOURCE: RTTNEWS

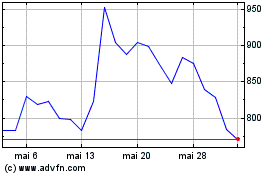

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Super Micro Computer (NASDAQ:SMCI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025