Tesla

Battery Day: Out With

The

Cobalt, In With The Manganese

Summary

-

Tesla

battery day is coming up on September 22. Big announcements are

widely expected with respect to its battery technology.

-

I believe

that the company will eliminate expensive cobalt in its battery,

with increases to the nickel content and introduction of

manganese.

-

There

will be a challenge to securing North American supply of battery

input metals that will be cost effective and environmentally

friendly.

-

Tesla

appears to be working to secure a North American supply of raw

materials which may provide speculative investment opportunities on

these raw material producers as well as a bullish thesis on Tesla

itself.

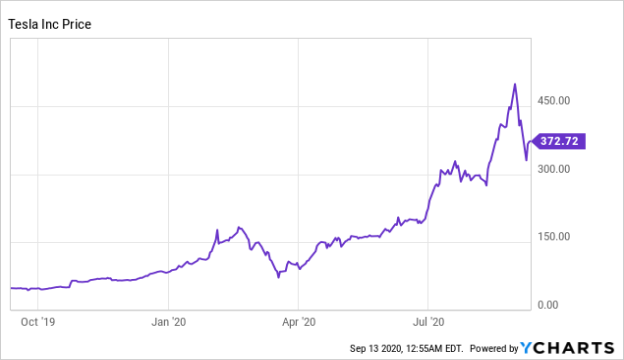

It's no

secret that Tesla (TSLA)

is aggressively valued. It has ballooned to more than a $300

billion market cap and neared half a trillion at its highs. It's

forward P/E is over 100, more than 10 times higher than mature

vehicle manufacturers like Ford (F)

or General Motors (GM).

In order to maintain that kind of valuation, Tesla has to meet

sky-high expectations of a society-changing electric vehicle

technology that can be produced profitably while being affordable

for consumers. It has been on this path so far, but there are still

more challenges to overcome.

One major

roadblock for Tesla and electric vehicles in general is their high

cost relative to gas-powered combustion engine vehicles. In order

to truly dominate the vehicle market, the company has to find a way

to reduce the sticker price of its cars. One of the most obvious

ways to do so is to reduce the cost of the battery. I believe that

Tesla is on this path and will be announcing a cobalt-free battery

at its much

anticipated Battery Day coming up

on September 22. My guess is that the cobalt will be replaced by

less costly materials such as an increase in nickel content to at

least 90% and introduction of manganese.

A

successful deployment of a cheaper battery would bring Tesla closer

than ever before to pricing its cars more in line with mid-size

sedans. There is also an opportunity to speculate on companies that

mine the needed raw materials. Especially those located in North

America for Tesla's gigafactory

in

Nevada.

Data by

YCharts

Out

with the cobalt...

My

suggestion of Tesla eliminating cobalt is not exactly a new one nor

is it a controversial statement. Not only is cobalt 2-3 times more

expensive than nickel, it's also politically toxic as a majority of

the world's cobalt comes out of Congo. That being said, there is a

limit to how much cost savings can be driven purely by converting

cobalt content into nickel. As outlined in a recent

CNBC article, the prices of the

two metals has converged over the years, and an increase in nickel

content in batteries will only further spur demand to drive prices

up. There will have to be a constant push for cheaper and cheaper

materials that still result in a long-lasting, reliable and safe

battery.

In 2016,

Tesla partnered with a battery researcher working out of Dalhousie

University in Nova Scotia, Canada by the name of Jeff Dahn. Dahn is

one of the pioneering developers of the lithium-ion battery and has

since been named Tesla's

Head of Battery Research. Whatever Tesla has

developed, Dahn will most certainly have been central to it. For

anyone who has done a bit of research, there is no shortage of

signals to try to figure out where this research is

headed.

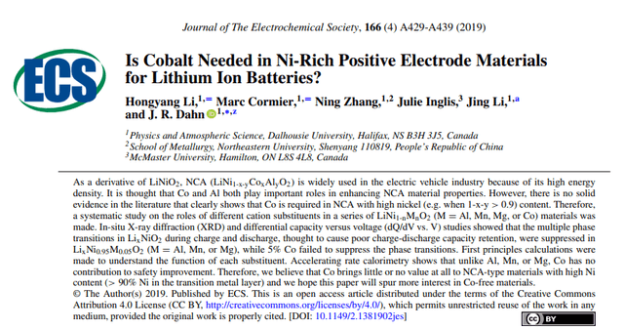

A paper

in Journal of The Electrochemical Society titled "Is

Cobalt Needed in Ni-Rich Positive Electrode Materials for Lithium

Ion Batteries?" gets to the heart

of the matter. It's co-authored by Jeff Dahn with the research

taking place at universities in Canada and China:

The

research concluded that cobalt brings little or no value to

NCA-type batteries where nickel is at least 90% of the transition

metal layer. The paper hoped that it would spur more interest in

cobalt-free materials and specifically named aluminum, manganese

and magnesium as three elements with more use than

cobalt.

