Altitrade Partners™ Says Investors Should Not Ignore Historical Stock Market Warning Signs

02 Julho 2014 - 7:00AM

InvestorsHub NewsWire

Earlier this week

Altitrade Partners™, located just outside of Denver, Colorado

published a report warning investors not to ignore many of the

historical signs which indicate that we may be nearing an important

juncture in the stock market. The four most dangerous words for

investors are “It’s different this time” said a spokesperson for

the firm, which engages in proprietary trading, investing and

research, with an emphasis on small caps, micro-caps and special

situations.

There are a number of

technical and fundamental indicators which we follow that are

showing us an increased likelihood that some sort of pause, or

correction, may be in store for the markets in the short to

intermediate term. We would expect many of the well-known indices,

and the investment products that have been created to replicate

them, such as the SPY, DIA, QQQ, and IWM to be most affected;

simply because of the large institutional ownership of

them.

The report titled

“Investors Are Playing Musical Chairs, Where Will You Be When the

Music Stops?” draws an analogy to the childhood game of musical

chairs. “In our view, the probability of a 10-15% correction far

outweighs the additional upside in the market of perhaps another

3-4%” according to the report.

Every new data point

that confirms an historical precedent is like another chair being

taken out of the game. Soon all the underpinnings for the bull case

are eliminated one-by-one; leaving investors vulnerable to giving

back gains earned over the past five years.

The report, which has

also been published on the Seeking Alpha web site, can be found by

following this link: http://www.altitradepartners.com/Altitrade_Partners/Reports/Reports.html

Altitrade Partners™

also goes on to address some of the psychological indicators that

they view as being important to understanding investor behavior,

and how that behavior influences the financial markets. Investing

is more than just paying attention to fundamental and technical

factors. You must also understand human behavior, the report

states.

We have a saying

around here that “the markets are simply emotions in motion”, and

if you understand human behavior and market psychology, we think

that it makes you a much better investor.

Simply put, there is

far too much investor complacency in the markets right now, and

that causes us to be concerned. It seems that investors have lost

their regard and respect for equity market risk. What we may be

experiencing, in the markets right now, is the proverbial calm

before the storm.

Seasonal tendencies

may also point to increased risk for market participants. If you

look at the volatility index, or VIX as it is better known,

historically there is an increase in volatility in the months of

August, September and October, said the firm’s

spokesperson.

Long-term success in

the stock market is about protecting your gains and assessing the

probabilities, in percentage terms, of the market rising or

falling. When you see a sign today, that in the past has produced

an outcome which occurs 80% of the time, you had better pay

attention to it. When you begin to see three or four such signs, it

makes you sit up and really take notice.

At Altitrade Partners™

that’s what we are observing in today’s market environment. We’re

seeing multiple signs that, taken in their past historical context,

have foretold a significant change in market direction. While we

are not in the business of predicting, we are in the business of

preparing and protecting capital in our trading accounts. We don’t

know exactly when the market will experience a correction, but like

all good baseball managers, we will play the percentages when they

are clearly in our favor.

The opinions

expressed herein, are exclusively those of Altitrade Partners™. We

do not provide investment advice, and do not offer buy and sell

recommendations on any securities mentioned in our reports. For

additional information about Altitrade Partners™, including our

full disclaimer, we invite you to visit http://www.altitradepartners.com/Altitrade_Partners/Disclaimer.html

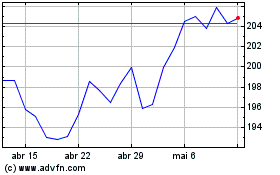

iShares Russell 2000 (AMEX:IWM)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

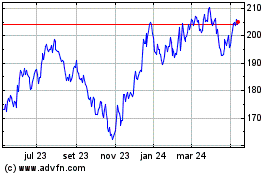

iShares Russell 2000 (AMEX:IWM)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025