February 1, 2021 -- InvestorsHub NewsWire -- via AheadOfTheHerd -- Max Resource Corp (TSX.V:MXR; OTC:MXROF; Frankfurt:M1D2) has procured a major

section of new ground at its CESAR copper-silver project in

Colombia.

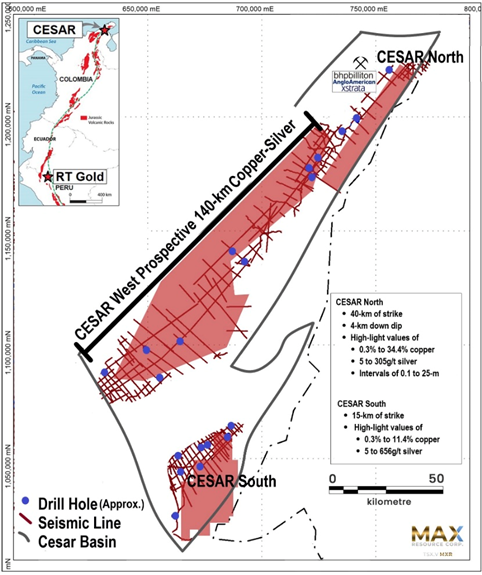

The Vancouver-based company reported acquiring 140 kilometers of

an area it considers highly prospective for copper-silver

mineralization. Under the deal, Max agreed to pay USD$175,000 to

secure 20 mineral applications. The vendor retains a 3% net smelter

returns royalty (NSR) and Max has the exclusive right to purchase

100% of the NSR for $4 million any time before production.

“CESAR West was identified through surface structural mapping,

interpretation of available seismic sections and drill core review.

The Max in-country field crew have commenced sampling and mapping

for Jurassic host rock and copper-silver mineralization along this

new continuous 140-kilometer-long landholding,” says Max’s CEO,

Brett Matich, in the Jan. 27 news

release.

“Max has achieved a major milestone, expanding its landholdings

in the Cesar Basin by over 300%. The newly discovered area lies

along the central-western part of the Cesar Basin, and together

with the recent copper discovery at depth, supports the

regional-scale potential of the CESAR project,” he concluded.

140-km-long CESAR West was identified through

surface structural mapping, interpretation of available seismic

sections and drill core review.

140-km-long CESAR West was identified through

surface structural mapping, interpretation of available seismic

sections and drill core review.

District scale opportunity

I must say, it is extremely rare for a junior resource company

the size of Max — valued at just $23 million as of Wednesday, Jan.

27 — to come by this much ground in a greenfield (no mining has yet

taken place) project.

Max Resource is developing a large sedimentary system, with

high-grade discoveries over a 200-km belt. Grades of up to 34%

copper and 656 grams per tonne silver have been assayed from

surface outcrops. The company now has an additional 140 km to

explore, at CESAR West. This year Max plans on sampling and mapping

for Jurassic-age host rock and copper-silver mineralization along

this new 140-km-long landholding.

In a recent AOTH

video Max’s CEO Brett Matich points out the scale of the

project, showing on a map how it is of a similar size to Poland’s

immense “Kupferschiefer” copper-silver deposits. (read more about

the Kupferschiefer comparison below).

Since November 2019, Max has been identifying stratabound copper

and silver zones within a 100 by 20-kilometer area (Kupferschiefer

is 20 km by 15 km), at their CESAR copper silver project in

northeastern Colombia.

Max continues to expand the surface “Kupferschiefer-style”

mineralization at CESAR, using continuous rock chip panel samples

and composite grab samples to identify structures, continuity of

thickness, strike length and potential size, prior to

drilling.

In Poland’s Kupferschiefer deposits, continuous mineralization

extends down dip and laterally for many kilometers. Could the

mineralization at CESAR do the same? If so, Max could be looking at

a district-scale, even a regionally extensive copper-silver

mineralized system.

Though early-stage, CESAR is one of the few copper projects that

is demonstrating the massive scale needed to interest a major.

(three large mining companies have already come into the project,

more on that below)

Moreover, and this is really important, Max doesn’t have to

drill it, not at this stage. The whole idea is to identify the

mineralized horizons and dips, then partner with a larger company,

or companies, to further develop the deposit, sell the project, or

get bought out.

So far, Max has managed to identify extensive

copper-silver mineralization through rock chip sampling because

rivers, streams and creeks cut across and expose the multiple

horizons for a considerable depth.

Copper at depth

In fact, Max has gone a step further in verifying the

exploration model at CESAR, based on analysis of recently obtained

historical drill core.

Earlier this month the company reported that stratabound

copper-silver mineralization found at surface, extends for over

400m down dip.