...and

in with the manganese

Of the

three cheaper and more useful metals than cobalt, I believe that

manganese makes for the best pairing in a nickel-dominant battery.

While I'm not an engineer,

Battery University explains in layman's

terms why manganese makes such a useful pairing with

nickel:

The

secret of NMC lies in combining nickel and manganese. An analogy of

this is table salt in which the main ingredients, sodium and

chloride, are toxic on their own but mixing them serves as

seasoning salt and food preserver. Nickel is known for its high

specific energy but poor stability; manganese has the benefit of

forming a spinel structure to achieve low internal resistance but

offers a low specific energy. Combining the metals enhances each

other strengths.

Nickel-manganese-cobalt,

or NMC batteries are already popular with other EV manufacturers

along with power tools and e-bikes, but Tesla might have avoided

using them until now due to

capacity fade issues that would

wreak havoc on the life of the battery. A recently published

research paper titled: "Operating

EC-based Electrolytes with Li- and Mn-Rich NCMs: The Role of

O2-Release on the Choice of the Cyclic

Carbonate"

leveraged Dahn's research to get to the heart of the capacity fade

problem associated with manganese. If one of the breakthroughs that

have not yet been made public through open access research articles

includes having solved this issue, then nickel-manganese batteries

should become the preferred choice for Tesla.

Securing

the supply of nickel and manganese

If Tesla

has indeed created a better and cheaper battery in a lab, the next

challenge would be securing the raw materials so that mass

production can take place. The strong preference would be to secure

supply in North America for Tesla's Nevada Gigafactory while

minimizing the carbon and environmental footprint. That might be

easier said than done. A blog from americanresources.org titled

"New

Chart Unveils Supply Chain Weaknesses for Manganese, a Critical

Input for EV Technology" showed that the

United States and Europe are trailing China in a global battery

arms race, particularly in the supply chain for lithium, cobalt,

graphite and nickel.

Despite

the challenges, Tesla appears to be making some aggressive moves to

combat the issue. The

Globe and Mail reported last Friday that

Tesla is in talks with Giga Metals Corporation (OTCQB:HNCKF)

(GIGA.V) to secure a supply of low carbon nickel in its Turnagain

mine in British Columbia. The result was Giga flying up 185% on the

OTC on over 10 million shares, an outstanding amount of volume for

a 5-letter symbol OTC stock. The Turnagain mine has measured and

indicated resources of 2.36 million tonnes

of

nickel.

However,

as the title of the previously linked americanresources.org blog

post implies, manganese might be the trickiest metal in which to

secure supply:

China,

while only producing 6% of global total output, has a "significant

advantage" in the manganese chemical refining step in the supply

chain accounting for 93% of production in 2019.

While

global prices are cheap, North American production of manganese is

non-existent. An added challenge is that while most manganese is

appropriate for the steel industry or as fertilizer, not all

manganese is suitable for battery production.

Tesla

does have an inside connection to one potential source of useful

manganese through Jeff Dahn. Manganese X Energy Corp.

(OTCPK:MNXXF)

(MN.V) owns the

Battery Hill Project in New Brunswick, an early-stage

manganese exploration project that is one province over from Dahn's

Dalhousie University in Nova Scotia. Manganese X has demonstrated

an ability to

produce high grade battery material out of its property

with it yielding manganese sulphate with a purity exceeding 99.95%.

The company has a Board Member and Director named Roger

Dahn,

who is the brother of Jeff Dahn. That family

connection is likely something that both Tesla and Manganese X

would be willing to exploit.

Conclusion

There is

a lot of hype around Tesla's Battery Day. I expect the company to

come through with technology breakthroughs that will lead to a

cheaper, more environmentally-friendly and more politically popular

battery that is made on North American soil. The stock should react

positively, but investors should also be on the lookout for North

American properties that can produce needed raw materials at

battery grades. The price performance of Giga Metals shows the

potential returns waiting for investors who are willing to dig deep

to find the right properties. Manganese X looks like another one

with a definitive connection through the Dahn name and the

Manganese supply potential.

Disclosure:

I am/we

are long HNCKF, MNXXF. I wrote this article myself, and it

expresses my own opinions. I am not receiving compensation for it

(other than from Seeking Alpha). I have no business relationship

with any company whose stock is mentioned in this

article.

Edward Vranic, CFA

Editor's

Note: This article covers one or more microcap stocks. Please be

aware of the risks associated with these stocks.