In the Jan. 12 news

release, Max notes that “The copper enriched intervals of the

historic drill core are hosted in grey sandstone that changes to

red (hematite rich) outside copper enrichment (refer to Figure 2).

This zonation from red hematite enriched sandstone to grey is very

characteristic of Poland’s Kupferschiefer and represents reducing

environment where copper was precipitated from solution to form the

Kupferschiefer copper-silver deposits.”

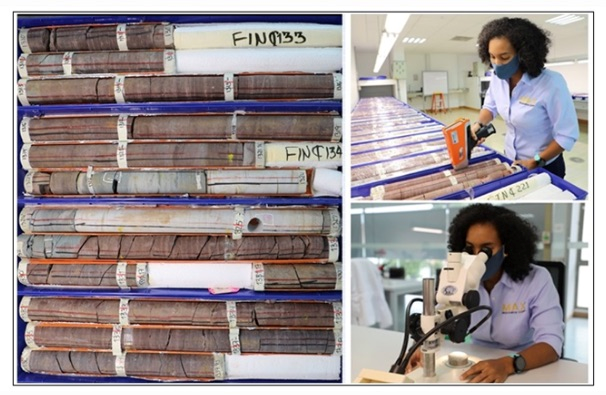

Drill core from the Cesar Basin, Colombia with grey

sandstone enriched with copper identified with XRF. The drill core

study involves core logging, XRF analysis, binocular microscope

studies and photography.

Drill core from the Cesar Basin, Colombia with grey

sandstone enriched with copper identified with XRF. The drill core

study involves core logging, XRF analysis, binocular microscope

studies and photography.

“Over the past year Max has demonstrated the regional scale and

lateral continuity of the CESAR stratabound copper-silver

mineralization, already traced for over 200 kilometers along strike

and now encountered in historical drill core extending down dip to

depths in excess of 400 meters,” says Matich.

The finding is critical for Max, which is quietly

advancing one of the

world’s most promising copper-silver projects in

northeastern Colombia, along the Andean Copper Belt that is

world-renowned for its porphyry deposits.

This sedimentary basin is a massive geological feature that

extends for over 1,000 km from the northern tip of Colombia

southwards through Ecuador and Peru. The basin was a seabed trapped

behind the uplifting Cordillera mountain ranges, and the model

suggests that rich copper and silver-bearing fluids flooded up into

the basin and deposited as they encountered organic matter on the

seafloor.

As such, CESAR represents a type of sediment-hosted copper

mineralization that is typically flat-lying, near surface, and is

known to be extensive in Africa, Poland and Colombia. These types

of deposits are generally higher grade than copper porphyry

deposits.

The CESAR project area enjoys major infrastructure thanks to

existing oil, gas and coal mining operations including Cerrejon,

the largest coal mine in Latin America, jointly owned by global

miners BHP, XStrata and Anglo American. However, this area has only

seen limited copper exploration.

Recognizing the prospect of a major copper discovery in the

Cesar region, Max Resource acquired full

ownership of the CESAR property shortly after its

discovery in the fall of 2019, and embarked on a first-pass

exploration program focused on identifying surface outcrops.

Exploration is happening on multiple fronts within the CESAR

target zone, along a major part of a 200-km-long sediment-hosted

copper-silver belt.

Historical drill core analysis

In December, MXR began an

analysis of historical drill core and seismic data from

the Cesar basin to determine the extent of mineralization down dip

from surface.

This analysis is part of a study conducted in collaboration with

the Ingeniería Geológica Universidad Nacional de Colombia (IGUN) at

the Colombian Geological Survey Facility.

The abundance of historical

diamond drill core and related seismic data from oil and

gas operations in the sedimentary Cesar basin, will allow Max to

model the paleo-topography of the mineralized stratabound horizon

at CESAR. This will help to identify prospective areas for

drilling.

Typical mineral exploration doesn’t drill 2,000-meter holes and

conduct seismic surveys as it is far too expensive, even though

this oil and gas type of exploration is the best method for

exploring sedimentary-hosted mineralization. By analyzing existing

drill hole data, Max is likely saving tens of millions in

exploration costs.

According to the company, the oil and gas drill cores, which are

securely stored at the Colombian Geological Survey Facility as

required by the Colombian government, have never been studied from

a metals perspective.

The analysis concentrates on drill core intersecting the

prospective Jurassic stratigraphy, focusing on XRF measurements,

binocular microscope studies, and photography of both selected

mineralized intervals and stratigraphic contacts. The results and

seismic sections are being integrated with the company’s existing

database to help build a 3D structural model.

According to Matich, “The importance of the archived IGUN

historic drill core cannot be understated. The modelling should

confirm the continuity of Jurassic stratigraphy and the

copper-silver horizons from surface to considerable depths down

dip. In addition, the study will greatly assist our targeted land

expansion.”

Kupferschiefer comparison

This was the same method used by global miner KGHM for its

sizeable Kupferschiefer copper deposits in Poland.

Kupferschiefer is Europe’s largest copper mine, with production

in 2018 of 30 million tonnes copper, and 40 million ounces of

silver in 2019, from an orebody 0.5 to 5.5 meters thick grading

1.49% copper and 48.6 g/t silver. The silver yield is almost twice

the production of the world’s second largest silver mine.

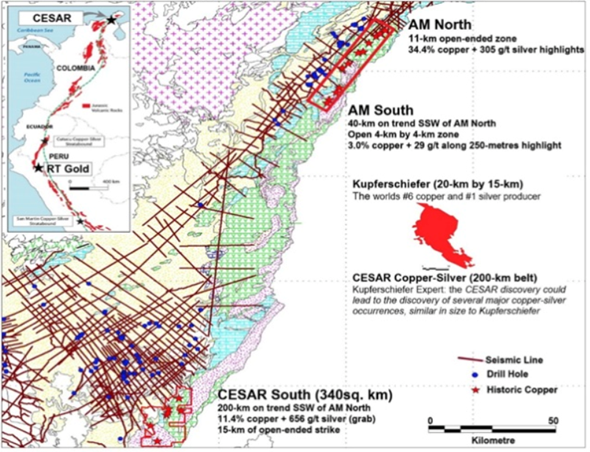

Based on the CESAR North (AM North and AM South) to CESAR South

discoveries at the opposite ends of the 200-km-long CESAR target

zone, Max believes that this large surface footprint represents

another “Kupferschiefer-type” mineralization on the other side of

the Atlantic.

CESAR Copper-Silver Project, NE Colombia

- AM North: recently

expanded to 29 km2 of continuous copper-silver

mineralization, open along strike and down dip, containing a

high-grade area with varying intervals grading 4.0 to 34.4% Cu and

28 to 305 g/t Ag;

- AM South: discovered along the same

stratabound mineralized trend, about 40 km south-southwest of AM

North covering an area of 16 km2. Highlight values of 6.8% Cu and

168 g/t Ag from 0.1 to 25 m intervals suggest that these horizons

could be of significant size;

- CESAR South: a newly

acquired 340 km2 property hosting stratabound

copper-silver over at least 15 km of strike with highlight grab

sample values of 11.4% Cu and 656 g/t Ag (see below).

CESAR South rock samples

CESAR South rock samples

Exploration

continues on the CESAR property, with outcrop samples

repeatedly returning high grades and new discoveries leading to

expanded copper holdings. Max believes the mineralization at CESAR

is stratabound — meaning confined to a single stratigraphic (rock

layer) unit — and Jurassic-age.

The fact that CESAR Cu-Ag stratabound mineralization appears to

be large sub-horizontal sheets that repeatedly outcrop at surface,

adds credibility to the Kupferschiefer comparison. Average grades

of 1.0% copper and 20 g/t silver at CESAR also make a compelling

case.

In a recent presentation, leading Kupferschiefer expert,

Professor Adam Piestrzynski, highlighted numerous similarities

between CESAR and

Kupferschiefer including basin

characteristics, lithology, mineralogy, deposit parameters, metal

grades and origin of sulfur.

Given these similarities, it makes sense for the company to

apply the Kupferschiefer exploration model to CESAR.

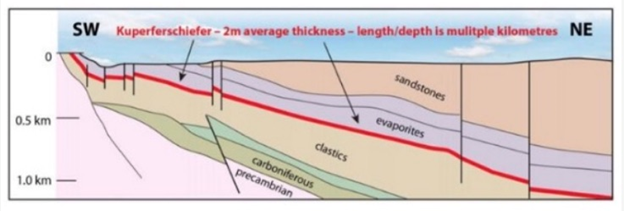

Kupferschiefer copper-silver mine in Poland:

- Bulk underground mining starts from 500 meters below

surface

- Average mining thickness of 2m

- Annual production of 30 million tons of copper at average grade

of 1.49%

- and 40 million ounces of silver at average grade of 48.6 grams

per tonne

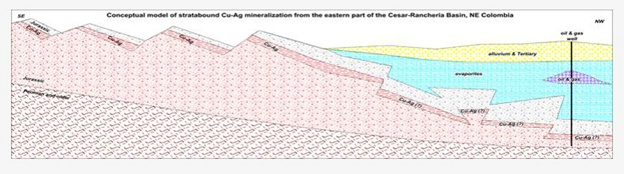

Conceptual model of Kupferschiefer

CESAR stratabound copper-silver project in Colombia:

- Mineralization starts at surface and extends down dip and

laterally

- Mining can potentially start from surface followed by

underground

- Bulk tonnage target grades of 1.0% copper and 20 g/t

silver

Conceptual model of CESAR

A notable difference is that the Kupferschiefer orebody starts

at 500m below surface, whereas the CESAR mineralization starts at

surface.

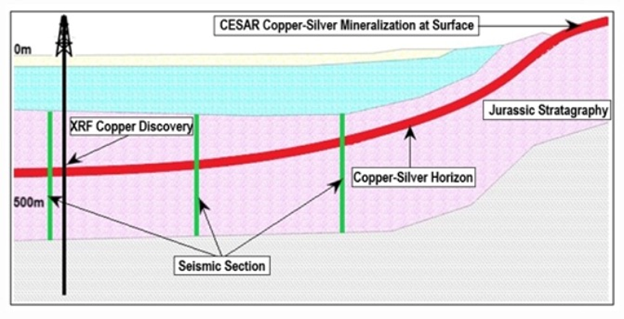

The company plans to continue drill core analysis, further

advancing the structural model by superimposing drill holes and

identified core intervals with copper, on to seismic sections and

projecting the mineralized horizon to surface (see diagram below).

All observed data is being recorded into the company’s database to

construct a 3D model.

The structural study also provides a guide for Max’s land

expansion strategy, and its ongoing CESAR copper-silver exploration

programs.

Copper-silver stratabound horizon based on XRF

readings and seismic sections projecting the horizon to

surface.

Copper-silver stratabound horizon based on XRF

readings and seismic sections projecting the horizon to

surface.

Though still early-stage, Max’s exploration at CESAR has, in

less than a year, led to three non-exclusive confidentiality

agreements: one with a leading global copper producer, a second

with a major mining company, and a third with a mid-tier copper

explorer.

The first phase of the partnership with one of the

yet-to-be-named companies, involves a technical study by Fathom

Geophysics, currently underway.

The aim of the study is to map stratigraphic (rock layers)

features that can help to pinpoint additional stratabound

copper-silver mineral horizons at CESAR.

Concurrently, the ongoing structural study between IGUN and the

Max team involves an analysis of historical drill core and seismic

data on the Cesar basin, to determine the down-dipping extent of

mineralization identified at surface.

If Max can demonstrate the potential “district scale” of CESAR,

its possible, in our opinion, that a major may jump in early and

buy out CESAR, as the prize could be far too big to ignore.

The company’s current priorities include regional geochemical

sampling, structural modeling interpretation of seismic data,

analysis of oil & gas drill cores and expansion of

landholdings.

All of these efforts, combined with ongoing surface sampling at

CESAR, a geophysical study, and analysis of oil and gas drill cores

in pursuit of copper-silver mineralization at depth, practically

ensures a steady flow of news from Max in the coming months.

Max Resource Corp.

TSXV:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.285, 2021.01.27

Shares Outstanding 87.6m

Market cap Cdn$24.9m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to

my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire AOTH/Richard

Mills Disclaimer carefully before you use this website or

read the newsletter. If you do not agree to all the AOTH/Richard

Mills Disclaimer, do not access/read this

website/newsletter/article, or any of its pages. By reading/using

this AOTH/Richard Millswebsite/newsletter/article,

and whether or not you actually read this Disclaimer, you

are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be,

construed as an offer to sell or the solicitation of an offer to

purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information

obtained from sources he believes to be reliable but

which has not been independently verified. AOTH/Richard Mills makes

no guarantee, representation or warranty and accepts no

responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are

subject to change without notice. AOTH/Richard Mills assumes no

warranty, liability or guarantee for the current relevance,

correctness or completeness of any information provided within this

Report and will not be held liable for the consequence of reliance

upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct

or indirect loss or damage or, in particular, for lost profit,

which you may incur as a result of the use and existence of the

information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor

and does not hold any licenses. These are solely personal thoughts

and opinions about finance and/or investments – no information

posted on this site is to be considered investment advice or a

recommendation to do anything involving finance or money aside from

performing your own due diligence and consulting with your personal

registered broker/financial advisor. You agree that by reading

AOTH/Richard Mills articles, you are acting at your OWN RISK. In no

event should AOTH/Richard Mills liable for any direct or indirect

trading losses caused by any information contained in AOTH/Richard

Mills articles. Information in AOTH/Richard Mills articles is not

an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any

financial instruments but does suggest consulting your own

registered broker/financial advisor with regards to any such

transactions

Richard owns shares of Max Resources (TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1). Max is a

paid advertiser on his site aheadoftheherd.com

SOURCE: AheadOfTheHerd

Max Resource (PK) (USOTC:MXROF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Max Resource (PK) (USOTC:MXROF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025